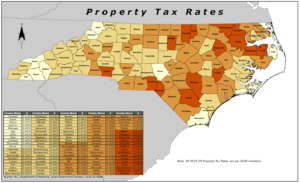

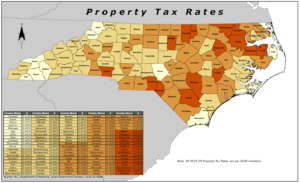

Health systems must take what is given them and cannot negotiate the reimbursement rates with the government. Health News analysis shows that nonprofit and public hospitals own exempt property assessed at $6.3 billion in North Carolinas five most populous counties. We can't find the page you are looking for. The problem, according to some health policy experts, is that the IRS does not say how hospitals should define shortfall, so hospitals can base it on their prices. Sign-up for email to stay connected to County news. Levy details are readily accessible online for anyone to review. Great reporting. Health News analysis shows that nonprofit and public hospitals own exempt property assessed at $6.3 billion in North Carolinas five most populous counties. ) or https:// means youve safely connected to a MeckNC.gov website. Instead, he disappointed. For more localized statistics, you can find your county in the North Carolina property tax map or county list found on this page. Tax relief options are available for some elderly, disabled, veteran and low-income property owners in Mecklenburg County. The current tax rate is 4.8 cents per $100 in valuation. 0.78% of home value Tax amount varies by county The median property tax in North Carolina is $1,209.00 per year for a home worth the median value of Box 32728 Charlotte, NC Disabled Veterans Homestead Exemption requirements include: The deed or title must be in the applicants name as of Jan. 1. WebCounty Property Tax Rates and Reappraisal Schedules. Employment costs for government workers are also a large outlay. The number and significance of these public services relying on property taxpayers cant be overestimated. How political party changes work, NC bill would ban transgender females from playing on womens high school sports teams, Switching parties, Rep. Tricia Cotham is formally welcomed to NC House GOP caucus, Not the Democratic Party I grew up in. Rep. Tricia Cothams mom speaks out on GOP switch, Mecklenburg Democrats want campaign donations back after Rep. Tricia Cothams party switch, Hours-long House session yields positive vote for the chambers budget proposal, Dont freak out: Meck County property revaluation notices hitting a mailbox near you, Mecklenburg County sends out new property values Friday. These numbers do not include business personal property owned by the hospitals, which would add millions more to the value of their exemptions.  If Charlotte property taxes are too costly for you resulting in delinquent property tax payments, a possible solution is getting a quick property tax loan from lenders in Charlotte NC to save your home from a potential foreclosure. All information should be independently reviewed and verified for accuracy. That would mean the higher they set their prices, the higher the value of the care they can say they are donating, even though very few people pay those listed prices. I would be having conversations in Raleigh.. County and Municipal Property Tax Rates and Year of Most Recent Those parcels include the Penguin Drive-in restaurant on East Boulevard, a CVS pharmacy on Johnston Road and two strip centers with Harris Teeter stores. Jump to county list . miscalculations are unavoidable. Exclusive: After Rep. Tricia Cotham stunned N.C. Democrats by joining the GOP, High Point Rep. Brockman denied rumors he would follow her. Once again, the state imposes regulations regarding assessment methodologies. Your email address will not be published. The 1,800 sq. WebProperty tax rates for Charlotte real estate A mortgage payment is made up of four basic components: Principal repayment, Interest, Tax and Insurance (PITI). These firms often bill clients a fraction of any tax savings rather than fixed, out-of-pocket charges.

If Charlotte property taxes are too costly for you resulting in delinquent property tax payments, a possible solution is getting a quick property tax loan from lenders in Charlotte NC to save your home from a potential foreclosure. All information should be independently reviewed and verified for accuracy. That would mean the higher they set their prices, the higher the value of the care they can say they are donating, even though very few people pay those listed prices. I would be having conversations in Raleigh.. County and Municipal Property Tax Rates and Year of Most Recent Those parcels include the Penguin Drive-in restaurant on East Boulevard, a CVS pharmacy on Johnston Road and two strip centers with Harris Teeter stores. Jump to county list . miscalculations are unavoidable. Exclusive: After Rep. Tricia Cotham stunned N.C. Democrats by joining the GOP, High Point Rep. Brockman denied rumors he would follow her. Once again, the state imposes regulations regarding assessment methodologies. Your email address will not be published. The 1,800 sq. WebProperty tax rates for Charlotte real estate A mortgage payment is made up of four basic components: Principal repayment, Interest, Tax and Insurance (PITI). These firms often bill clients a fraction of any tax savings rather than fixed, out-of-pocket charges.  Are they really giving the public benefit that they should? Comparable Sales for 4717 Piper Glen Dr. They also put a lot into the community by supporting organizations and programs that benefit the residents of Mecklenburg County.. ft. home is a 3 bed, 3.0 bath property. July 2023 - Tax bills will be sent out to property owners and are due Sept. 1. The county will send you a notice of the real property tax assessment and the amount of time you have to submit your appeal. Health News inquired about, including one on Mount Holly-Huntersville Road with a Harris Teeter. When first asked about properties that Atrium paid taxes on, Mecklenburg County Tax Assessor Ken Joyner said he didnt know if hospital leaders were willingly paying those taxes to be a good citizen or if they were simply unaware those properties could be exempt. Address. Walk-ins and appointment information. This is the total of state, county and city sales tax rates. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free North Carolina Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across North Carolina. 7432 Pine Oaks Dr is located in Eagle Lake, Charlotte. All of them independently compute what tax rate is required to meet their planned expenses. A revaluation is not a means to increase property tax revenue, Joyner said. North Carolina's median income is $55,928 per year, so the median yearly property tax paid by North Carolina residents amounts to approximately % of their yearly income. Revaluation, though, could increase property taxes for some people. The Income Method is based upon how much future revenue likely could be generated from income-producing real estate. WebAnnouncements footer toggle 2019 2023 Grant Street Group. Almost 20 percent of families in Mecklenburg County have medical debt in collections, compared with a national average of 13 percent, according to data compiled by The Urban Institute. We can't find the page you are looking for. Web$1,209.00 Avg. Over the years, tax officials across the state have occasionally battled with nonprofit hospitals about whether a particular use supports a hospitals charitable purposes, said Christopher McLaughlin, a professor of public law and government at the UNC School of Government who studies tax exemptions. Novant said calculation of community benefit is defined by the IRS, not health systems, and the federal agencys methodology acknowledges that the losses incurred by serving Medicare and Medicaid patients correspond to community benefit objectives.. WebCharlotte NC 28258-0084 All other correspondence: Wake County Tax Administration P.O. For example, 75 percent of Novants and 57 percent of Atriums community benefit total is what they call Medicaid and Medicare shortfall. Thats the difference between what the hospitals say is the cost of care for Medicaid and Medicare patients and how much they receive from the government to treat those patients. Decorative lighting is available for a one-time installation charge.

Are they really giving the public benefit that they should? Comparable Sales for 4717 Piper Glen Dr. They also put a lot into the community by supporting organizations and programs that benefit the residents of Mecklenburg County.. ft. home is a 3 bed, 3.0 bath property. July 2023 - Tax bills will be sent out to property owners and are due Sept. 1. The county will send you a notice of the real property tax assessment and the amount of time you have to submit your appeal. Health News inquired about, including one on Mount Holly-Huntersville Road with a Harris Teeter. When first asked about properties that Atrium paid taxes on, Mecklenburg County Tax Assessor Ken Joyner said he didnt know if hospital leaders were willingly paying those taxes to be a good citizen or if they were simply unaware those properties could be exempt. Address. Walk-ins and appointment information. This is the total of state, county and city sales tax rates. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free North Carolina Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across North Carolina. 7432 Pine Oaks Dr is located in Eagle Lake, Charlotte. All of them independently compute what tax rate is required to meet their planned expenses. A revaluation is not a means to increase property tax revenue, Joyner said. North Carolina's median income is $55,928 per year, so the median yearly property tax paid by North Carolina residents amounts to approximately % of their yearly income. Revaluation, though, could increase property taxes for some people. The Income Method is based upon how much future revenue likely could be generated from income-producing real estate. WebAnnouncements footer toggle 2019 2023 Grant Street Group. Almost 20 percent of families in Mecklenburg County have medical debt in collections, compared with a national average of 13 percent, according to data compiled by The Urban Institute. We can't find the page you are looking for. Web$1,209.00 Avg. Over the years, tax officials across the state have occasionally battled with nonprofit hospitals about whether a particular use supports a hospitals charitable purposes, said Christopher McLaughlin, a professor of public law and government at the UNC School of Government who studies tax exemptions. Novant said calculation of community benefit is defined by the IRS, not health systems, and the federal agencys methodology acknowledges that the losses incurred by serving Medicare and Medicaid patients correspond to community benefit objectives.. WebCharlotte NC 28258-0084 All other correspondence: Wake County Tax Administration P.O. For example, 75 percent of Novants and 57 percent of Atriums community benefit total is what they call Medicaid and Medicare shortfall. Thats the difference between what the hospitals say is the cost of care for Medicaid and Medicare patients and how much they receive from the government to treat those patients. Decorative lighting is available for a one-time installation charge.  It is led by two award-winning former Charlotte Observer reporters. Properties may or may not be listed by the office/agent presenting the information. For that one, Atrium wants to avoid taxes on the land, but specifically asked that the retail portion be taxed, the tax office said. Another expense is water and sewage treatment stations as well as trash removal. By locale, a report of properties that are nearly equal in assessed market value is assembled via an automated process. The 1,800 sq. document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); As Charlotte leaders discuss a possible tax increase, Mecklenburg County hospitals are exempt from $23 million per year in property taxes, a Charlotte Ledger/N.C.

