David works in California and would be entitled to a weekly unemployment benefit of $400, based on his prior earnings. Recommended Reading: Maximum Unemployment Benefits Mn. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. },{ Your employer might contest your claim, in which case you may need to provide additional information or documentation to the state agency. Unemployment insurance benefits are not only available to someone who lost his or her job entirely. She was laid off from her job, and she currently earns $250 per week from a part-time job. In most cases, an individual is not considered eligible if they voluntarily choose to work part time. Unemployment Insurance benefits are only extended to claimants whore able and available for work.

David works in California and would be entitled to a weekly unemployment benefit of $400, based on his prior earnings. Recommended Reading: Maximum Unemployment Benefits Mn. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. },{ Your employer might contest your claim, in which case you may need to provide additional information or documentation to the state agency. Unemployment insurance benefits are not only available to someone who lost his or her job entirely. She was laid off from her job, and she currently earns $250 per week from a part-time job. In most cases, an individual is not considered eligible if they voluntarily choose to work part time. Unemployment Insurance benefits are only extended to claimants whore able and available for work.  You can apply for Unemployment Insurance benefits over the phone and the internet depending on the state youre filing from. reapply for a new claim by phone, mail, or fax. Many state unemployment insurance websites show claimants where they are in the consideration process, so check back regularly to see what your status is until you get your money. This field is for validation purposes and should be left unchanged. Depending on your state's rules, you may be eligible for partial benefits if you had two part-time jobs and lost one of them. Tip:The fastest way to apply is throughUI Online. "name": "What if My Hours Have Been Cut? It also helps employers by allowing them to keep their existing employees and avoid the costs of hiring and training new people. Filing via Internet is by far the fastest method. New Yorks unemployment agency determines weekly benefits for part-time workers (those working less than 30 hours a week) by looking at the number of hours a claimant works each week.. Part-time workers who work four hours or less in a given week won't see any reduction in their weekly unemployment benefit. Mail your application to the address on the form and allow extra time for processing. Partial Claims should not be filed when an employee is not able and available to accept all work offered by the employer. Submit the first date you were affect "https://www.yelp.com/biz/mathew-and-george-litigation-attorneys-los-angeles", How Long Must I Be Employed Before Being Eligible for Unemployment? These wages you report will then be reduced from your partial benefit rate which is around 20% higher than your weekly benefit rate. The attorney listings on this site are paid attorney advertising. Paper filed partial claims require manual review and processing therefore, payments may be significantly delayed during peak periods. The waiting period can only be served if you certify for benefits and meet all eligibility requirements for that week. "@type": "PostalAddress", This program provides unemployment benefits to employees who have their hours or wages cut so they can keep their current positions and avoid financial hardship. Most people who collect unemployment are out of work, but partial unemployment benefits allow those who are still working to claim aid as well. Do Not Sell or Share My Personal Information, , J.D., University of Missouri School of Law, Collecting Unemployment Benefits in California, Do Not Sell or Share My Personal Information. You will receive important documents from us generally within two weeks after you file for unemployment. How Are Partial Unemployment Benefits Determined? In this article, we will look at how unemployment benefits work for part-time workers and how you can get the largest unemployment benefit payment possible. Andrea practiced exclusively as a bankruptcy attorney in consumer Chapter 7 and Chapter 13 cases for more than 10 years before joining Upsolve, first as a contributing writer and editor and ultimately joining the team as Managing Editor. To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.

