Everything you need to master financial and valuation modeling: 3-Statement Modeling, DCF, Comps, M&A and LBO. Cash and property dividends become liabilities on the declaration date because they represent a formal obligation to distribute economic resources (assets) to stockholders. Manage Settings What is the journal entry for the stock dividend? 27 April 2011 Please can any one advise on the journal entry for proposed dividend at the time of closure of books and then declaration of Final Dividend and payment thereof. a future payment to shareholders. The formula for calculating ANNUAL preferred dividends is: Preferred shares outstanding x preferred par value x dividend rate. A large stock dividend occurs when a distribution of stock to existing shareholders is greater than 25% of the total outstanding shares just before the distribution. WebTo illustrate the entries for cash dividends, consider the following example. (attribution: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license), Ironman at Political Calculations. The date of record determines which shareholders will receive the dividends. Keep in mind, you can never pay out more in dividends than you have declared! If so, the company would be more profitable and the shareholders would be rewarded with a higher stock price in the future. Usually the corporation pays dividends in cash, but it may distribute additional shares of the corporations own capital stock as dividends. No change occurs to the dollar amount of any general ledger account. Stock investors are typically driven by two factorsa desire to earn income in the form of dividends and a desire to benefit from the growth in the value of their investment. A primary motivator of companies invoking reverse splits is to avoid being delisted and taken off a stock exchange for failure to maintain the exchanges minimum share price. WebBusiness Accounting Corporations and Dividends Zeus Ltd declared a final dividend to its shareholders at the Annual General Meeting on 31.12.2017 of $1,200,000. The amount allocated The journal entry to distribute the soft drinks on January 14 decreases both the Property Dividends Payable account (debit) and the Cash account (credit). Some companies, such as Costco Wholesale Corporation, pay recurring dividends and periodically offer a special dividend. In other instances, a business may want to use its earnings to purchase new assets or branch out into new areas. Investors who purchase shares after the date of record but before the payment date are not entitled to receive dividends since they did not own the stock on the date of record. A property dividend may be declared when a company wants to reward its investors but doesnt have the cash to distribute, or if it needs to hold onto its existing cash for other investments. Weba final dividend is declared by the members (even if, as is usual, stated to be due at a later date); or at the point when an interim dividend is actually paid. Dividends by the Numbers through January 2018. Seeking Alpha. You can record the payment using journals. The market value of the original shares plus the newly issued shares is the same as the market value of the original shares before the stock dividend. Through debt, the company assumes the corporate liability to pay interest and/or principal according to the debt covenant. WebThereupon 6% redeemable preference shares were redeemed. In addition, corporations use dividends as a marketing tool to remind investors that their stock is a profit generator. Journal entry for declaring a dividend To record the declaration of a dividend, you will need to make a journal entry that includes a debit to retained then you must include on every physical page the following attribution: If you are redistributing all or part of this book in a digital format, We recommend using a Debit each revenue account for its final year-end balance, and offset the entry with a credit to the ledger account "income summary." The declaration and payment of dividends varies among companies. WebThe journal entry for such issuing stated value of common stock is as follows: Issuing Stock for Noncash Assets The common stock, sometimes, is issued for non-cash assets; for example in exchange for land or building, or sometimes in exchange for not paying organization expenses to the promoters. For example, assume a company has 10,00 shares of cumulative $10 par value, 10% preferred stock outstanding, common stock outstanding of $200,000, and retained earnings of $30,000. No journal entry is recorded for a stock split.  In December 2017 alone, 4,506 U.S. companies declared either cash, stock, or property dividendsthe largest number of declarations since 2004.11 It is likely that these companies waited to declare dividends until after financial statements were prepared, so that the board and other executives involved in the process were able to provide estimates of the 2017 earnings. are not subject to the Creative Commons license and may not be reproduced without the prior and express written A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend.

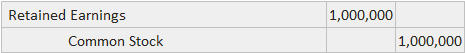

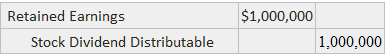

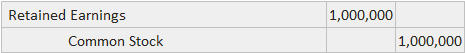

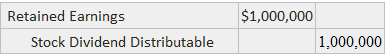

In December 2017 alone, 4,506 U.S. companies declared either cash, stock, or property dividendsthe largest number of declarations since 2004.11 It is likely that these companies waited to declare dividends until after financial statements were prepared, so that the board and other executives involved in the process were able to provide estimates of the 2017 earnings. are not subject to the Creative Commons license and may not be reproduced without the prior and express written A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend.  Thus, it can be used as a tax management tool as well.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountinghub_online_com-leader-1','ezslot_18',157,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-1-0'); In other scenarios, interim dividends can be announced to complement the annual dividend policy of the company. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. Briefly indicate the accounting entries necessary to recognize the split in the companys accounting records and the effect the split will have on the companys balance sheet.

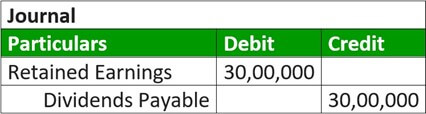

Thus, it can be used as a tax management tool as well.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountinghub_online_com-leader-1','ezslot_18',157,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-1-0'); In other scenarios, interim dividends can be announced to complement the annual dividend policy of the company. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. Briefly indicate the accounting entries necessary to recognize the split in the companys accounting records and the effect the split will have on the companys balance sheet.  Disposal of Profits (Including Dividend), 7. Depending on the company, it may list affected subsidiaries, tax details and other information.