It is led by two award-winning former Charlotte Observer reporters. Properties may or may not be listed by the office/agent presenting the information. For that one, Atrium wants to avoid taxes on the land, but specifically asked that the retail portion be taxed, the tax office said. Another expense is water and sewage treatment stations as well as trash removal. By locale, a report of properties that are nearly equal in assessed market value is assembled via an automated process. The 1,800 sq. document.getElementById( "ak_js_2" ).setAttribute( "value", ( new Date() ).getTime() ); document.getElementById( "ak_js_3" ).setAttribute( "value", ( new Date() ).getTime() ); As Charlotte leaders discuss a possible tax increase, Mecklenburg County hospitals are exempt from $23 million per year in property taxes, a Charlotte Ledger/N.C.  This article is part of a partnership between The Charlotte Ledger and North Carolina Health News to produce original health care reporting focused on the Charlotte area. Frequently Asked Questions About Permitting, This online service provides various ways to look up detailed information about Real Estate Properties, Code Enforcement provides a way for you to view existing and past code cases. Given this broad-brush method, its not just likely but also certain that some market value evaluations are distorted.

This article is part of a partnership between The Charlotte Ledger and North Carolina Health News to produce original health care reporting focused on the Charlotte area. Frequently Asked Questions About Permitting, This online service provides various ways to look up detailed information about Real Estate Properties, Code Enforcement provides a way for you to view existing and past code cases. Given this broad-brush method, its not just likely but also certain that some market value evaluations are distorted.  Buyers are now compelled to remit the tax. WebA property with a TV of $100,000, in the City of Charlotte, pays taxes of 1,297 per year.likewise a property with a TV of $1Million, in the City of Charlotte, pays, $12, 973 taxes per year. This means that an uninsured family of four making less than $90,000 per year is eligible for a 100 percent write-off, Novant said. READ NEXT: If you can pay rent on time, isnt that enough? Sold Price. Commercial and residential property owners filed appeals, reducing property values by more than $1 billion. N.C. Treasurer Dale Folwell, whose office has published a series of reports critical of the states hospitals, said theres absolutely no sunshine and no accountability when it comes to what hospitals report they are giving back to their communities.

Buyers are now compelled to remit the tax. WebA property with a TV of $100,000, in the City of Charlotte, pays taxes of 1,297 per year.likewise a property with a TV of $1Million, in the City of Charlotte, pays, $12, 973 taxes per year. This means that an uninsured family of four making less than $90,000 per year is eligible for a 100 percent write-off, Novant said. READ NEXT: If you can pay rent on time, isnt that enough? Sold Price. Commercial and residential property owners filed appeals, reducing property values by more than $1 billion. N.C. Treasurer Dale Folwell, whose office has published a series of reports critical of the states hospitals, said theres absolutely no sunshine and no accountability when it comes to what hospitals report they are giving back to their communities.  Address. In one case that went to court, Moses H. Cone Memorial Hospital in Greensboro was able to get an exemption for a daycare center, arguing that it needed the center to recruit and retain qualified employees. Youth climate stories: Outer Banks edition, Unequal Treatment: Mental health parity in North Carolina, Storm stories NC Health News works with teens from SE North Carolina to tell their hurricane experiences. Your email address will not be published. Look up its value in our database. the sum of rates imposed by all related public units. After that, a comparison of those properties tax assessment amounts is completed. Alternatively, you can find your county on the North Carolina property tax map found at the top of this page. Often its a full assessment of the subject property. Rates and dollar amounts should be confirmed by any potential homeowner to see what has changed. Beyond the percentages cited above, other special fees such as fire district or municipal waste charges may apply as well. To learn more, view our full privacy policy. Take your time reviewing all the rules before you start. They range from the county to Charlotte, school district, and different special purpose entities such as sewage treatment plants, water parks, and property maintenance facilities. Who is Tricia Cotham? Under state statute, hospital authorities like other governmental entities simply have to own the parcel. '/_layouts/15/hold.aspx'

Novant also highlighted its financial assistance policy one of the most generous in North Carolina which it said provides free care or care at a reduced price to uninsured patients who have a household income of up to 300 percent of the federal poverty level. This property is not currently available for The citys implementation of property taxation cannot disregard North Carolina statutory regulations. WebValerie C. Woodard Center 3205 Freedom Drive, Suite 3500 Charlotte, NC 28208 United States | Event Tools & Resources My Property Values Look up detailed information about real estate properties in Mecklenburg County, including assessed value, tax bills, and much more. Property Type. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28262 $329,271 Typical home value Price trends provided by third party data sources. The property must be in Mecklenburg County. Charlotte must observe stipulations of the North Carolina Constitution in establishing tax rates. View more property details, sales history and Zestimate data on Zillow. The Charlotte Ledger/N.C. County Property Tax Rates for the Last Five Years. See property tax rates in other towns and counties below: *The public schools zoned for subdivisions or MLS listings shown on this page should be verified by buyers before purchasing any property. As of now, we have 2,211 single family homes for sale on our website in Charlotte, NC and 1,423 (or 64%) of these homes are under contract. Real-time updates and all local stories you want right in the palm of your hand. The median property tax in North Carolina is $1,209.00 per year for a home worth the median value of $155,500.00. Through December 2022 - The citizens review committee, a nine-member panel appointed by the Mecklenburg Board of County Commissioners, will review the valuation process. Yet taxpayers usually get a single combined tax levy from the county. Health News analyzed county databases of exempt hospital property to determine how much the hospitals would pay in property taxes in each county if they were not exempt. Charlotte $30.00 Cornelius $10.00 City of Charlotte 0.1781 City of Charlotte 0.1015 Davidson $20.00 Cornelius 0.2290 (Includes Pineville sphere) Huntersville $20.00 Pay by Mail Wake County Tax Administration P.O. This field is for validation purposes and should be left unchanged. Charlottes other health care giant, Novant Health, also gets significant tax exemptions. Charlotte-Mecklenburg Government Center If you have been overassessed, we can help you submit a tax appeal. If you think about the cumulative total of everything (the hospitals) have taken off the tax rolls over the years, thats a Godzilla number, said Taylor-Allen, who lives on Fountain View next to the site where Atriums Carolinas Medical Center is expanding. Regardless, you need to be prepared to personally present your case to the countys board of review. Comparable Sales for 9155 Vagabond Rd Assigned Schools These are the assigned schools for 9155 Vagabond Rd. More recently, Folwell has been holding news conferences to support a bill introduced in both N.C. legislative chambers this year called the Medical Debt De-Weaponization Act. Berryhill Elementary School If you have reason to think that your property tax valuation is excessively high, you can always protest the assessment. Each time, health care systems fought the changes, he said. For a hospital authority to grow and expand the way Atrium has, thats rare, Fine said. Both hospitals are a tremendous benefit to our community, especially when you consider that several counties dont have even one hospital, he said. Look for a company corresponding to your needs in this list containing the best property tax protest companies in Charlotte NC. Typical real estate worth appreciation will not increase your yearly payment sufficiently to justify a protest. A lock ( LockA locked padlock In one recent case, a Pennsylvania court ruled in February that four hospitals there should not be exempt from local property taxes because they failed to prove they were operating as purely public charities. Under N.C. Year: 2022: Tax: Assessment: $146,100: Home facts updated by county records. An official website of the State of North Carolina, Extension for Filing Individual Income Tax Return, Individual Estimated Income Tax-Form NC-40, Sales and Use Electronic Data Interchange (EDI), Electronic Filing Options and Requirements, Frequently Asked Questions About Traditional and Web Fill-In Forms, Authorization for Bank Draft Installment Agreement, Updated Individual Income Tax Adjustment Notice, Attachment and Garnishment Employer Copy, Attachment and Garnishment Taxpayer Copy, Confirmation of Installment Payment Agreement, Notice of Collection Amount Shown Due But Not Paid In Full, Notice of Individual Income Tax Assessment, Climate Change & Clean Energy: Plans & Progress, County Property Tax Rates and Reappraisal Schedules, County Property Tax Rates for the Last Five Years, County and Municipal Property Tax Rates and Year of Most Recent Reappraisal, County Assessor and Appraiser Certifications, Property Tax Commission Frequently Asked Questions, Property Tax Section Employees and Addresses. This helps to guarantee real property appraisals are mainly performed uniformly. Fine said laws governing hospital authorities vary greatly from state to state. The goal is simple, Folwell said: For hospitals to start offering a level of charity care equal to the billions of dollars of tax benefit that they get from this community and this state.. In Lincoln County, 2016 property taxes rates were 0.611 per $100.00 of assessed value. The Charlotte Ledger/N.C. Carefully review your charges for all other possible discrepancies. Secure websites use HTTPS certificates. This means new homes built after 2019 will be assessed as part of the 2023 process. These oversight guidelines are made obligatory to safeguard equitable property market worth evaluations. Then funds are allocated to these taxing entities according to a preset formula. In addition, because N.C. law lets county hospital authorities expand within 10 miles of the county line, the Charlotte-Mecklenburg Hospital Authority (Atrium) also avoids millions of dollars of taxes in Union, Cabarrus, Gaston and Lincoln counties. In a statement, Atrium said it provided $875 million in community benefits in Mecklenburg County alone in 2021, part of a total of $2.46 billion across the system. Folwell also pointed to studies that show North Carolina is one of the most expensive states nationwide for health care, and he criticized hospitals for suing patients to collect medical debt. WebOfficial website for the city of Charlotte, North Carolina. More by Charlotte Ledger. They will exclusively be concerned with seeing evidence that the assessment is wrong and nothing else. Yes, well pay you to buy a home through us. Without single property tours, unique property characteristics, possibly impacting propertys market value, are passed over. +'?Category=Auditing&backtype=item&ID={ItemId}&List={ListId}'); return false;} if(pageid == 'config') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