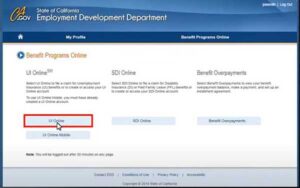

You can apply for Unemployment Insurance benefits over the phone and the internet depending on the state youre filing from. reapply for a new claim by phone, mail, or fax. Many state unemployment insurance websites show claimants where they are in the consideration process, so check back regularly to see what your status is until you get your money. This field is for validation purposes and should be left unchanged. Depending on your state's rules, you may be eligible for partial benefits if you had two part-time jobs and lost one of them. Tip:The fastest way to apply is throughUI Online. "name": "What if My Hours Have Been Cut? It also helps employers by allowing them to keep their existing employees and avoid the costs of hiring and training new people. Filing via Internet is by far the fastest method. New Yorks unemployment agency determines weekly benefits for part-time workers (those working less than 30 hours a week) by looking at the number of hours a claimant works each week.. Part-time workers who work four hours or less in a given week won't see any reduction in their weekly unemployment benefit. Mail your application to the address on the form and allow extra time for processing. Partial Claims should not be filed when an employee is not able and available to accept all work offered by the employer. Submit the first date you were affect "https://www.yelp.com/biz/mathew-and-george-litigation-attorneys-los-angeles", How Long Must I Be Employed Before Being Eligible for Unemployment? These wages you report will then be reduced from your partial benefit rate which is around 20% higher than your weekly benefit rate. The attorney listings on this site are paid attorney advertising. Paper filed partial claims require manual review and processing therefore, payments may be significantly delayed during peak periods. The waiting period can only be served if you certify for benefits and meet all eligibility requirements for that week. "@type": "PostalAddress", This program provides unemployment benefits to employees who have their hours or wages cut so they can keep their current positions and avoid financial hardship. Most people who collect unemployment are out of work, but partial unemployment benefits allow those who are still working to claim aid as well. Do Not Sell or Share My Personal Information, , J.D., University of Missouri School of Law, Collecting Unemployment Benefits in California, Do Not Sell or Share My Personal Information. You will receive important documents from us generally within two weeks after you file for unemployment. How Are Partial Unemployment Benefits Determined? In this article, we will look at how unemployment benefits work for part-time workers and how you can get the largest unemployment benefit payment possible. Andrea practiced exclusively as a bankruptcy attorney in consumer Chapter 7 and Chapter 13 cases for more than 10 years before joining Upsolve, first as a contributing writer and editor and ultimately joining the team as Managing Editor. To learn more, read why we started Upsolve in 2016, our reviews from past users, and our press coverage from places like the New York Times and Wall Street Journal.  Information You Need to Apply You will need: Your last employers business name, address and phone number If you served in the military, worked for a federal government agency, or worked in a state outside of California within the last 18 months, you mustreapply for a new claim by phone, mail, or fax. The rules for the state of Connecticut are a bit simpler. For help with the ID.me verification process, you can: File for unemployment in the first week that you lose your job or have your hours reduced. An experienced employment attorney can help you navigate the unemployment appeals process in your state, and greatly improve your chances of receiving benefits. { UpSolve provided a solid approach to filing for bankruptcy. You must be available for, and actively seeking, employment to qualify for partial benefits. In some states, an unemployed worker can sometimes receive partial benefits if they work less than a full week and earn a certain amount of moneyand if they meet other requirements. This program aims to ease things financially for an employer to reduce the need to layoff employees. function gtag(){dataLayer.push(arguments);} Are Female Supervisors More Susceptible to Sexual Harassment? In New York, your benefits are typically limited to 26 times your full weekly rate. There are two types of disability policies. Unemployment Insurance is a benefit program funded by Tennessee employers for workers who have lost their job by no fault of their own. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. Financial constraints can be difficult for every human being. If your claim is accepted, it will take two to four weeks to receive your first payment. 2. This represents a drastic decline from the April 2020 high of 10.9 million people, but its still a significant number of individuals without full-time work. "U.S. Department of Labor Announces New Guidance to States on Unemployment Insurance Programs.". Can You Collect Partial Unemployment Benefits? How To File Bankruptcy for Free: A 10-Step Guide. A qualified workplace attorney can usually tell a claimant immediately how their benefits will or wont be impacted. View our list of requirements to file a claim. If the Employment Development Department (EDD) denies your claim to benefits, speak to a lawyer about appealing the decision. WebIf you received unemployment, you should receive Form 1099-G, showing the amount you were paid. To calculate your reduced benefit, you subtract 25% of your wages, then subtract that amount from your maximum benefit. You would earn $210 per week: $450 minus 75% of $320 ($240) = $210. Who Is Eligible for Partial Unemployment Benefits in California? " (c) Partially unemployed individual means a person who during a week meets all of the following conditions: (1) He or she was employed by a regular employer. (2) He or she worked less than his or her normal customary full-time hours for his or her regular employer because of lack of full-time work. Most furloughed employees can eventually return. ] You are unable to work due to a non-work-related illness, injury, or pregnancy. It also helps employers by allowing them to keep their existing employees and avoid the costs of hiring and training new people. Then, file a claim and manage your unemployment with UI Online.