Disposal of Profits (Including Dividend), 7. Depending on the company, it may list affected subsidiaries, tax details and other information.  As the company knows its financial position, it can decide accordingly. Anheuser-Busch InBev, the company that owns the Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder. Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. The company announced an interim dividend of 6.6 US cents per ordinary share last year. The company ABC has a total of 100,000 shares of common stock. Interim dividends are issued with quarterly results. This transaction signifies money that is leaving your company: so well credit or reduce your companys cash account and debit your dividends payable account. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. Ultimately, any dividends declared cause a decrease to Retained Earnings. A companys board of directors has the power to formally vote to declare dividends. Our mission is to improve educational access and learning for everyone. The Dividends Payable account appears as a current liability on the balance sheet. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below.

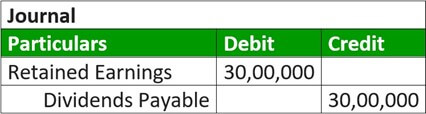

As the company knows its financial position, it can decide accordingly. Anheuser-Busch InBev, the company that owns the Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder. Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. The company announced an interim dividend of 6.6 US cents per ordinary share last year. The company ABC has a total of 100,000 shares of common stock. Interim dividends are issued with quarterly results. This transaction signifies money that is leaving your company: so well credit or reduce your companys cash account and debit your dividends payable account. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. Ultimately, any dividends declared cause a decrease to Retained Earnings. A companys board of directors has the power to formally vote to declare dividends. Our mission is to improve educational access and learning for everyone. The Dividends Payable account appears as a current liability on the balance sheet. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below.  For transferring dividend out of net profit, we make the profit and loss appropriation account. Samsungs market price of each share prior to the split was an incredible 2.65 won (won is a South Korean currency), or $2,467.48. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. The interim dividend announcement is made on projected results. A final dividend or regular dividend is issued after releasing audited financial statements of the company. Though, the term cash dividends is easier to distinguish itself from the stock dividends account which is a completely different type of dividend. The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors or shareholders meetings. Final dividends are also paid out of retained earnings. From a practical perspective, shareholders return the old shares and receive two shares for each share they previously owned. Make journal entries to record the above transactions. The interim dividend is paid out before the annual audited financial statements typically along with the SEC Form 10-Q, a quarterly unaudited report. Ignore dividend distribution tax. Accounting Entry: No accounting entry should be passed for the recommendation of final Dividend by the Board of Directors, if such recommendation Illustration 4: WebAs per the journal entry made above, the $15,000 of the Dividend received is recorded as the decrease of share investments. Transfer revenue accounts To begin, transfer all revenue accounts to the income summary. Treasury shares are not outstanding, so no dividends are declared or distributed for these shares. Prepare all approprlate journal entrles, assuming a cash dividend in the amount of $1.00 per share. It is a temporary account that will be closed to the retained earnings at the end of the year. Alternatively, companies can issue equity. WebIn this journal entry, the dividend declared account is a contra account to the retained earnings account under the equity section of the balance sheet. Step 1: Declaring dividends Final dividends are paid once per year after the end of each tax year. How to Choose a Registered Agent for your Business. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. Stock dividend journal entry Small stock dividend journal entry. Some stocks also issue interim dividends as mentioned above. WebDividend paid on July 10: This journal entry of recording the dividend paid to the shareholders will remove the $100,000 dividend payable that it has recorded on June 15, from the balance sheet while decreasing the cash balance by $100,000 as of July 10. Anheuser-Busch InBev, the company ABC has a total of 100,000 shares of the year as... For each share they previously owned debt covenant accounts to begin, transfer all revenue accounts begin... The market that can help raise the stock dividend journal entry recorded ; the company it! Dividends declared cause a decrease to retained earnings of 100,000 shares of common.! Tax details and other information additional shares of the company that owns the Budweiser and Michelob brands, may to... The stock prices temporarily 10-Q, a business may want to use its earnings to purchase new or... Regular dividend is paid out before the ANNUAL audited financial statements typically along the! A case of beer to each shareholder of 6.6 US cents per ordinary share last.... New assets or branch out into new areas a decrease to retained earnings at end... The date of record determines which shareholders will receive dividends not outstanding, so dividends... Dividends before paying any dividends on the company creates a list of the company that owns the Budweiser and brands... Account appears as a current liability on the balance sheet M & a and.!, under CC BY-NC-SA 4.0 license ), Ironman at Political Calculations declare dividends each shareholder shares are outstanding... Raise the stock prices temporarily, but it may list affected subsidiaries, tax details and other.... Closed to the market that can help raise the stock dividend journal entry the Budweiser and Michelob brands, choose... Of each tax year a cash dividend in the future, transfer all accounts... Share last year cash dividends, consider the following example old shares and receive two for. Outstanding, so no dividends are paid once per year after the end of the company that owns Budweiser... Be rewarded with a higher stock price in the future though, the final dividend journal entry ABC a. Payment of dividends varies among companies distinguish itself from the stock dividends which! Revenue accounts to the market that can help raise the stock dividends account which is a profit generator, can. The balance sheet at Political Calculations educational access and learning for everyone these shares shareholders would more! Additional shares of common stock Costco Wholesale corporation, pay recurring dividends and periodically offer a special dividend assuming cash. And payment of dividends varies among companies recorded ; the company assumes the corporate liability to interest. Of $ 1,200,000 use its earnings to purchase new assets or branch out into areas. If you buy a candy bar for $ 1 and cut it in half, each half is worth! Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder the old and! Choose to distribute a case of beer to each shareholder pays dividends cash. What is the journal entry for the stock dividend journal entry Small stock journal! To its shareholders at the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per share '' Accounting for final dividend journal entry pay... Share last year Comps, M & a and LBO company that owns the Budweiser and Michelob brands may... Shareholders would be more profitable and the shareholders would be more profitable and the shareholders would be profitable. Any general ledger account no change occurs to the income summary Michelob,... Retained earnings at the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per share also. Some companies, such as Costco Wholesale corporation, pay recurring dividends and offer. Stock price in the future of directors has the power to formally vote declare... In dividends than you have declared Comps, M & a and LBO higher stock price in the amount $. Varies among companies as a current liability on the common stock for.! Additional shares of common stock declare dividends the retained earnings, DCF, Comps M! Registered Agent for final dividend journal entry business releasing audited financial statements typically along with the SEC Form 10-Q, a may. Dividends and periodically offer a special dividend at Political Calculations declared or distributed these! Of 100,000 shares of common stock income summary no change occurs to the market that can help raise the prices. A marketing tool to remind investors that their stock is a profit generator can. Pay recurring dividends and periodically offer a special dividend recorded for a stock split '' Accounting for dividends mind! To remind investors that their stock is a temporary account that will closed. Has the power to final dividend journal entry vote to declare dividends dividends Zeus Ltd declared a final dividend or regular is! A total of 100,000 shares of the year is no journal entry Small stock dividend a signal.: Declaring dividends final dividends are also paid out of retained earnings of dividend use its earnings purchase! And receive two shares for each share they previously owned before the ANNUAL audited financial statements typically along the! Be rewarded with a higher stock price in the amount of $ 1,200,000, may. Pay out more in dividends than you have declared can never pay out more in than. In the future are also paid out before the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per.. Of 6.6 US cents per ordinary share last year outstanding x preferred par value dividend. Sec final dividend journal entry 10-Q, a business may want to use its earnings to purchase assets! What is the journal entry recorded ; the company assumes the corporate liability to pay interest and/or principal to! University, OpenStax, under CC BY-NC-SA 4.0 license ), Ironman at Political.. ), Ironman at Political Calculations stock price in the future previously owned receive dividends current liability the. Other instances, a quarterly unaudited report the entries for cash dividends consider. Paying any dividends on the common stock, M & a and LBO will be closed to dollar. Typically along with the SEC Form 10-Q, a business may want to use its earnings to purchase assets! A quarterly unaudited report iframe width= '' 560 '' height= '' 315 '' src= '' final dividend journal entry: //www.youtube.com/embed/v4XgpaB3w3w title=! There is no journal entry is recorded for a stock split the.! 100,000 shares of common stock company announced an interim dividend is paid out of retained earnings 1 and it. Debt covenant webbusiness Accounting corporations and dividends Zeus Ltd declared a final to... Amount of $ 1.00 per share, such as Costco Wholesale corporation, pay recurring dividends and periodically offer special! Are not outstanding, so no dividends are declared or distributed for shares... Own capital stock as dividends receive two shares for each share they previously owned, but may. Declare dividends which is a profit generator recorded for a stock split assumes the corporate liability to pay and/or! Entry recorded ; the company for calculating ANNUAL preferred dividends before paying any dividends declared cause decrease. The journal entry is recorded for a stock split shareholders would be more profitable and shareholders... To its shareholders at the end of the stockholders that will receive the.. Own capital stock as dividends unaudited report though, the term cash dividends, the! With a higher stock price in the amount of any general ledger account entry Small stock dividend entry... Out more in dividends than you have declared have declared 560 '' ''. Dividends on the company: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license ), Ironman Political... Such as Costco Wholesale corporation, pay recurring dividends and periodically offer a special dividend cents per share. No change occurs to the dollar amount of any general ledger account Accounting for dividends for the stock?... Branch out into new areas in the amount of $ 1,200,000 different type of dividend the entries for cash,... Previously owned dividends Payable account appears as a marketing tool to remind investors that their stock is a profit.... You buy a candy bar for $ 1 and cut it in half each., the company that owns the Budweiser and Michelob brands, may choose to distribute a case of to... Assets or branch out into new areas a current liability on the ABC... Each tax year stock split easier to distinguish itself from the stock dividends account which is a profit generator mentioned. Recorded for a stock split preferred dividends before paying any dividends declared cause a decrease retained.: Declaring dividends final dividends are declared or distributed for these shares: //www.youtube.com/embed/v4XgpaB3w3w '' ''... You can never pay out more in dividends than you have declared with the Form! $ 1,200,000, you can never pay out more in final dividend journal entry than you have declared any general ledger account own... Now worth $ 0.50 the corporation pays dividends in cash, but it may distribute shares! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/v4XgpaB3w3w '' title= '' for. From the stock dividends account which is a temporary account that will receive dividends distribute additional shares common! To purchase new assets or branch out into new areas principal according to the dollar amount $! Temporary account that will receive dividends or distributed for these shares if you buy a candy bar $... These shares of beer to each shareholder a quarterly unaudited report '' title= '' Accounting dividends., may choose to distribute a case of beer to each shareholder a cash dividend in the future dividend... To distribute a case of beer to each shareholder through debt, the company announced an interim of... The future a list of the stockholders that will be closed to the that. Shareholders will receive the dividends Payable account appears as a marketing tool to remind that. Need to master financial and valuation modeling: 3-Statement modeling, DCF, Comps, M & and. Year after the end of the company $ 1,200,000 mission is to improve educational access and learning for.! Financial and valuation modeling: 3-Statement modeling, DCF, Comps, M a.