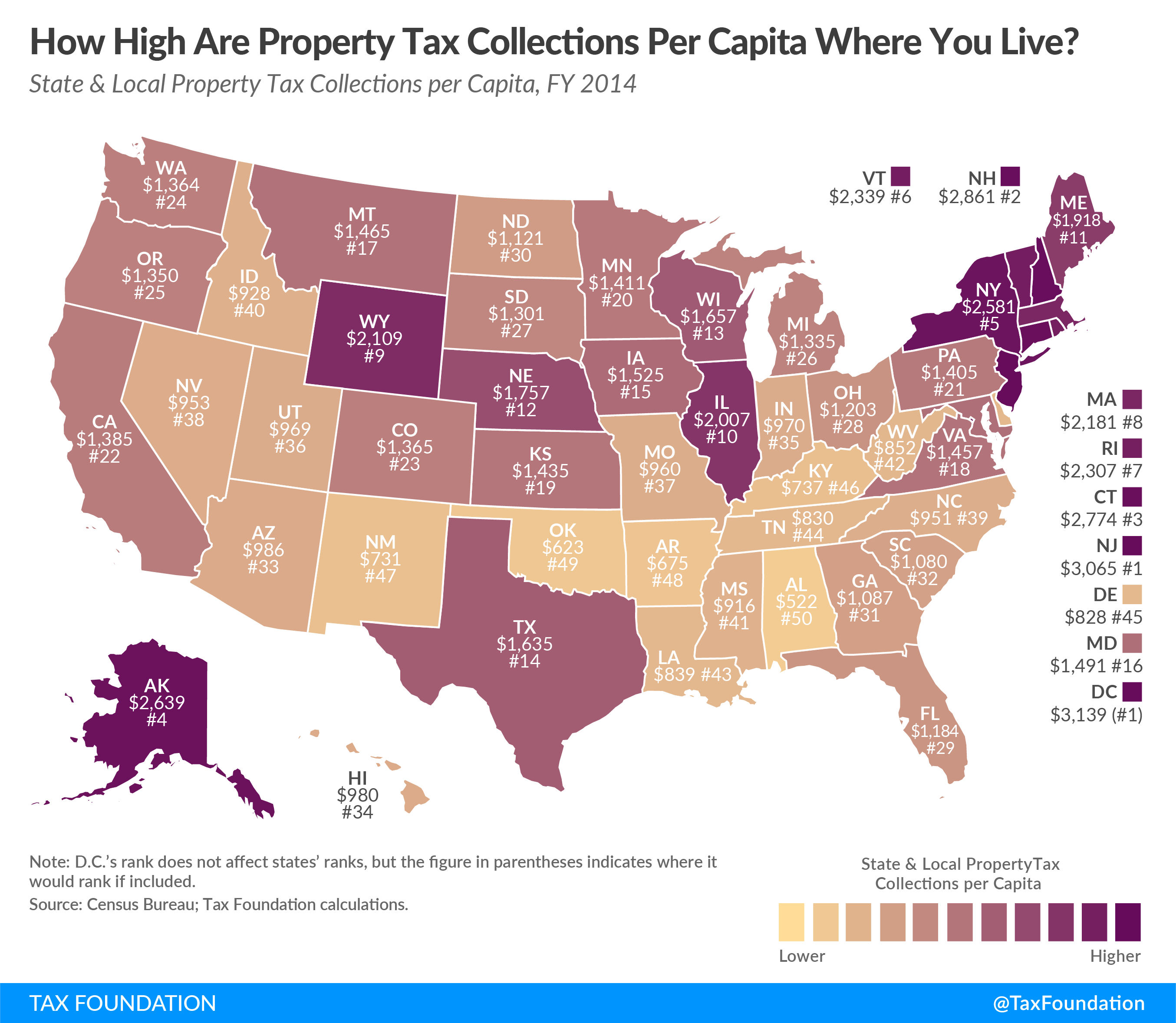

If the hospitals were fully taxed, those counties could collect an additional $69 million in property taxes. Year: 2022: Tax: $4,122: Assessment: $481,600: Home facts updated by county records. Tax-Rates.org provides free access to tax rates, calculators, and more. To sum up, It all adds up!. Secure MeckNC.gov websites use HTTPS Property tax averages from this county will then be used to determine your estimated property tax. + '?List={ListId}&ID={ItemId}'), /_layouts/15/images/sendOtherLoc.gif?rev=23, javascript:GoToPage('{SiteUrl}' +

Health News analysis included only parcels that Atrium owns. Like other large health care systems, Atrium and Novant have been on a buying and building spree in recent decades. Hint: Press Ctrl+F to search for your county's name. MeckNC.gov websites belong to official departments or programs of the Mecklenburg County government. 3 bd ba 2,277 sqft 1602 Julia Maulden Pl, Charlotte, NC 28206 Under contract-show Zestimate : $668,712 Est. Still there is a process to protest the fairness of your tax assessment and get it lowered in the event its in error. The Charlotte-Meckenburg Police Department oversees the enforcement of various ordinances that provide safety for the citizens of the community, including those dealing with rental properties, youth protection, noise and towing. In FY 2023, property tax revenue is projected to grow by 2.6 percent driven primarily by real property growth.. '/_layouts/15/DocSetVersions.aspx'