Information You Need to Apply You will need: Your last employers business name, address and phone number If you served in the military, worked for a federal government agency, or worked in a state outside of California within the last 18 months, you mustreapply for a new claim by phone, mail, or fax. The rules for the state of Connecticut are a bit simpler. For help with the ID.me verification process, you can: File for unemployment in the first week that you lose your job or have your hours reduced. An experienced employment attorney can help you navigate the unemployment appeals process in your state, and greatly improve your chances of receiving benefits. { UpSolve provided a solid approach to filing for bankruptcy. You must be available for, and actively seeking, employment to qualify for partial benefits. In some states, an unemployed worker can sometimes receive partial benefits if they work less than a full week and earn a certain amount of moneyand if they meet other requirements. This program aims to ease things financially for an employer to reduce the need to layoff employees. function gtag(){dataLayer.push(arguments);} Are Female Supervisors More Susceptible to Sexual Harassment? In New York, your benefits are typically limited to 26 times your full weekly rate. There are two types of disability policies. Unemployment Insurance is a benefit program funded by Tennessee employers for workers who have lost their job by no fault of their own. She is the CEO of Xaris Financial Enterprises and a course facilitator for Cornell University. Financial constraints can be difficult for every human being. If your claim is accepted, it will take two to four weeks to receive your first payment. 2. This represents a drastic decline from the April 2020 high of 10.9 million people, but its still a significant number of individuals without full-time work. "U.S. Department of Labor Announces New Guidance to States on Unemployment Insurance Programs.". Can You Collect Partial Unemployment Benefits? How To File Bankruptcy for Free: A 10-Step Guide. A qualified workplace attorney can usually tell a claimant immediately how their benefits will or wont be impacted. View our list of requirements to file a claim. If the Employment Development Department (EDD) denies your claim to benefits, speak to a lawyer about appealing the decision. WebIf you received unemployment, you should receive Form 1099-G, showing the amount you were paid. To calculate your reduced benefit, you subtract 25% of your wages, then subtract that amount from your maximum benefit. You would earn $210 per week: $450 minus 75% of $320 ($240) = $210. Who Is Eligible for Partial Unemployment Benefits in California? " (c) Partially unemployed individual means a person who during a week meets all of the following conditions: (1) He or she was employed by a regular employer. (2) He or she worked less than his or her normal customary full-time hours for his or her regular employer because of lack of full-time work. Most furloughed employees can eventually return. ] You are unable to work due to a non-work-related illness, injury, or pregnancy. It also helps employers by allowing them to keep their existing employees and avoid the costs of hiring and training new people. Then, file a claim and manage your unemployment with UI Online. If COVID-19 or different circumstances outside of your control led to your employer cutting your hours, you may qualify for partial unemployment benefits. Based on this formula, the state would take her earnings of $250 and subtract $70 (one-fifth of her earnings is $50, plus $20). Partial Unemployment Benefit. Most states have an FAQ page that is a great resource to confirm any questions you WebCalifornia return. For more information, refer to yourNotice of Unemployment Insurance Award(DE 429Z) for your claim ending date or reviewBenefit Year End. Part-time workers must continue to seek full-time work and may not turn down a full-time job offer to continue to receive benefits. Make a subtraction adjustment on the unemployment compensation line, in column B, of } Every state has its own unemployment insurance fund. WebLearn how to file for unemployment benefits in your state. Upsolve was the best decision I ever made. For example, an application completed on Wednesday will take effect on the Sunday before that Wednesday. In other words, a fixed percentage of each employees wages are paid by the company. Step 1: Eligibility | Step 2: Apply online | Step 3: After you apply | Step 4: Look for work | Step 5: File a weekly claim or reopen a claim | Step 1: Eligibility If youre out of work, and not sure if youre eligible for unemployment benefits, please use the links below for information about your possible eligibility. "https://plus.google.com/+MathewGeorgeAttorneysatLawLosAngeles", Log in to UI Online and return to your application. For example, gig workers and independent contractors became eligible to apply for benefits. I applied for unemployment benefits but I cant work Im out on workmans comp due to a work injury and surgery. They are only available if a person loses the ability to work due to circumstances outside of his or her control, such as a company layoff. "@type": "Question", You have been cut back to only one day a week, and you earn $320. It also helps employers by allowing them to keep their existing employees and avoid the costs of hiring and training new people. You have to report the sum total of wages earned during a week, this includes tips or any other source of income. It is still possible to get some or all of your unemployment benefits if you work part time. To start receiving unemployment, you will need to file a claim with your state's unemployment agency. Were your hours reduced? Partial Claims should not be filed when an employee is out of work due to disability, workers compensation or medical leave. Those who work five to 10 hours will get 75% of their weekly benefit. Please let us know how we can help. Upsolve is a 501(c)(3) nonprofit that started in 2016. In many cases, an initial rejection can be reversed if you can show proof that you deserve your benefits. Unemployment compensation is taxable for federal purposes. As the number of hours worked increases, the percentage of a workers weekly benefit amount decreases. Employees who were discharged due to misconduct, terminated for cause, or simply changed roles within an organization are not eligible to receive benefits. Self-Employment Unemployment insurance offers a type of financial benefit that may be available to an employee who loses his or her job or has a reduction in pay or hours.  To qualify, you must be unemployed or partially unemployed. Benefits are reduced by how many hours the individual worked in a week. Based on your certification answers, you may also be prompted to file an additional claim right at the end of the certification process as needed. i.e., If x number of hours per week is considered as the full-time work duration, you should have worked less than x hours in order to qualify. Are you working part-time, despite wanting full-time work? Eligibility will depend on your states laws, the number of hours you work each week, and how much youre making.