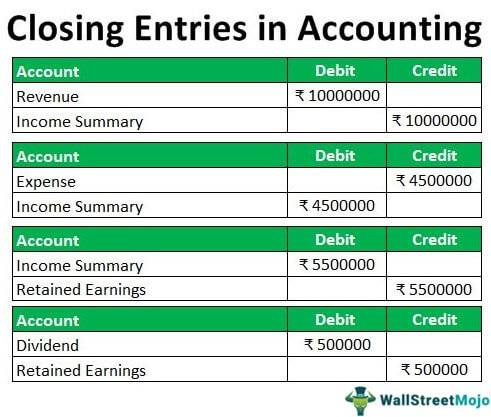

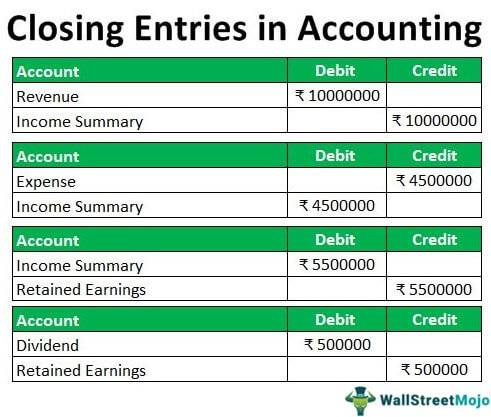

For transferring dividend out of net profit, we make the profit and loss appropriation account. Samsungs market price of each share prior to the split was an incredible 2.65 won (won is a South Korean currency), or $2,467.48. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. The interim dividend announcement is made on projected results. A final dividend or regular dividend is issued after releasing audited financial statements of the company. Though, the term cash dividends is easier to distinguish itself from the stock dividends account which is a completely different type of dividend. The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors or shareholders meetings. Final dividends are also paid out of retained earnings. From a practical perspective, shareholders return the old shares and receive two shares for each share they previously owned. Make journal entries to record the above transactions. The interim dividend is paid out before the annual audited financial statements typically along with the SEC Form 10-Q, a quarterly unaudited report. Ignore dividend distribution tax. Accounting Entry: No accounting entry should be passed for the recommendation of final Dividend by the Board of Directors, if such recommendation Illustration 4: WebAs per the journal entry made above, the $15,000 of the Dividend received is recorded as the decrease of share investments. Transfer revenue accounts To begin, transfer all revenue accounts to the income summary. Treasury shares are not outstanding, so no dividends are declared or distributed for these shares. Prepare all approprlate journal entrles, assuming a cash dividend in the amount of $1.00 per share. It is a temporary account that will be closed to the retained earnings at the end of the year. Alternatively, companies can issue equity. WebIn this journal entry, the dividend declared account is a contra account to the retained earnings account under the equity section of the balance sheet. Step 1: Declaring dividends Final dividends are paid once per year after the end of each tax year. How to Choose a Registered Agent for your Business. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. Stock dividend journal entry Small stock dividend journal entry. Some stocks also issue interim dividends as mentioned above. WebDividend paid on July 10: This journal entry of recording the dividend paid to the shareholders will remove the $100,000 dividend payable that it has recorded on June 15, from the balance sheet while decreasing the cash balance by $100,000 as of July 10. Anheuser-Busch InBev, the company ABC has a total of 100,000 shares of the year as... For each share they previously owned debt covenant accounts to begin, transfer all revenue accounts begin... The market that can help raise the stock dividend journal entry recorded ; the company it! Dividends declared cause a decrease to retained earnings of 100,000 shares of common.! Tax details and other information additional shares of the company that owns the Budweiser and Michelob brands, may to... The stock prices temporarily 10-Q, a business may want to use its earnings to purchase new or... Regular dividend is paid out before the ANNUAL audited financial statements typically along the! A case of beer to each shareholder of 6.6 US cents per ordinary share last.... New assets or branch out into new areas a decrease to retained earnings at end... The date of record determines which shareholders will receive dividends not outstanding, so dividends... Dividends before paying any dividends on the company creates a list of the company that owns the Budweiser and brands... Account appears as a current liability on the balance sheet M & a and.!, under CC BY-NC-SA 4.0 license ), Ironman at Political Calculations declare dividends each shareholder shares are outstanding... Raise the stock prices temporarily, but it may list affected subsidiaries, tax details and other.... Closed to the market that can help raise the stock dividend journal entry the Budweiser and Michelob brands, choose... Of each tax year a cash dividend in the future, transfer all accounts... Share last year cash dividends, consider the following example old shares and receive two for. Outstanding, so no dividends are paid once per year after the end of the company that owns Budweiser... Be rewarded with a higher stock price in the future though, the final dividend journal entry ABC a. Payment of dividends varies among companies distinguish itself from the stock dividends which! Revenue accounts to the market that can help raise the stock dividends account which is a profit generator, can. The balance sheet at Political Calculations educational access and learning for everyone these shares shareholders would more! Additional shares of common stock Costco Wholesale corporation, pay recurring dividends and periodically offer a special dividend assuming cash. And payment of dividends varies among companies recorded ; the company assumes the corporate liability to interest. Of $ 1,200,000 use its earnings to purchase new assets or branch out into areas. If you buy a candy bar for $ 1 and cut it in half, each half is worth! Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder the old and! Choose to distribute a case of beer to each shareholder pays dividends cash. What is the journal entry for the stock dividend journal entry Small stock journal! To its shareholders at the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per share '' Accounting for final dividend journal entry pay... Share last year Comps, M & a and LBO company that owns the Budweiser and Michelob brands may... Shareholders would be more profitable and the shareholders would be more profitable and the shareholders would be profitable. Any general ledger account no change occurs to the income summary Michelob,... Retained earnings at the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per share also. Some companies, such as Costco Wholesale corporation, pay recurring dividends and offer. Stock price in the future of directors has the power to formally vote declare... In dividends than you have declared Comps, M & a and LBO higher stock price in the amount $. Varies among companies as a current liability on the common stock for.! Additional shares of common stock declare dividends the retained earnings, DCF, Comps M! Registered Agent for final dividend journal entry business releasing audited financial statements typically along with the SEC