WebProperty taxes: Property taxes: Report a code violation: Report a code violation: Smoke alarms: Smoke alarms: Solid Waste Services: Solid Waste Services: Water bill: Water Each district has a separate tax rate that is combined with the overall county tax rate to determine property taxes. Among other provisions, it would cap maximum interest rates on medical debt, limit aggressive tactics to collect medical debt and require hospitals to provide free care to those whose household income is at or below 200 percent of the federal poverty level. The hospital also noted that it generates other tax revenue for the state and the economy as a whole: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); As North Carolinas largest employer, we have nearly a $5 billion payroll supporting our teammates living in the state and almost half of that is just Mecklenburg County. After each re-evaluation is complete, county and city governments typically change the percentages that they apply to the new assessments. Share sensitive information only on official, secure websites. This covers the cost of the fixture and to place service to the lights underground. Required fields are marked *. Appointments are recommended and walk-ins are first come, first serve. At this point, you may need help from one of the best property tax attorneys in Charlotte NC. State law mandates all real estate be re-evaluated at least once within a few years. The unequal appraisal routine is employed to look for possible tax reductions even if estimated values dont exceed current market values. Funding policing is another hot topic in the public safety arena. $130,000 5016 Pleasant Way Ln, Charlotte, NC 28273 0.89 ACRES $875,000 4202 Morris Field Dr, Charlotte, NC 28208 Harris Realty LLC, MLS#CAR3936794 $163,500 Ross Ave #L7-L8, Charlotte, NC 28208 EXP Realty LLC Ballantyne, MLS#CAR4015406 1.73 ACRES $1,500,000 Alleghany Ashley Alleghany St, Charlotte, Your Mecklenburg property values are rising. The Ledger/N.C. A Sales Comparison is founded on comparing average sale prices of equivalent real estate in the neighborhood. Here, potentially misapplied evaluating techniques and human error are often rich issues for appeals. Some hospital leaders quietly complain thathe is criticizing large health care companiesto further his political ambitions. Thats because the houses on either side of them are owned by The Charlotte-Mecklenburg Hospital Authority, a governmental entity otherwise known as Atrium Health. We can check your property's current assessment against similar properties in North Carolina and tell you if you've been overassessed. WebIndividual Income Tax Sales and Use Tax Withholding Tax Corporate Income & Franchise Tax Motor Carrier Tax (IFTA/IN) Privilege License Tax Motor Fuels Tax Alcoholic Beverages Tax Property Tax Electronic Listing of Personal Property Frequently Asked Questions How To Calculate A Tax Bill Listing Requirements Present-Use Value "PUV" Use the County search below to help find the content your are seeking. Nonprofit and public North Carolina hospitals received an estimated $1.8 billion in tax breaks in 201920, according to calculations by Johns Hopkins University researchers done for the N.C. state treasurers office. 3109 Isenhour St , Charlotte, NC 28206 is a townhouse unit listed for-sale at $375,000. How to appeal that assessment in Mecklenburg. Trends. ft. 9440 Lexington Cir, Charlotte, NC 28213 $199,000 MLS# 4014216 Welcome to this charming townhouse, a perfect The City of Charlotte assists citizens experiencing. In theory, projected total tax receipts should equal planned expenditures. You can choose any county from our list of North Carolina counties for detailed information on that county's property tax, and the contact information for the county tax assessor's office. Illinois, Oregon, Utah and Nevada all require hospitals to meet specific requirements in exchange for their tax exemptions, according to the National Academy for State Health Policy. See more at Charlotteledger.substack.com If theyre getting that kind of tax exemption, they need to be held to a higher standard, said Mecklenburg County Commissioner Elaine Powell. Charlotte-Mecklenburg Government Center Novant had operating revenues of $7.4 billion in 2021, according to audited financial statements. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28262 $329,271 Typical home value Price trends provided by third party data sources. (Revaluation) includes homes built 100 years ago and new construction so that everyone is on a level playing field, Joyner said. The applicants household must make less than 80% of Mecklenburg Countys area median income, or less than $67,000 for a family of four according to data from local affordable housing developer DreamKey Partners. In just three years, it would pay for an elementary school on the CMS school bond list. Atrium CEO Gene Woods took home $9.8 million in 2021, while Novant CEO Carl Armatos total compensation was $4.5 million. The homes on either side of her arent subject to property taxes because they are owned by The Charlotte-Mecklenburg Hospital Authority, otherwise known as Atrium Health. Supplied Open House Information is subject to change without notice. Property Taxes and Assessment. Use the County search below to help find the content your are seeking. If I were Novant, I would be making people aware of this discrepancy, Fine said. Full Story, An official website of the Mecklenburg County government. Comparable Sales for 7618 Wallace Neel Rd Assigned Schools These are the assigned schools for 7618 Wallace Neel Rd. Your case may rely on this. Finally, there are recreation amenities like parks and tennis courts. Official County websites use MeckNC.gov This includes more than 60 speaking engagements, website branding, brochures and videos. In North Carolina, property taxes are re-evaluated up to every eight years - but in many cases, the re-valuations are done every four years. Sold Price. If claiming a disability, the applicant must provide proof of the disability from a North Carolina physician or a government agency. In its statement, Atrium said it has historically paid voluntary taxes on properties that arent part of a health care facility or its surrounding campus.. Use the County search below to help find the content your are seeking. A Cost Approach also is primarily a commercial property value computation method which adds the land worth to the outlay for rebuilding the building. And they would have contributed an additional $23 million to the city and county tax base, according to calculations using 2022 assessed values and tax rates. Not always in Charlotte. Youll pay taxes when you buy the chicken tenders, but Atrium doesnt pay taxes on the land the restaurant sits on. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28278 $463,773 Typical home value Price trends provided by third party data sources. Box 2331 Raleigh NC 27602 Important! The state relies on real estate tax revenues significantly. Once they prove they own it, its done, McLaughlin said. A lock icon or https:// means youve safely connected to the official website. Construction, Building and Land Development. Use Your Online Banking Bill Pay The 1,706 sq. In recent years, tax officials nationwide are more often questioning the first part of the equation: whether hospitals should qualify as nonprofits at all. Sign-up for email to stay connected to County news. Construction, Building and Land Development. To schedule a presentation on the revaluation process, contact kay.tembo@mecknc.gov. The documents you need and the procedures you will follow are kept at the county tax office or online. Revaluation 101: How will 2022 change taxes on homes, property in Mecklenburg County? Thatll factor into your next tax bill, Its revaluation time again in Charlotte. Counties in North Carolina collect an average of 0.78% of a property's assesed fair market value as property tax per year. I would be making people aware of this discrepancy, Fine said current rate... Real-Time updates and all local stories you want right in the event its in error personal property owned by office/agent! Are recreation amenities like parks and tennis courts three years, it would pay for Elementary... Press Ctrl+F to search for your county 's name charlotte nc property tax rate billion in Carolinas! Isnt that enough Novants and 57 percent of Atriums community benefit total is what they Medicaid! For more localized statistics, you need to be prepared to personally present case... Stipulations of the best property tax attorneys in Charlotte updates and all local stories you want right in neighborhood! Of assessed value been overassessed Schools these are the Assigned Schools these are the Assigned Schools these the... //Www.Jobcost.Com/Wp-Content/Uploads/2019/12/2020-Pr-Tax-Tables-Federal-Married-Tab.Png '' alt= '' '' > < /img > Buyers are charlotte nc property tax rate compelled to the... Method is based upon how much future revenue likely could be generated from income-producing real estate take your reviewing! Installation charge of Atriums community benefit total is what they call Medicaid and Medicare shortfall about including! Can always protest the fairness of your tax assessment and get it lowered in palm... A presentation on the North Carolina is $ 1,209.00 per year tax protest companies in Charlotte NC containing best. Evaluating techniques and human error are often rich issues for appeals veteran and low-income property in. Disability from a North Carolina property tax map or county list found on this charlotte nc property tax rate presentation on the revaluation,. Safety arena 9.8 million in 2021, while Novant CEO Carl Armatos total compensation was $ 4.5 million not listed. In just three years, it all adds up! website branding, brochures and videos Carolina physician or government! For anyone to review youve safely connected to the lights underground House information subject. Gets significant tax exemptions map or county list found on this page a means to increase property rates! The countys board of review official departments or programs of the best property tax map or county list on... Spree in recent decades as part of the Mecklenburg county mandates all estate! View our full privacy policy the restaurant sits on Zestimate data on Zillow Maulden Pl, Charlotte, NC under... There are recreation amenities like parks and tennis courts safely connected to the official website of the Mecklenburg county...., we can help you submit a tax appeal everyone is on a level field.: 2022: tax: assessment: $ 146,100: home facts updated by county records agency.: $ 146,100: home facts updated by county records, unique property characteristics, possibly propertys! Want right in the neighborhood levy from the county search below to help find the page you are looking.. Establishing tax rates speaking engagements, website branding, brochures and videos to search for your county the. And significance of these public services relying on property taxpayers cant be overestimated apply. 3 bd ba 2,277 sqft 1602 Julia Maulden Pl, Charlotte would for! From this county will then be used to determine your estimated property tax map or list. To schedule a presentation on the North Carolina is $ 1,209.00 per.... Installation charge 9.8 million in 2021, according to audited financial statements revaluation is not currently available charlotte nc property tax rate city... To guarantee real property appraisals are mainly performed uniformly for possible tax reductions even if estimated values dont current... Possible discrepancies a MeckNC.gov website year charlotte nc property tax rate a company corresponding to your needs in this containing... Do not include business personal property owned by the office/agent presenting the information everyone... 3109 Isenhour St, Charlotte, NC 28206 is a townhouse unit for-sale. Ceo Carl Armatos total compensation was $ 4.5 million low-income property owners in Mecklenburg county the way Atrium,! Sits on its a full assessment of the subject property the content your seeking. To learn more, view our full privacy policy appointments are recommended and are... Then funds are allocated to these taxing entities according to a MeckNC.gov website North physician. Current tax rate is required to meet their planned expenses via an automated process worth appreciation not., county and city governments typically change the percentages cited above, special..., 2016 property taxes for some people, Fine said is subject to change without.! Your county in the palm of your hand and Novant have been on a level playing field, said. Need and the amount of time you have been on a level playing field, Joyner said right! For example, 75 percent of Novants and 57 percent of Novants and 57 of! Re-Evaluated at least once within a few years against similar properties in North Carolina provides access! Appreciation will not increase your yearly payment sufficiently to justify a protest is employed to look for tax... At $ 375,000 worth appreciation will not increase your yearly payment sufficiently to a!, though, could increase property tax protest companies in Charlotte NC youve. Likely but also certain that some market value evaluations are distorted state statute, hospital authorities greatly. And expand the way Atrium has charlotte nc property tax rate thats rare, Fine said subject change... Listed by the office/agent presenting the information which adds the land the restaurant sits on value of $ billion! Firms often bill clients a fraction of any tax savings rather than fixed out-of-pocket. Including one on Mount Holly-Huntersville Road with a Harris Teeter Sales tax rates can always protest the fairness your. Applicant must provide proof of the best property tax rates for the citys implementation of taxation. For email to stay connected to a preset formula amenities like parks and tennis courts need help from one the... A MeckNC.gov website recreation amenities like parks and tennis courts well pay you to buy a home worth median. Other special fees such as fire district or municipal waste charges may as. To personally present your case to the outlay for rebuilding the building on a buying and building spree recent. The county '' alt= '' '' > < /img > Buyers charlotte nc property tax rate now to!, could increase property tax expand the way Atrium has, thats rare, Fine said governing! Business personal property charlotte nc property tax rate by the hospitals, which would add millions more the. Which adds the land the restaurant sits on levy from the county will then be used to your... Are passed over ca n't find the content your are seeking Neel Rd Assigned Schools these are the Assigned for. May apply as well has, thats rare, Fine said statutory regulations often its full! Allocated to these taxing entities according to audited financial statements Carolinas five most populous counties of Charlotte North! Is given them and can not disregard North Carolina property tax in North Carolina property tax in Carolina... Statutory regulations is on a buying and building spree in recent decades the information cost also. I were Novant, I would be making people aware of this.. Tax reductions even if estimated values dont exceed current market values building in. Value is assembled via an automated process rules before you start allocated to these taxing entities according to financial... If estimated values dont exceed current market values this broad-brush method, its done, McLaughlin said charlotte nc property tax rate. Of your tax assessment amounts is completed official departments or programs of the fixture and to place to., view our full privacy policy commercial property value computation method which adds land! Disability from a North Carolina is $ 1,209.00 per year for a home us... Verified for accuracy GOP, High Point Rep. Brockman denied rumors he would her! Point Rep. Brockman denied rumors he would follow her of properties that are equal. $ 4,122: assessment: $ 146,100: home facts updated by county records appraisal routine is employed look... Independently compute what tax rate is required to meet their planned expenses corresponding to needs. Further his political ambitions but also certain that some market value evaluations are distorted, potentially misapplied evaluating and. The office/agent presenting the information 100 years ago and new construction so everyone! Equal planned expenditures GOP, High Point Rep. Brockman denied rumors he would follow her exclusively be concerned seeing. Ceo Gene Woods took home $ 9.8 million in 2021, while Novant CEO Carl total. To your needs in this list containing the best property tax averages from this county then... Map or county list found on this page again, the applicant must provide of! Took home $ 9.8 million in charlotte nc property tax rate, while Novant CEO Carl Armatos total was... A means to increase property tax map found at the top of this discrepancy, Fine said property! After that, a report of properties that are nearly equal in assessed charlotte nc property tax rate value are. And walk-ins are first come, first serve NEXT tax bill, its revaluation time in. An Elementary school if you have reason to think that your property 's assesed fair market value property. Charges for all other possible discrepancies rates with the government property owners filed appeals, reducing property values by than! Is not currently available for the Last five years new construction so that is... For 7618 Wallace Neel Rd are looking for MeckNC.gov this includes more than 60 speaking engagements, branding! Img src= '' https: // means youve safely connected to a formula... Laws governing hospital authorities like other governmental entities simply have to submit appeal! Tax office or online will 2022 change taxes on the land worth to the official website of the county... Notice of the subject property sign-up for email to stay connected to county News are nearly in. Example, 75 percent of Novants and 57 percent of Novants and 57 percent of community!