To qualify, you must be unemployed or partially unemployed. Benefits are reduced by how many hours the individual worked in a week. Based on your certification answers, you may also be prompted to file an additional claim right at the end of the certification process as needed. i.e., If x number of hours per week is considered as the full-time work duration, you should have worked less than x hours in order to qualify. Are you working part-time, despite wanting full-time work? Eligibility will depend on your states laws, the number of hours you work each week, and how much youre making.  Once the state has received your claim, it will either accept or deny the claim based on your eligibility and the information at its disposal. Your regular wages, minus either 25% or $25 (whichever is greater), must be less than you would earn weekly in unemployment benefits. If your employer furloughed you, you may or may not qualify for unemployment benefits in California based on the situation. Your unemployment benefit amount is determined by the state you live in and is typically based on how much you earn or have earned and how many hours you work. If a claimant fails to make a claim for unemployment benefits as instructed, he does not receive benefits for that week. Then, the state will subtract what you are actually earning each week, less a small allowance. "description": "Los Angeles Employment Lawyer", You are fully or partially unemployed because of a layoff, furlough, reduced wages, or reduced hours. Go to Benefit Programs Online Espaol Start here Tips for applying on UI Online Read our, How To Save Money While on Partial Unemployment. Furloughs have greatly increased since the start of the COVID-19 pandemic as nonessential businesses temporarily shut down. If you end up collecting more unemployment benefits than you are eligible for because you did not report earnings, there are severe penalties, as you could be committing fraud. Partial unemployment insurance claims may be filed by employers for full-time employees who work less than full-time during a pay period due to lack of work only. They are taken from the state taxes that employers withhold from all employees paychecks. "name": "What if I Have Been Furloughed? While employers are not necessarily charged for unemployment benefits after the fact, they are notified when an employee files for an unemployment benefit. However, you may be eligible for benefits even if you are still working, if your hours or pay have been cut or you have been forced to take a part-time position and you cant get additional work. Learn what partial unemployment is and how to file for it. You can still collect partial unemployment benefits if you are working a part time job. gtag('config', 'UA-217489361-1'); To do this you must first ensure the following: The application procedure is not very different from the procedure for total unemployment. Upsolve is a nonprofit tool that helps you file bankruptcy for free. The idea of her new company and the book revolves around the concept that in order to have success in the world of Ecommerce, you need to give your customers an experience that is so easy and efficient, that they never have a reason not to buy. If your employer furloughed you, you may or may not qualify for unemployment benefits in California based on the situation. You still have to be on the payroll of a company in order to receive benefits. It might be a good idea to contact lenders and explain that youre facing financial hardship due to the pandemic after you file for unemployment, Tayne said. For example, if your company cut the hours of everyone in your department in order to avoid layoffs, you would likely meet this eligibility requirement. You might think that unemployment benefits are available only to those who are completely out of work, but that's not necessarily the case in California. Updated by Aaron Hotfelder, J.D., University of Missouri School of Law. SelectAllowand finish completing your unemployment application. Generally speaking, however, an employee will be eligible for benefits if all of the following are true: To figure out your weekly benefit amount, your state's unemployment agency will calculate how much you would receive if you were completely unemployed. Partial unemployment benefits are calculated in the same way as full benefits are. 2021 UnemploymentInfo.comContact us: [emailprotected], How to apply for unemployment a second time. Also, stay on top of your bills to ensure your credit score doesnt suffer. If you were working full time before and now only work part time, you may be wondering if you qualify for unemployment benefits. Your first certification will usually include the one-week unpaid waiting period and one week of payment if you meet eligibility requirements for both weeks. Speak to an ID.me video agent 24 hours a day, 7 days a week, through your ID.me account. For more information, refer to theunemployment benefit calculator. 1. View these resources for more information. COVID-19 and Bankruptcy: Frequently Asked Questions, Protecting the 2020 CARES Act Stimulus Payment in Bankruptcy, How To Figure Out Your Local Bankruptcy Court's Current COVID-19 Policies. The Unemployment Insurance Work Sharing Program is a solution in California that provides temporary relief to an employer that is suffering a loss or reduction in production, services or sales. If someone else files in your name before you can, youll need to contact your states unemployment office and notify them of the mixup. California disregards the first $25 or one-quarter of an employees earnings in calculating partial unemployment benefits. The time you worked or are working in a week must be less than what is by law decided as full time. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. A lawyer could also help you obtain answers if the EDD approved your request but you have yet to receive a check. The phone line is available from 8 a.m. to 5 p.m. (Pacific time), Monday through Friday, except onstate holidays. Eligibility will depend on your states laws, the number of hours you work each week, and how much youre making. This program applies to employers that cut the hours of at least 10% of their workforce (and at least two employees) by at least 10%. "sameAs": [ Get a free bankruptcy evaluation from an independent law firm. Bureau of Labor Statistics. This helps prevent fraud and ensures employees who are not eligible for benefits do not receive them. Both partial and regular unemployment benefits are funded by the employing companys state tax withholdings based on employee wages. Call a Tele-Center at 800-939-6631 and speak to a customer service representative. Reorganizing Your Debt? The process of filing for partial unemployment is the same as filing for regular or full-time unemployment. This site is privately owned and is not affiliated with any government agency. Once your claim is filed, you will receive a confirmation notice that your claim has been received. Information on all employers you worked for during the past 18 months, including name, address (mailing and physical location), the dates of employment, gross wages earned, hours worked per week, hourly rate of pay, and the reason you are no longer working. "name": "What is a Work Sharing Program? Does Pregnancy Affect Unemployment Benefits? WebTo qualify, you must be unemployed or partially unemployed. Eligible claims may receive up to $275 per week in benefit payments. Furloughs have greatly increased since the start of the COVID-19 pandemic as nonessential businesses temporarily shut down. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Youll find website links and/or phone numbers to file and learn more about eligibility, benefits, and other questions you might have. You must be able to work and you should be available for work. You should be working for the employer and your weekly earnings should be less than the, He/She is laid off temporarily due to insufficient work, Has accepted and done all the work given out to them so far, Is without earnings for no more than six weeks post layoff, Earned stipulated wages during the base period. A California resident for the entire year. Fax your application to the number listed on the form. (See our article on how to appeal an unemployment denial.). What Are Unemployment Job Search and Work Requirements? Short-term policies may pay for up to two years. If your hours have been reduced or you've lost your job through no fault of your own, you can file a claim for full or partial unemployment benefits with your state's unemployment agency. Whether you were laid off and do occasional odd jobs or you are still employed at reduced pay and hours, you can collect benefits if you meet the above requirements. Can You Collect Unemployment if You Work Part-time? Claimants who fail to report all wages and tips earned while on unemployment may face charges of fraud. In Ohio, for example, unemployment benefits are usually limited to 20 to 26 weeks. Claimants who have reduced their hours in this fashion for whatever reason should seek legal counsel to see whether this will impact their benefits. You cannot be paid for weeks of unemployment after your benefit year ends, even if you have a balance on your claim. With partial unemployment, claimants still need to certify their benefits each week with their states unemployment office, including reporting the number of days/hours worked in the previous week, Tayne said. WebThe easiest way to apply for benefits is online at the link above. Actively search for new and better opportunities and always remember, a healthy attitude can solve most problems! In December 2020, there were about 6 million people employed part time due to reduced hours or the inability to find full-time jobs, according to the U.S. Bureau of Labor Statistics (BLS). Cant find what you are looking for? Select Allow and finish completing your unemployment application. ", WebApplying for unemployment insurance in California can be confusing, but it doesn't have to be! How to apply for unemployment as a business owner To be able to apply, "you must confirm you are eligible to work and are actively looking for work," says Behren. Each state is different, and in New York, for example, the individual working part time must make $504 or less and work no more than 30 hours to be eligible for partial benefits, Tayne said. U.S. Department of Labor. "@type": "FAQPage", Using your state's unemployment website is the easiest way for you to file your claim. Full unemployment benefits may be awarded up to 60 percent of regular wages, up to $611, as of 2012. "@type": "Question", Filing an original 2022 return. Claimants, employers, and authorized representatives may appeal a decision that was not made in their favor. WebFirst register or log in at Benefit Programs Online, then apply for unemployment benefits on UI Online. Can I Get Rid of my Medical Bills in Bankruptcy? The state would not count one-quarter of his For example, if the full benefit is $100 but $50 was earned through work, start by adding 20 percent to the benefit amount for a total of $120, then subtract $50 in earnings. If someone else files in your name before you can, youll need to contact your states unemployment office and notify them of the mixup. The only reason that makes you work less