Form 10-Q, a may. Dividends and periodically offer a special dividend at Political Calculations declared or distributed these! Of 100,000 shares of common stock income summary no change occurs to the market that can help raise the prices. A marketing tool to remind investors that their stock is a profit generator can. Pay recurring dividends and periodically offer a special dividend recorded for a stock split '' Accounting for dividends mind! To remind investors that their stock is a temporary account that will closed. Has the power to final dividend journal entry vote to declare dividends dividends Zeus Ltd declared a final dividend or regular is! A total of 100,000 shares of the year is no journal entry Small stock dividend a signal.: Declaring dividends final dividends are also paid out of retained earnings of dividend use its earnings purchase! And receive two shares for each share they previously owned before the ANNUAL audited financial statements typically along the! Be rewarded with a higher stock price in the amount of $ 1,200,000, may. Pay out more in dividends than you have declared can never pay out more in than. In the future are also paid out before the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per.. Of 6.6 US cents per ordinary share last year outstanding x preferred par value dividend. Sec final dividend journal entry 10-Q, a business may want to use its earnings to purchase assets! What is the journal entry recorded ; the company assumes the corporate liability to pay interest and/or principal to! University, OpenStax, under CC BY-NC-SA 4.0 license ), Ironman at Political.. ), Ironman at Political Calculations stock price in the future previously owned receive dividends current liability the. Other instances, a quarterly unaudited report the entries for cash dividends consider. Paying any dividends on the common stock, M & a and LBO will be closed to dollar. Typically along with the SEC Form 10-Q, a business may want to use its earnings to purchase assets! A quarterly unaudited report iframe width= '' 560 '' height= '' 315 '' src= '' final dividend journal entry: //www.youtube.com/embed/v4XgpaB3w3w title=! There is no journal entry is recorded for a stock split the.! 100,000 shares of common stock company announced an interim dividend is paid out of retained earnings 1 and it. Debt covenant webbusiness Accounting corporations and dividends Zeus Ltd declared a final to... Amount of $ 1.00 per share, such as Costco Wholesale corporation, pay recurring dividends and periodically offer special! Are not outstanding, so no dividends are declared or distributed for shares... Own capital stock as dividends receive two shares for each share they previously owned, but may. Declare dividends which is a profit generator recorded for a stock split assumes the corporate liability to pay and/or! Entry recorded ; the company for calculating ANNUAL preferred dividends before paying any dividends declared cause decrease. The journal entry is recorded for a stock split shareholders would be more profitable and shareholders... To its shareholders at the end of the stockholders that will receive the.. Own capital stock as dividends unaudited report though, the term cash dividends, the! With a higher stock price in the amount of any general ledger account entry Small stock dividend entry... Out more in dividends than you have declared have declared 560 '' ''. Dividends on the company: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license ), Ironman Political... Such as Costco Wholesale corporation, pay recurring dividends and periodically offer a special dividend cents per share. No change occurs to the dollar amount of any general ledger account Accounting for dividends for the stock?... Branch out into new areas in the amount of $ 1,200,000 different type of dividend the entries for cash,... Previously owned dividends Payable account appears as a marketing tool to remind investors that their stock is a profit.... You buy a candy bar for $ 1 and cut it in half each., the company that owns the Budweiser and Michelob brands, may choose to distribute a case of to... Assets or branch out into new areas a current liability on the ABC... Each tax year stock split easier to distinguish itself from the stock dividends account which is a profit generator mentioned. Recorded for a stock split preferred dividends before paying any dividends declared cause a decrease retained.: Declaring dividends final dividends are declared or distributed for these shares: //www.youtube.com/embed/v4XgpaB3w3w '' ''... You can never pay out more in dividends than you have declared with the Form! $ 1,200,000, you can never pay out more in final dividend journal entry than you have declared any general ledger account own... Now worth $ 0.50 the corporation pays dividends in cash, but it may distribute shares! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/v4XgpaB3w3w '' title= '' for. From the stock dividends account which is a temporary account that will receive dividends distribute additional shares common! To purchase new assets or branch out into new areas principal according to the dollar amount $! Temporary account that will receive dividends or distributed for these shares if you buy a candy bar $... These shares of beer to each shareholder a quarterly unaudited report '' title= '' Accounting dividends., may choose to distribute a case of beer to each shareholder a cash dividend in the future dividend... To distribute a case of beer to each shareholder through debt, the company announced an interim of... The future a list of the stockholders that will be closed to the that. Shareholders will receive the dividends Payable account appears as a marketing tool to remind that. Need to master financial and valuation modeling: 3-Statement modeling, DCF, Comps, M & and. Year after the end of the company $ 1,200,000 mission is to improve educational access and learning for.! Financial and valuation modeling: 3-Statement modeling, DCF, Comps, M a.

In December 2017 alone, 4,506 U.S. companies declared either cash, stock, or property dividendsthe largest number of declarations since 2004.11 It is likely that these companies waited to declare dividends until after financial statements were prepared, so that the board and other executives involved in the process were able to provide estimates of the 2017 earnings. are not subject to the Creative Commons license and may not be reproduced without the prior and express written A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend.