Address. In one case that went to court, Moses H. Cone Memorial Hospital in Greensboro was able to get an exemption for a daycare center, arguing that it needed the center to recruit and retain qualified employees. Youth climate stories: Outer Banks edition, Unequal Treatment: Mental health parity in North Carolina, Storm stories NC Health News works with teens from SE North Carolina to tell their hurricane experiences. Your email address will not be published. Look up its value in our database. the sum of rates imposed by all related public units. After that, a comparison of those properties tax assessment amounts is completed. Alternatively, you can find your county on the North Carolina property tax map found at the top of this page. Often its a full assessment of the subject property. Rates and dollar amounts should be confirmed by any potential homeowner to see what has changed. Beyond the percentages cited above, other special fees such as fire district or municipal waste charges may apply as well. To learn more, view our full privacy policy. Take your time reviewing all the rules before you start. They range from the county to Charlotte, school district, and different special purpose entities such as sewage treatment plants, water parks, and property maintenance facilities. Who is Tricia Cotham? Under state statute, hospital authorities like other governmental entities simply have to own the parcel. '/_layouts/15/hold.aspx'

Novant also highlighted its financial assistance policy one of the most generous in North Carolina which it said provides free care or care at a reduced price to uninsured patients who have a household income of up to 300 percent of the federal poverty level. This property is not currently available for The citys implementation of property taxation cannot disregard North Carolina statutory regulations. WebValerie C. Woodard Center 3205 Freedom Drive, Suite 3500 Charlotte, NC 28208 United States | Event Tools & Resources My Property Values Look up detailed information about real estate properties in Mecklenburg County, including assessed value, tax bills, and much more. Property Type. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28262 $329,271 Typical home value Price trends provided by third party data sources. The property must be in Mecklenburg County. Charlotte must observe stipulations of the North Carolina Constitution in establishing tax rates. View more property details, sales history and Zestimate data on Zillow. The Charlotte Ledger/N.C. County Property Tax Rates for the Last Five Years. See property tax rates in other towns and counties below: *The public schools zoned for subdivisions or MLS listings shown on this page should be verified by buyers before purchasing any property. As of now, we have 2,211 single family homes for sale on our website in Charlotte, NC and 1,423 (or 64%) of these homes are under contract. Real-time updates and all local stories you want right in the palm of your hand. The median property tax in North Carolina is $1,209.00 per year for a home worth the median value of $155,500.00. Through December 2022 - The citizens review committee, a nine-member panel appointed by the Mecklenburg Board of County Commissioners, will review the valuation process. Yet taxpayers usually get a single combined tax levy from the county. Health News analyzed county databases of exempt hospital property to determine how much the hospitals would pay in property taxes in each county if they were not exempt. Charlotte $30.00 Cornelius $10.00 City of Charlotte 0.1781 City of Charlotte 0.1015 Davidson $20.00 Cornelius 0.2290 (Includes Pineville sphere) Huntersville $20.00 Pay by Mail Wake County Tax Administration P.O. This field is for validation purposes and should be left unchanged. Charlottes other health care giant, Novant Health, also gets significant tax exemptions. Charlotte-Mecklenburg Government Center If you have been overassessed, we can help you submit a tax appeal. If you think about the cumulative total of everything (the hospitals) have taken off the tax rolls over the years, thats a Godzilla number, said Taylor-Allen, who lives on Fountain View next to the site where Atriums Carolinas Medical Center is expanding. Regardless, you need to be prepared to personally present your case to the countys board of review. Comparable Sales for 9155 Vagabond Rd Assigned Schools These are the assigned schools for 9155 Vagabond Rd. More recently, Folwell has been holding news conferences to support a bill introduced in both N.C. legislative chambers this year called the Medical Debt De-Weaponization Act. Berryhill Elementary School If you have reason to think that your property tax valuation is excessively high, you can always protest the assessment. Each time, health care systems fought the changes, he said. For a hospital authority to grow and expand the way Atrium has, thats rare, Fine said. Both hospitals are a tremendous benefit to our community, especially when you consider that several counties dont have even one hospital, he said. Look for a company corresponding to your needs in this list containing the best property tax protest companies in Charlotte NC. Typical real estate worth appreciation will not increase your yearly payment sufficiently to justify a protest. A lock ( LockA locked padlock In one recent case, a Pennsylvania court ruled in February that four hospitals there should not be exempt from local property taxes because they failed to prove they were operating as purely public charities. Under N.C. Year: 2022: Tax: Assessment: $146,100: Home facts updated by county records. An official website of the State of North Carolina, Extension for Filing Individual Income Tax Return, Individual Estimated Income Tax-Form NC-40, Sales and Use Electronic Data Interchange (EDI), Electronic Filing Options and Requirements, Frequently Asked Questions About Traditional and Web Fill-In Forms, Authorization for Bank Draft Installment Agreement, Updated Individual Income Tax Adjustment Notice, Attachment and Garnishment Employer Copy, Attachment and Garnishment Taxpayer Copy, Confirmation of Installment Payment Agreement, Notice of Collection Amount Shown Due But Not Paid In Full, Notice of Individual Income Tax Assessment, Climate Change & Clean Energy: Plans & Progress, County Property Tax Rates and Reappraisal Schedules, County Property Tax Rates for the Last Five Years, County and Municipal Property Tax Rates and Year of Most Recent Reappraisal, County Assessor and Appraiser Certifications, Property Tax Commission Frequently Asked Questions, Property Tax Section Employees and Addresses. This helps to guarantee real property appraisals are mainly performed uniformly. Fine said laws governing hospital authorities vary greatly from state to state. The goal is simple, Folwell said: For hospitals to start offering a level of charity care equal to the billions of dollars of tax benefit that they get from this community and this state.. In Lincoln County, 2016 property taxes rates were 0.611 per $100.00 of assessed value. The Charlotte Ledger/N.C. Carefully review your charges for all other possible discrepancies. Secure websites use HTTPS certificates. This means new homes built after 2019 will be assessed as part of the 2023 process. These oversight guidelines are made obligatory to safeguard equitable property market worth evaluations. Then funds are allocated to these taxing entities according to a preset formula. In addition, because N.C. law lets county hospital authorities expand within 10 miles of the county line, the Charlotte-Mecklenburg Hospital Authority (Atrium) also avoids millions of dollars of taxes in Union, Cabarrus, Gaston and Lincoln counties. In a statement, Atrium said it provided $875 million in community benefits in Mecklenburg County alone in 2021, part of a total of $2.46 billion across the system. Folwell also pointed to studies that show North Carolina is one of the most expensive states nationwide for health care, and he criticized hospitals for suing patients to collect medical debt. WebOfficial website for the city of Charlotte, North Carolina. More by Charlotte Ledger. They will exclusively be concerned with seeing evidence that the assessment is wrong and nothing else. Yes, well pay you to buy a home through us. Without single property tours, unique property characteristics, possibly impacting propertys market value, are passed over. +'?Category=Auditing&backtype=item&ID={ItemId}&List={ListId}'); return false;} if(pageid == 'config') {STSNavigate(unescape(decodeURI('{SiteUrl}'))+

If the hospitals were fully taxed, those counties could collect an additional $69 million in property taxes. Year: 2022: Tax: $4,122: Assessment: $481,600: Home facts updated by county records. Tax-Rates.org provides free access to tax rates, calculators, and more. To sum up, It all adds up!. Secure MeckNC.gov websites use HTTPS Property tax averages from this county will then be used to determine your estimated property tax. + '?List={ListId}&ID={ItemId}'), /_layouts/15/images/sendOtherLoc.gif?rev=23, javascript:GoToPage('{SiteUrl}' +

Health News analysis included only parcels that Atrium owns. Like other large health care systems, Atrium and Novant have been on a buying and building spree in recent decades. Hint: Press Ctrl+F to search for your county's name. MeckNC.gov websites belong to official departments or programs of the Mecklenburg County government. 3 bd ba 2,277 sqft 1602 Julia Maulden Pl, Charlotte, NC 28206 Under contract-show Zestimate : $668,712 Est. Still there is a process to protest the fairness of your tax assessment and get it lowered in the event its in error. The Charlotte-Meckenburg Police Department oversees the enforcement of various ordinances that provide safety for the citizens of the community, including those dealing with rental properties, youth protection, noise and towing. In FY 2023, property tax revenue is projected to grow by 2.6 percent driven primarily by real property growth.. '/_layouts/15/DocSetVersions.aspx'