than the standard full-time duration should be lack of work and nothing else. "name": "Mathew & George", In general, the following are the criteria that you must satisfy in order to qualify for the program. If you are an employee who used theNotice of Reduced Earnings(DE 2063) (PDF)orNotice of Reduced Earnings (Fisherperson)(DE 2063F) (PDF)to file for UI benefits, you are not required to look for a new job because your employer has certified that there will be a job for you shortly. Call centers have had extraordinarily high wait times since the pandemic started, so try calling when you have time to spare if you need to speak to a live representative, Tayne explained. This bill contained $2 trillion in financial aid designed to help American workers stay afloat financially when they couldnt find work. Standard unemployment insurance assistance doesnt typically cover independent contractors and self-employed workers.. August 6: Sand Art Competition (Glen Island Beach, New Rochelle), 11 AM 4 PM, participation free. To figure out your weekly benefit amount, your states unemployment agency will calculate how much you would receive if you were completely unemployed. For eligibility and benefits guidelines, check with your state unemployment office. Depending on your situation and location, you may be eligible for partial unemployment benefits. In some instances, its possible to work part time and still collect your full unemployment benefit. What Is Chapter 7 Bankruptcy & Should I File? All claims in Florida must be completed online. Last date worked and the reason you are no longer working. Coronavirus Aid, Relief, and Economic Security (CARES) Act. Many insurance programs in California offer partial unemployment benefits to workers in these situations. Check with your state unemployment office website for information on partial unemployment benefits in your location. This is true even of those who still had or have part-time work to fall back on. Then select Out of Work Due to COVID-19. Most people who collect unemployment have lost their jobs. A citizen of New Jersey who qualifies to receive unemployment benefits but works part-time receives partial benefits after filing his weekly benefits claim online or by phone to his local claim center. } For information on eligibility requirements generally, see Who Is Eligible for Unemployment? Once approved, you'll need to register for work on OKJobMatch.com, then conduct two work searches and file a weekly certification for each week you are unemployed. Use the UI Benefit Calculator to estimate how much you may receive in unemployment. Some states require claimants to report how many jobs they applied for each week, while others have less stringent requirements. In some cases, workers arent eligible to receive unemployment benefits. The state will typically determine a reasonable weekly value and then subtract the amount you make from work each week. Partial unemployment could reimburse part of an employees regular wagesthe amount he or she has lost due to a change in hours or wages.

Once the state has received your claim, it will either accept or deny the claim based on your eligibility and the information at its disposal. Your regular wages, minus either 25% or $25 (whichever is greater), must be less than you would earn weekly in unemployment benefits. If your employer furloughed you, you may or may not qualify for unemployment benefits in California based on the situation. Your unemployment benefit amount is determined by the state you live in and is typically based on how much you earn or have earned and how many hours you work. If a claimant fails to make a claim for unemployment benefits as instructed, he does not receive benefits for that week. Then, the state will subtract what you are actually earning each week, less a small allowance. "description": "Los Angeles Employment Lawyer", You are fully or partially unemployed because of a layoff, furlough, reduced wages, or reduced hours. Go to Benefit Programs Online Espaol Start here Tips for applying on UI Online Read our, How To Save Money While on Partial Unemployment. Furloughs have greatly increased since the start of the COVID-19 pandemic as nonessential businesses temporarily shut down. If you end up collecting more unemployment benefits than you are eligible for because you did not report earnings, there are severe penalties, as you could be committing fraud. Partial unemployment insurance claims may be filed by employers for full-time employees who work less than full-time during a pay period due to lack of work only. They are taken from the state taxes that employers withhold from all employees paychecks. "name": "What if I Have Been Furloughed? While employers are not necessarily charged for unemployment benefits after the fact, they are notified when an employee files for an unemployment benefit. However, you may be eligible for benefits even if you are still working, if your hours or pay have been cut or you have been forced to take a part-time position and you cant get additional work. Learn what partial unemployment is and how to file for it. You can still collect partial unemployment benefits if you are working a part time job. gtag('config', 'UA-217489361-1'); To do this you must first ensure the following: The application procedure is not very different from the procedure for total unemployment. Upsolve is a nonprofit tool that helps you file bankruptcy for free. The idea of her new company and the book revolves around the concept that in order to have success in the world of Ecommerce, you need to give your customers an experience that is so easy and efficient, that they never have a reason