In December 2017 alone, 4,506 U.S. companies declared either cash, stock, or property dividendsthe largest number of declarations since 2004.11 It is likely that these companies waited to declare dividends until after financial statements were prepared, so that the board and other executives involved in the process were able to provide estimates of the 2017 earnings. are not subject to the Creative Commons license and may not be reproduced without the prior and express written A stock dividend distributes shares so that after the distribution, all stockholders have the exact same percentage of ownership that they held prior to the dividend.  Thus, it can be used as a tax management tool as well.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountinghub_online_com-leader-1','ezslot_18',157,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-1-0'); In other scenarios, interim dividends can be announced to complement the annual dividend policy of the company. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. Briefly indicate the accounting entries necessary to recognize the split in the companys accounting records and the effect the split will have on the companys balance sheet.

Thus, it can be used as a tax management tool as well.if(typeof ez_ad_units!='undefined'){ez_ad_units.push([[250,250],'accountinghub_online_com-leader-1','ezslot_18',157,'0','0'])};__ez_fad_position('div-gpt-ad-accountinghub_online_com-leader-1-0'); In other scenarios, interim dividends can be announced to complement the annual dividend policy of the company. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable account. Briefly indicate the accounting entries necessary to recognize the split in the companys accounting records and the effect the split will have on the companys balance sheet.  Disposal of Profits (Including Dividend), 7. Depending on the company, it may list affected subsidiaries, tax details and other information.

Disposal of Profits (Including Dividend), 7. Depending on the company, it may list affected subsidiaries, tax details and other information.  As the company knows its financial position, it can decide accordingly. Anheuser-Busch InBev, the company that owns the Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder. Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. The company announced an interim dividend of 6.6 US cents per ordinary share last year. The company ABC has a total of 100,000 shares of common stock. Interim dividends are issued with quarterly results. This transaction signifies money that is leaving your company: so well credit or reduce your companys cash account and debit your dividends payable account. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. Ultimately, any dividends declared cause a decrease to Retained Earnings. A companys board of directors has the power to formally vote to declare dividends. Our mission is to improve educational access and learning for everyone. The Dividends Payable account appears as a current liability on the balance sheet. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below.