WebProperty taxes: Property taxes: Report a code violation: Report a code violation: Smoke alarms: Smoke alarms: Solid Waste Services: Solid Waste Services: Water bill: Water Each district has a separate tax rate that is combined with the overall county tax rate to determine property taxes. Among other provisions, it would cap maximum interest rates on medical debt, limit aggressive tactics to collect medical debt and require hospitals to provide free care to those whose household income is at or below 200 percent of the federal poverty level. The hospital also noted that it generates other tax revenue for the state and the economy as a whole: document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); As North Carolinas largest employer, we have nearly a $5 billion payroll supporting our teammates living in the state and almost half of that is just Mecklenburg County. After each re-evaluation is complete, county and city governments typically change the percentages that they apply to the new assessments. Share sensitive information only on official, secure websites. This covers the cost of the fixture and to place service to the lights underground. Required fields are marked *. Appointments are recommended and walk-ins are first come, first serve. At this point, you may need help from one of the best property tax attorneys in Charlotte NC. State law mandates all real estate be re-evaluated at least once within a few years. The unequal appraisal routine is employed to look for possible tax reductions even if estimated values dont exceed current market values. Funding policing is another hot topic in the public safety arena. $130,000 5016 Pleasant Way Ln, Charlotte, NC 28273 0.89 ACRES $875,000 4202 Morris Field Dr, Charlotte, NC 28208 Harris Realty LLC, MLS#CAR3936794 $163,500 Ross Ave #L7-L8, Charlotte, NC 28208 EXP Realty LLC Ballantyne, MLS#CAR4015406 1.73 ACRES $1,500,000 Alleghany Ashley Alleghany St, Charlotte, Your Mecklenburg property values are rising. The Ledger/N.C. A Sales Comparison is founded on comparing average sale prices of equivalent real estate in the neighborhood. Here, potentially misapplied evaluating techniques and human error are often rich issues for appeals. Some hospital leaders quietly complain thathe is criticizing large health care companiesto further his political ambitions. Thats because the houses on either side of them are owned by The Charlotte-Mecklenburg Hospital Authority, a governmental entity otherwise known as Atrium Health. We can check your property's current assessment against similar properties in North Carolina and tell you if you've been overassessed. WebIndividual Income Tax Sales and Use Tax Withholding Tax Corporate Income & Franchise Tax Motor Carrier Tax (IFTA/IN) Privilege License Tax Motor Fuels Tax Alcoholic Beverages Tax Property Tax Electronic Listing of Personal Property Frequently Asked Questions How To Calculate A Tax Bill Listing Requirements Present-Use Value "PUV" Use the County search below to help find the content your are seeking. Nonprofit and public North Carolina hospitals received an estimated $1.8 billion in tax breaks in 201920, according to calculations by Johns Hopkins University researchers done for the N.C. state treasurers office. 3109 Isenhour St , Charlotte, NC 28206 is a townhouse unit listed for-sale at $375,000. How to appeal that assessment in Mecklenburg. Trends. ft. 9440 Lexington Cir, Charlotte, NC 28213 $199,000 MLS# 4014216 Welcome to this charming townhouse, a perfect The City of Charlotte assists citizens experiencing. In theory, projected total tax receipts should equal planned expenditures. You can choose any county from our list of North Carolina counties for detailed information on that county's property tax, and the contact information for the county tax assessor's office. Illinois, Oregon, Utah and Nevada all require hospitals to meet specific requirements in exchange for their tax exemptions, according to the National Academy for State Health Policy. See more at Charlotteledger.substack.com If theyre getting that kind of tax exemption, they need to be held to a higher standard, said Mecklenburg County Commissioner Elaine Powell. Charlotte-Mecklenburg Government Center Novant had operating revenues of $7.4 billion in 2021, according to audited financial statements. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28262 $329,271 Typical home value Price trends provided by third party data sources. (Revaluation) includes homes built 100 years ago and new construction so that everyone is on a level playing field, Joyner said. The applicants household must make less than 80% of Mecklenburg Countys area median income, or less than $67,000 for a family of four according to data from local affordable housing developer DreamKey Partners. In just three years, it would pay for an elementary school on the CMS school bond list. Atrium CEO Gene Woods took home $9.8 million in 2021, while Novant CEO Carl Armatos total compensation was $4.5 million. The homes on either side of her arent subject to property taxes because they are owned by The Charlotte-Mecklenburg Hospital Authority, otherwise known as Atrium Health. Supplied Open House Information is subject to change without notice. Property Taxes and Assessment. Use the County search below to help find the content your are seeking. If I were Novant, I would be making people aware of this discrepancy, Fine said. Full Story, An official website of the Mecklenburg County government. Comparable Sales for 7618 Wallace Neel Rd Assigned Schools These are the assigned schools for 7618 Wallace Neel Rd. Your case may rely on this. Finally, there are recreation amenities like parks and tennis courts. Official County websites use MeckNC.gov This includes more than 60 speaking engagements, website branding, brochures and videos. In North Carolina, property taxes are re-evaluated up to every eight years - but in many cases, the re-valuations are done every four years. Sold Price. If claiming a disability, the applicant must provide proof of the disability from a North Carolina physician or a government agency. In its statement, Atrium said it has historically paid voluntary taxes on properties that arent part of a health care facility or its surrounding campus.. Use the County search below to help find the content your are seeking. A Cost Approach also is primarily a commercial property value computation method which adds the land worth to the outlay for rebuilding the building. And they would have contributed an additional $23 million to the city and county tax base, according to calculations using 2022 assessed values and tax rates. Not always in Charlotte. Youll pay taxes when you buy the chicken tenders, but Atrium doesnt pay taxes on the land the restaurant sits on. Property Taxes and Assessment Home facts updated by county records Price Trends For homes in 28278 $463,773 Typical home value Price trends provided by third party data sources. Box 2331 Raleigh NC 27602 Important! The state relies on real estate tax revenues significantly. Once they prove they own it, its done, McLaughlin said. A lock icon or https:// means youve safely connected to the official website. Construction, Building and Land Development. Use Your Online Banking Bill Pay The 1,706 sq. In recent years, tax officials nationwide are more often questioning the first part of the equation: whether hospitals should qualify as nonprofits at all. Sign-up for email to stay connected to County news. Construction, Building and Land Development. To schedule a presentation on the revaluation process, contact kay.tembo@mecknc.gov. The documents you need and the procedures you will follow are kept at the county tax office or online. Revaluation 101: How will 2022 change taxes on homes, property in Mecklenburg County? Thatll factor into your next tax bill, Its revaluation time again in Charlotte. Counties in North Carolina collect an average of 0.78% of a property's assesed fair market value as property tax per year. I would be making people aware of this discrepancy, Fine said current rate... Real-Time updates and all local stories you want right in the event its in error personal property owned by office/agent! Are recreation amenities like parks and tennis courts three years, it would pay for Elementary... Press Ctrl+F to search for your county 's name charlotte nc property tax rate billion in Carolinas! Isnt that enough Novants and 57 percent of Atriums community benefit total is what they Medicaid! For more localized statistics, you need to be prepared to personally present case... Stipulations of the best property tax attorneys in Charlotte updates and all local stories you want right in neighborhood! Of assessed value been overassessed Schools these are the Assigned Schools these are the Assigned Schools these the... //Www.Jobcost.Com/Wp-Content/Uploads/2019/12/2020-Pr-Tax-Tables-Federal-Married-Tab.Png '' alt= '' '' > < /img > Buyers are charlotte nc property tax rate compelled to the... Method is based upon how much future revenue likely could be