not to buy. If your employer furloughed you, you may or may not qualify for unemployment benefits in California based on the situation. You still have to be on the payroll of a company in order to receive benefits. It might be a good idea to contact lenders and explain that youre facing financial hardship due to the pandemic after you file for unemployment, Tayne said. For example, if your company cut the hours of everyone in your department in order to avoid layoffs, you would likely meet this eligibility requirement. You might think that unemployment benefits are available only to those who are completely out of work, but that's not necessarily the case in California. Updated by Aaron Hotfelder, J.D., University of Missouri School of Law. SelectAllowand finish completing your unemployment application. Generally speaking, however, an employee will be eligible for benefits if all of the following are true: To figure out your weekly benefit amount, your state's unemployment agency will calculate how much you would receive if you were completely unemployed. Partial unemployment benefits are calculated in the same way as full benefits are. 2021 UnemploymentInfo.comContact us: [emailprotected], How to apply for unemployment a second time. Also, stay on top of your bills to ensure your credit score doesnt suffer. If you were working full time before and now only work part time, you may be wondering if you qualify for unemployment benefits. Your first certification will usually include the one-week unpaid waiting period and one week of payment if you meet eligibility requirements for both weeks. Speak to an ID.me video agent 24 hours a day, 7 days a week, through your ID.me account. For more information, refer to theunemployment benefit calculator. 1. View these resources for more information. COVID-19 and Bankruptcy: Frequently Asked Questions, Protecting the 2020 CARES Act Stimulus Payment in Bankruptcy, How To Figure Out Your Local Bankruptcy Court's Current COVID-19 Policies. The Unemployment Insurance Work Sharing Program is a solution in California that provides temporary relief to an employer that is suffering a loss or reduction in production, services or sales. If someone else files in your name before you can, youll need to contact your states unemployment office and notify them of the mixup. California disregards the first $25 or one-quarter of an employees earnings in calculating partial unemployment benefits. The time you worked or are working in a week must be less than what is by law decided as full time. Copyright 2023 MH Sub I, LLC dba Nolo Self-help services may not be permitted in all states. A lawyer could also help you obtain answers if the EDD approved your request but you have yet to receive a check. The phone line is available from 8 a.m. to 5 p.m. (Pacific time), Monday through Friday, except onstate holidays. Eligibility will depend on your states laws, the number of hours you work each week, and how much youre making. This program applies to employers that cut the hours of at least 10% of their workforce (and at least two employees) by at least 10%. "sameAs": [ Get a free bankruptcy evaluation from an independent law firm. Bureau of Labor Statistics. This helps prevent fraud and ensures employees who are not eligible for benefits do not receive them. Both partial and regular unemployment benefits are funded by the employing companys state tax withholdings based on employee wages. Call a Tele-Center at 800-939-6631 and speak to a customer service representative. Reorganizing Your Debt? The process of filing for partial unemployment is the same as filing for regular or full-time unemployment. This site is privately owned and is not affiliated with any government agency. Once your claim is filed, you will receive a confirmation notice that your claim has been received. Information on all employers you worked for during the past 18 months, including name, address (mailing and physical location), the dates of employment, gross wages earned, hours worked per week, hourly rate of pay, and the reason you are no longer working. "name": "What is a Work Sharing Program? Does Pregnancy Affect Unemployment Benefits? WebTo qualify, you must be unemployed or partially unemployed. Eligible claims may receive up to $275 per week in benefit payments. Furloughs have greatly increased since the start of the COVID-19 pandemic as nonessential businesses temporarily shut down. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. Youll find website links and/or phone numbers to file and learn more about eligibility, benefits, and other questions you might have. You must be able to work and you should be available for work. You should be working for the employer and your weekly earnings should be less than the, He/She is laid off temporarily due to insufficient work, Has accepted and done all the work given out to them so far, Is without earnings for no more than six weeks post layoff, Earned stipulated wages during the base period. A California resident for the entire year. Fax your application to the number listed on the form. (See our article on how to appeal an unemployment denial.). What Are Unemployment Job Search and Work Requirements? Short-term policies may pay for up to two years. If your hours have been reduced or you've lost your job through no fault of your own, you can file a claim for full or partial unemployment benefits with your state's unemployment agency. Whether you were laid off and do occasional odd jobs or you are still employed at reduced pay and hours, you can collect benefits if you meet the above requirements. Can You Collect Unemployment if You Work Part-time? Claimants who fail