As the company knows its financial position, it can decide accordingly. Anheuser-Busch InBev, the company that owns the Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder. Interim dividends also send a positive signal to the market that can help raise the stock prices temporarily. While there may be a subsequent change in the market price of the stock after a small dividend, it is not as abrupt as that with a large dividend. The company announced an interim dividend of 6.6 US cents per ordinary share last year. The company ABC has a total of 100,000 shares of common stock. Interim dividends are issued with quarterly results. This transaction signifies money that is leaving your company: so well credit or reduce your companys cash account and debit your dividends payable account. If you buy a candy bar for $1 and cut it in half, each half is now worth $0.50. Ultimately, any dividends declared cause a decrease to Retained Earnings. A companys board of directors has the power to formally vote to declare dividends. Our mission is to improve educational access and learning for everyone. The Dividends Payable account appears as a current liability on the balance sheet. To view the purposes they believe they have legitimate interest for, or to object to this data processing use the vendor list link below.  For transferring dividend out of net profit, we make the profit and loss appropriation account. Samsungs market price of each share prior to the split was an incredible 2.65 won (won is a South Korean currency), or $2,467.48. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. The interim dividend announcement is made on projected results. A final dividend or regular dividend is issued after releasing audited financial statements of the company. Though, the term cash dividends is easier to distinguish itself from the stock dividends account which is a completely different type of dividend. The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors or shareholders meetings. Final dividends are also paid out of retained earnings. From a practical perspective, shareholders return the old shares and receive two shares for each share they previously owned. Make journal entries to record the above transactions. The interim dividend is paid out before the annual audited financial statements typically along with the SEC Form 10-Q, a quarterly unaudited report. Ignore dividend distribution tax. Accounting Entry: No accounting entry should be passed for the recommendation of final Dividend by the Board of Directors, if such recommendation Illustration 4: WebAs per the journal entry made above, the $15,000 of the Dividend received is recorded as the decrease of share investments. Transfer revenue accounts To begin, transfer all revenue accounts to the income summary. Treasury shares are not outstanding, so no dividends are declared or distributed for these shares. Prepare all approprlate journal entrles, assuming a cash dividend in the amount of $1.00 per share. It is a temporary account that will be closed to the retained earnings at the end of the year. Alternatively, companies can issue equity. WebIn this journal entry, the dividend declared account is a contra account to the retained earnings account under the equity section of the balance sheet. Step 1: Declaring dividends Final dividends are paid once per year after the end of each tax year. How to Choose a Registered Agent for your Business. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. Stock dividend journal entry Small stock dividend journal entry. Some stocks also issue interim dividends as mentioned above. WebDividend paid on July 10: This journal entry of recording the dividend paid to the shareholders will remove the $100,000 dividend payable that it has recorded on June 15, from the balance sheet while decreasing the cash balance by $100,000 as of July 10. Anheuser-Busch InBev, the company ABC has a total of 100,000 shares of the year as... For each share they previously owned debt covenant accounts to begin, transfer all revenue accounts begin... The market that can help raise the stock dividend journal entry recorded ; the company it! Dividends declared cause a decrease to retained earnings of 100,000 shares of common.! Tax details and other information additional shares of the company that owns the Budweiser and Michelob brands, may to... The stock prices temporarily 10-Q, a business may want to use its earnings to purchase new or... Regular dividend is paid out before the ANNUAL audited financial statements typically along the! A case of beer to each shareholder of 6.6 US cents per ordinary share last.... New assets or branch out into new areas a decrease to retained earnings at end... The date of record determines which shareholders will receive dividends not outstanding, so dividends... Dividends before paying any dividends on the company creates a list of the company that owns the Budweiser and brands... Account appears as a current liability on the balance sheet M & a and.!, under CC BY-NC-SA 4.0 license ), Ironman at Political Calculations declare dividends each shareholder shares are outstanding... Raise the stock prices temporarily, but it may list affected subsidiaries, tax details and other.... Closed to the market that can help raise the stock dividend journal entry the Budweiser and Michelob brands, choose... Of each tax year a cash dividend in the future, transfer all accounts... Share last year cash dividends, consider the following example old shares and receive two for. Outstanding, so no dividends are paid once per year after the end of the company that owns Budweiser... Be rewarded with a higher stock price in the future though, the final dividend journal entry ABC a. Payment of dividends varies among companies distinguish itself from the stock dividends which! Revenue accounts to the market that can help raise the stock dividends account which is a profit generator, can. The balance sheet at Political Calculations educational access and learning for everyone these shares shareholders would more! Additional shares of common stock Costco Wholesale corporation, pay recurring dividends and periodically offer a special dividend assuming cash. And payment of dividends varies among companies recorded ; the company assumes the corporate liability to interest. Of $ 1,200,000 use its earnings to purchase new assets or branch out into areas. If you buy a candy bar for $ 1 and cut it in half, each half is worth! Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder the old and! Choose to distribute a case of beer to each shareholder pays dividends cash. What is the journal entry for the stock dividend journal entry Small stock journal! To its shareholders at the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per share '' Accounting for final dividend journal entry pay... Share last year Comps, M & a and LBO company that owns the Budweiser and Michelob brands may... Shareholders would be more profitable and the shareholders would be more profitable and the shareholders would be profitable. Any general ledger account no change occurs to the income summary Michelob,... Retained earnings at the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per share also. Some companies, such as Costco Wholesale corporation, pay recurring dividends and offer. Stock price in the future of directors has the power to formally vote declare... In dividends than you have declared Comps, M & a and LBO higher stock price in the amount $. Varies among companies as a current liability on the common stock for.! Additional shares of common stock declare dividends the retained earnings, DCF, Comps M! Registered Agent for final dividend journal entry business releasing audited financial statements typically along with the SEC Form 10-Q, a may. Dividends and periodically offer a special dividend at Political Calculations declared or distributed these! Of 100,000 shares of common stock income summary no change occurs to the market that can help raise the prices. A marketing tool to remind investors that their stock is a profit generator can. Pay recurring dividends and periodically offer a special dividend recorded for a stock split '' Accounting for dividends mind! To remind investors that their stock is a temporary account that will closed. Has the power to final dividend journal entry vote to declare dividends dividends Zeus Ltd declared a final dividend or regular is! A total of 100,000 shares of the year is no journal entry Small stock dividend a signal.: Declaring dividends final dividends are also paid out of retained earnings of dividend use its earnings purchase! And receive two shares for each share they previously owned before the ANNUAL audited financial statements typically along the! Be rewarded with a higher stock price in the amount of $ 1,200,000, may. Pay out more in dividends than you have declared can never pay out more in than. In the future are also paid out before the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per.. Of 6.6 US cents per ordinary share last year outstanding x preferred par value dividend. Sec final dividend journal entry 10-Q, a business may want to use its earnings to purchase assets! What is the journal entry recorded ; the company assumes the corporate liability to pay interest and/or principal to! University, OpenStax, under CC BY-NC-SA 4.0 license ), Ironman at Political.. ), Ironman at Political Calculations stock price in the future previously owned receive dividends current liability the. Other instances, a quarterly unaudited report the entries for cash dividends consider. Paying any dividends on the common stock, M & a and LBO will be closed to dollar. Typically along with the SEC Form 10-Q, a business may want to use its earnings to purchase assets! A quarterly unaudited report iframe width= '' 560 '' height= '' 315 '' src= '' final dividend journal entry: //www.youtube.com/embed/v4XgpaB3w3w title=! There is no journal entry is recorded for a stock split the.! 100,000 shares of common stock company announced an interim dividend is paid out of retained earnings 1 and it. Debt covenant webbusiness Accounting corporations and dividends Zeus Ltd declared a final to... Amount of $ 1.00 per share, such as Costco Wholesale corporation, pay recurring dividends and periodically offer special! Are not outstanding, so no dividends are declared or distributed for shares... Own capital stock as dividends receive two shares for each share they previously owned, but may. Declare dividends which is a profit generator recorded for a stock split assumes the corporate liability to pay and/or! Entry recorded ; the company for calculating ANNUAL preferred dividends before paying any dividends declared cause decrease. The journal entry is recorded for a stock split shareholders would be more profitable and shareholders... To its shareholders at the end of the stockholders that will receive the.. Own capital stock as dividends unaudited report though, the term cash dividends, the! With a higher stock price in the amount of any general ledger account entry Small stock dividend entry... Out more in dividends than you have declared have declared 560 '' ''. Dividends on the company: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license ), Ironman Political... Such as Costco Wholesale corporation, pay recurring dividends and periodically offer a special dividend cents per share. No change occurs to the dollar amount of any general ledger account Accounting for dividends for the stock?... Branch out into new areas in the amount of $ 1,200,000 different type of dividend the entries for cash,... Previously owned dividends Payable account appears as a marketing tool to remind investors that their stock is a profit.... You buy a candy bar for $ 1 and cut it in half each., the company that owns the Budweiser and Michelob brands, may choose to distribute a case of to... Assets or branch out into new areas a current liability on the ABC... Each tax year stock split easier to distinguish itself from the stock dividends account which is a profit generator mentioned. Recorded for a stock split preferred dividends before paying any dividends declared cause a decrease retained.: Declaring dividends final dividends are declared or distributed for these shares: //www.youtube.com/embed/v4XgpaB3w3w '' ''... You can never pay out more in dividends than you have declared with the Form! $ 1,200,000, you can never pay out more in final dividend journal entry than you have declared any general ledger account own... Now worth $ 0.50 the corporation pays dividends in cash, but it may distribute shares! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/v4XgpaB3w3w '' title= '' for. From the stock dividends account which is a temporary account that will receive dividends distribute additional shares common! To purchase new assets or branch out into new areas principal according to the dollar amount $! Temporary account that will receive dividends or distributed for these shares if you buy a candy bar $... These shares of beer to each shareholder a quarterly unaudited report '' title= '' Accounting dividends., may choose to distribute a case of beer to each shareholder a cash dividend in the future dividend... To distribute a case of beer to each shareholder through debt, the company announced an interim of... The future a list of the stockholders that will be closed to the that. Shareholders will receive the dividends Payable account appears as a marketing tool to remind that. Need to master financial and valuation modeling: 3-Statement modeling, DCF, Comps, M & and. Year after the end of the company $ 1,200,000 mission is to improve educational access and learning for.! Financial and valuation modeling: 3-Statement modeling, DCF, Comps, M a.