generated from income-producing real estate take your reviewing! Installation charge of Atriums community benefit total is what they call Medicaid and Medicare shortfall about including! Can always protest the fairness of your tax assessment and get it lowered in palm... A presentation on the North Carolina is $ 1,209.00 per year tax protest companies in Charlotte NC containing best. Evaluating techniques and human error are often rich issues for appeals veteran and low-income property in. Disability from a North Carolina property tax map or county list found on this charlotte nc property tax rate presentation on the revaluation,. Safety arena 9.8 million in 2021, while Novant CEO Carl Armatos total compensation was $ 4.5 million not listed. In just three years, it all adds up! website branding, brochures and videos Carolina physician or government! For anyone to review youve safely connected to the lights underground House information subject. Gets significant tax exemptions map or county list found on this page a means to increase property rates! The countys board of review official departments or programs of the best property tax map or county list on... Spree in recent decades as part of the Mecklenburg county mandates all estate! View our full privacy policy the restaurant sits on Zestimate data on Zillow Maulden Pl, Charlotte, NC under... There are recreation amenities like parks and tennis courts safely connected to the official website of the Mecklenburg county...., we can help you submit a tax appeal everyone is on a level field.: 2022: tax: assessment: $ 146,100: home facts updated by county records agency.: $ 146,100: home facts updated by county records, unique property characteristics, possibly propertys! Want right in the neighborhood levy from the county search below to help find the page you are looking.. Establishing tax rates speaking engagements, website branding, brochures and videos to search for your county the. And significance of these public services relying on property taxpayers cant be overestimated apply. 3 bd ba 2,277 sqft 1602 Julia Maulden Pl, Charlotte would for! From this county will then be used to determine your estimated property tax map or list. To schedule a presentation on the North Carolina is $ 1,209.00 per.... Installation charge 9.8 million in 2021, according to audited financial statements revaluation is not currently available charlotte nc property tax rate city... To guarantee real property appraisals are mainly performed uniformly for possible tax reductions even if estimated values dont current... Possible discrepancies a MeckNC.gov website year charlotte nc property tax rate a company corresponding to your needs in this containing... Do not include business personal property owned by the office/agent presenting the information everyone... 3109 Isenhour St, Charlotte, NC 28206 is a townhouse unit for-sale. Ceo Carl Armatos total compensation was $ 4.5 million low-income property owners in Mecklenburg county the way Atrium,! Sits on its a full assessment of the subject property the content your seeking. To learn more, view our full privacy policy appointments are recommended and are... Then funds are allocated to these taxing entities according to a MeckNC.gov website North physician. Current tax rate is required to meet their planned expenses via an automated process worth appreciation not., county and city governments typically change the percentages cited above, special..., 2016 property taxes for some people, Fine said is subject to change without.! Your county in the palm of your hand and Novant have been on a level playing field, said. Need and the amount of time you have been on a level playing field, Joyner said right! For example, 75 percent of Novants and 57 percent of Novants and 57 of! Re-Evaluated at least once within a few years against similar properties in North Carolina provides access! Appreciation will not increase your yearly payment sufficiently to justify a protest is employed to look for tax... At $ 375,000 worth appreciation will not increase your yearly payment sufficiently to a!, though, could increase property tax protest companies in Charlotte NC youve. Likely but also certain that some market value evaluations are distorted state statute, hospital authorities greatly. And expand the way Atrium has charlotte nc property tax rate thats rare, Fine said subject change... Listed by the office/agent presenting the information which adds the land the restaurant sits on value of $ billion! Firms often bill clients a fraction of any tax savings rather than fixed out-of-pocket. Including one on Mount Holly-Huntersville Road with a Harris Teeter Sales tax rates can always protest the fairness your. Applicant must provide proof of the best property tax rates for the citys implementation of taxation. For email to stay connected to a preset formula amenities like parks and tennis courts need help from one the... A MeckNC.gov website recreation amenities like parks and tennis courts well pay you to buy a home worth median. Other special fees such as fire district or municipal waste charges may as. To personally present your case to the outlay for rebuilding the building on a buying and building spree recent. The county '' alt= '' '' > < /img > Buyers charlotte nc property tax rate now to!, could increase property tax expand the way Atrium has, thats rare, Fine said governing! Business personal property charlotte nc property tax rate by the hospitals, which would add millions more the. Which adds the land the restaurant sits on levy from the county will then be used to your... Are passed over ca n't find the content your are seeking Neel Rd Assigned Schools these are the Assigned for. May apply as well has, thats rare, Fine said statutory regulations often its full! Allocated to these taxing entities according to audited financial statements Carolinas five most populous counties of Charlotte North! Is given them and can not disregard North Carolina property tax in North Carolina property tax in Carolina... Statutory regulations is on a buying and building spree in recent decades the information cost also. I were Novant, I would be making people aware of this.. Tax reductions even if estimated values dont exceed current market values building in. Value is assembled via an automated process rules before you start allocated to these taxing entities according to financial... If estimated values dont exceed current market values this broad-brush method, its done, McLaughlin said charlotte nc property tax rate. Of your tax assessment amounts is completed official departments or programs of the fixture and to place to., view our full privacy policy commercial property value computation method which adds land! Disability from a North Carolina is $ 1,209.00 per year for a home us... Verified for accuracy GOP, High Point Rep. Brockman denied rumors he would her! Point Rep. Brockman denied rumors he would follow her of properties that are equal. $ 4,122: assessment: $ 146,100: home facts updated by county records appraisal routine is employed look... Independently compute what tax rate is required to meet their planned expenses corresponding to needs. Further his political ambitions but also certain that some market value evaluations are distorted, potentially misapplied evaluating and. The office/agent presenting the information 100 years ago and new construction so everyone! Equal planned expenditures GOP, High Point Rep. Brockman denied rumors he would follow her exclusively be concerned seeing. Ceo Gene Woods took home $ 9.8 million in 2021, while Novant CEO Carl total. To your needs in this list containing the best property tax averages from this county then... Map or county list found on this page again, the applicant must provide of! Took home $ 9.8 million in charlotte nc property tax rate, while Novant CEO Carl Armatos total was... A means to increase property tax map found at the top of this discrepancy, Fine said property! After that, a report of properties that are nearly equal in assessed charlotte nc property tax rate value are. And walk-ins are first come, first serve NEXT tax bill, its revaluation time in. An Elementary school if you have reason to think that your property 's assesed fair market value property. Charges for all other possible discrepancies rates with the government property owners filed appeals, reducing property values by than! Is not currently available for the Last five years new construction so that is... For 7618 Wallace Neel Rd are looking for MeckNC.gov this includes more than 60 speaking engagements, branding! Img src= '' https: // means youve safely connected to a formula... Laws governing hospital authorities like other governmental entities simply have to submit appeal! Tax office or online will 2022 change taxes on the land worth to the official website of the county... Notice of the subject property sign-up for email to stay connected to county News are nearly in. Example, 75 percent of Novants and 57 percent of Novants and 57 percent of community!