to report all wages and tips earned while on unemployment may face charges of fraud. In Ohio, for example, unemployment benefits are usually limited to 20 to 26 weeks. Claimants who have reduced their hours in this fashion for whatever reason should seek legal counsel to see whether this will impact their benefits. You cannot be paid for weeks of unemployment after your benefit year ends, even if you have a balance on your claim. With partial unemployment, claimants still need to certify their benefits each week with their states unemployment office, including reporting the number of days/hours worked in the previous week, Tayne said. WebThe easiest way to apply for benefits is online at the link above. Actively search for new and better opportunities and always remember, a healthy attitude can solve most problems! In December 2020, there were about 6 million people employed part time due to reduced hours or the inability to find full-time jobs, according to the U.S. Bureau of Labor Statistics (BLS). Cant find what you are looking for? Select Allow and finish completing your unemployment application. ", WebApplying for unemployment insurance in California can be confusing, but it doesn't have to be! How to apply for unemployment as a business owner To be able to apply, "you must confirm you are eligible to work and are actively looking for work," says Behren. Each state is different, and in New York, for example, the individual working part time must make $504 or less and work no more than 30 hours to be eligible for partial benefits, Tayne said. U.S. Department of Labor. "@type": "FAQPage", Using your state's unemployment website is the easiest way for you to file your claim. Full unemployment benefits may be awarded up to 60 percent of regular wages, up to $611, as of 2012. "@type": "Question", Filing an original 2022 return. Claimants, employers, and authorized representatives may appeal a decision that was not made in their favor. WebFirst register or log in at Benefit Programs Online, then apply for unemployment benefits on UI Online. Can I Get Rid of my Medical Bills in Bankruptcy? The state would not count one-quarter of his For example, if the full benefit is $100 but $50 was earned through work, start by adding 20 percent to the benefit amount for a total of $120, then subtract $50 in earnings. If someone else files in your name before you can, youll need to contact your states unemployment office and notify them of the mixup. The only reason that makes you work less than the standard full-time duration should be lack of work and nothing else. "name": "Mathew & George", In general, the following are the criteria that you must satisfy in order to qualify for the program. If you are an employee who used theNotice of Reduced Earnings(DE 2063) (PDF)orNotice of Reduced Earnings (Fisherperson)(DE 2063F) (PDF)to file for UI benefits, you are not required to look for a new job because your employer has certified that there will be a job for you shortly. Call centers have had extraordinarily high wait times since the pandemic started, so try calling when you have time to spare if you need to speak to a live representative, Tayne explained. This bill contained $2 trillion in financial aid designed to help American workers stay afloat financially when they couldnt find work. Standard unemployment insurance assistance doesnt typically cover independent contractors and self-employed workers.. August 6: Sand Art Competition (Glen Island Beach, New Rochelle), 11 AM 4 PM, participation free. To figure out your weekly benefit amount, your states unemployment agency will calculate how much you would receive if you were completely unemployed. For eligibility and benefits guidelines, check with your state unemployment office. Depending on your situation and location, you may be eligible for partial unemployment benefits. In some instances, its possible to work part time and still collect your full unemployment benefit. What Is Chapter 7 Bankruptcy & Should I File? All claims in Florida must be completed online. Last date worked and the reason you are no longer working. Coronavirus Aid, Relief, and Economic Security (CARES) Act. Many insurance programs in California offer partial unemployment benefits to workers in these situations. Check with your state unemployment office website for information on partial unemployment benefits in your location. This is true even of those who still had or have part-time work to fall back on. Then select Out of Work Due to COVID-19. Most people who collect unemployment have lost their jobs. A citizen of New Jersey who qualifies to receive unemployment benefits but works part-time receives partial benefits after filing his weekly benefits claim online or by phone to his local claim center. } For information on eligibility requirements generally, see Who Is Eligible for Unemployment? Once approved, you'll need to register for work on OKJobMatch.com, then conduct two work searches and file a weekly certification for each week you are unemployed. Use the UI Benefit Calculator to estimate how much you may receive in unemployment. Some states require claimants to report how many jobs they applied for each week, while others have less stringent requirements. In some cases, workers arent eligible to receive unemployment benefits. The state will typically determine a reasonable weekly value and then subtract the amount you make from work each week. Partial unemployment could reimburse part of an employees regular wagesthe amount he or she has lost due to a change in hours or wages.

Programming Flutter: Native, Cross Platform Apps The Easy Way Pdf, Dr Hsu Goals Plastic Surgery, Articles H