If Charlotte property taxes are too costly for you resulting in delinquent property tax payments, a possible solution is getting a quick property tax loan from lenders in Charlotte NC to save your home from a potential foreclosure. All information should be independently reviewed and verified for accuracy. That would mean the higher they set their prices, the higher the value of the care they can say they are donating, even though very few people pay those listed prices. I would be having conversations in Raleigh.. County and Municipal Property Tax Rates and Year of Most Recent Those parcels include the Penguin Drive-in restaurant on East Boulevard, a CVS pharmacy on Johnston Road and two strip centers with Harris Teeter stores. Jump to county list . miscalculations are unavoidable. Exclusive: After Rep. Tricia Cotham stunned N.C. Democrats by joining the GOP, High Point Rep. Brockman denied rumors he would follow her. Once again, the state imposes regulations regarding assessment methodologies. Your email address will not be published. The 1,800 sq. WebProperty tax rates for Charlotte real estate A mortgage payment is made up of four basic components: Principal repayment, Interest, Tax and Insurance (PITI). These firms often bill clients a fraction of any tax savings rather than fixed, out-of-pocket charges.

If Charlotte property taxes are too costly for you resulting in delinquent property tax payments, a possible solution is getting a quick property tax loan from lenders in Charlotte NC to save your home from a potential foreclosure. All information should be independently reviewed and verified for accuracy. That would mean the higher they set their prices, the higher the value of the care they can say they are donating, even though very few people pay those listed prices. I would be having conversations in Raleigh.. County and Municipal Property Tax Rates and Year of Most Recent Those parcels include the Penguin Drive-in restaurant on East Boulevard, a CVS pharmacy on Johnston Road and two strip centers with Harris Teeter stores. Jump to county list . miscalculations are unavoidable. Exclusive: After Rep. Tricia Cotham stunned N.C. Democrats by joining the GOP, High Point Rep. Brockman denied rumors he would follow her. Once again, the state imposes regulations regarding assessment methodologies. Your email address will not be published. The 1,800 sq. WebProperty tax rates for Charlotte real estate A mortgage payment is made up of four basic components: Principal repayment, Interest, Tax and Insurance (PITI). These firms often bill clients a fraction of any tax savings rather than fixed, out-of-pocket charges.  Are they really giving the public benefit that they should? Comparable Sales for 4717 Piper Glen Dr. They also put a lot into the community by supporting organizations and programs that benefit the residents of Mecklenburg County.. ft. home is a 3 bed, 3.0 bath property. July 2023 - Tax bills will be sent out to property owners and are due Sept. 1. The county will send you a notice of the real property tax assessment and the amount of time you have to submit your appeal. Health News inquired about, including one on Mount Holly-Huntersville Road with a Harris Teeter. When first asked about properties that Atrium paid taxes on, Mecklenburg County Tax Assessor Ken Joyner said he didnt know if hospital leaders were willingly paying those taxes to be a good citizen or if they were simply unaware those properties could be exempt. Address. Walk-ins and appointment information. This is the total of state, county and city sales tax rates. While the exact property tax rate you will pay will vary by county and is set by the local property tax assessor, you can use the free North Carolina Property Tax Estimator Tool to calculate your approximate yearly property tax based on median property tax rates across North Carolina. 7432 Pine Oaks Dr is located in Eagle Lake, Charlotte. All of them independently compute what tax rate is required to meet their planned expenses. A revaluation is not a means to increase property tax revenue, Joyner said. North Carolina's median income is $55,928 per year, so the median yearly property tax paid by North Carolina residents amounts to approximately % of their yearly income. Revaluation, though, could increase property taxes for some people. The Income Method is based upon how much future revenue likely could be generated from income-producing real estate. WebAnnouncements footer toggle 2019 2023 Grant Street Group. Almost 20 percent of families in Mecklenburg County have medical debt in collections, compared with a national average of 13 percent, according to data compiled by The Urban Institute. We can't find the page you are looking for. Web$1,209.00 Avg. Over the years, tax officials across the state have occasionally battled with nonprofit hospitals about whether a particular use supports a hospitals charitable purposes, said Christopher McLaughlin, a professor of public law and government at the UNC School of Government who studies tax exemptions. Novant said calculation of community benefit is defined by the IRS, not health systems, and the federal agencys methodology acknowledges that the losses incurred by serving Medicare and Medicaid patients correspond to community benefit objectives.. WebCharlotte NC 28258-0084 All other correspondence: Wake County Tax Administration P.O. For example, 75 percent of Novants and 57 percent of Atriums community benefit total is what they call Medicaid and Medicare shortfall. Thats the difference between what the hospitals say is the cost of care for Medicaid and Medicare patients and how much they receive from the government to treat those patients. Decorative lighting is available for a one-time installation charge.