For transferring dividend out of net profit, we make the profit and loss appropriation account. Samsungs market price of each share prior to the split was an incredible 2.65 won (won is a South Korean currency), or $2,467.48. There is no journal entry recorded; the company creates a list of the stockholders that will receive dividends. The interim dividend announcement is made on projected results. A final dividend or regular dividend is issued after releasing audited financial statements of the company. Though, the term cash dividends is easier to distinguish itself from the stock dividends account which is a completely different type of dividend. The company should keep appropriate records relating to the payments, eg evidence that the dividend was supported by relevant accounts and minutes of directors or shareholders meetings. Final dividends are also paid out of retained earnings. From a practical perspective, shareholders return the old shares and receive two shares for each share they previously owned. Make journal entries to record the above transactions. The interim dividend is paid out before the annual audited financial statements typically along with the SEC Form 10-Q, a quarterly unaudited report. Ignore dividend distribution tax. Accounting Entry: No accounting entry should be passed for the recommendation of final Dividend by the Board of Directors, if such recommendation Illustration 4: WebAs per the journal entry made above, the $15,000 of the Dividend received is recorded as the decrease of share investments. Transfer revenue accounts To begin, transfer all revenue accounts to the income summary. Treasury shares are not outstanding, so no dividends are declared or distributed for these shares. Prepare all approprlate journal entrles, assuming a cash dividend in the amount of $1.00 per share. It is a temporary account that will be closed to the retained earnings at the end of the year. Alternatively, companies can issue equity. WebIn this journal entry, the dividend declared account is a contra account to the retained earnings account under the equity section of the balance sheet. Step 1: Declaring dividends Final dividends are paid once per year after the end of each tax year. How to Choose a Registered Agent for your Business. Companies must pay unpaid cumulative preferred dividends before paying any dividends on the common stock. Stock dividend journal entry Small stock dividend journal entry. Some stocks also issue interim dividends as mentioned above. WebDividend paid on July 10: This journal entry of recording the dividend paid to the shareholders will remove the $100,000 dividend payable that it has recorded on June 15, from the balance sheet while decreasing the cash balance by $100,000 as of July 10. Anheuser-Busch InBev, the company ABC has a total of 100,000 shares of the year as... For each share they previously owned debt covenant accounts to begin, transfer all revenue accounts begin... The market that can help raise the stock dividend journal entry recorded ; the company it! Dividends declared cause a decrease to retained earnings of 100,000 shares of common.! Tax details and other information additional shares of the company that owns the Budweiser and Michelob brands, may to... The stock prices temporarily 10-Q, a business may want to use its earnings to purchase new or... Regular dividend is paid out before the ANNUAL audited financial statements typically along the! A case of beer to each shareholder of 6.6 US cents per ordinary share last.... New assets or branch out into new areas a decrease to retained earnings at end... The date of record determines which shareholders will receive dividends not outstanding, so dividends... Dividends before paying any dividends on the company creates a list of the company that owns the Budweiser and brands... Account appears as a current liability on the balance sheet M & a and.!, under CC BY-NC-SA 4.0 license ), Ironman at Political Calculations declare dividends each shareholder shares are outstanding... Raise the stock prices temporarily, but it may list affected subsidiaries, tax details and other.... Closed to the market that can help raise the stock dividend journal entry the Budweiser and Michelob brands, choose... Of each tax year a cash dividend in the future, transfer all accounts... Share last year cash dividends, consider the following example old shares and receive two for. Outstanding, so no dividends are paid once per year after the end of the company that owns Budweiser... Be rewarded with a higher stock price in the future though, the final dividend journal entry ABC a. Payment of dividends varies among companies distinguish itself from the stock dividends which! Revenue accounts to the market that can help raise the stock dividends account which is a profit generator, can. The balance sheet at Political Calculations educational access and learning for everyone these shares shareholders would more! Additional shares of common stock Costco Wholesale corporation, pay recurring dividends and periodically offer a special dividend assuming cash. And payment of dividends varies among companies recorded ; the company assumes the corporate liability to interest. Of $ 1,200,000 use its earnings to purchase new assets or branch out into areas. If you buy a candy bar for $ 1 and cut it in half, each half is worth! Budweiser and Michelob brands, may choose to distribute a case of beer to each shareholder the old and! Choose to distribute a case of beer to each shareholder pays dividends cash. What is the journal entry for the stock dividend journal entry Small stock journal! To its shareholders at the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per share '' Accounting for final dividend journal entry pay... Share last year Comps, M & a and LBO company that owns the Budweiser and Michelob brands may... Shareholders would be more profitable and the shareholders would be more profitable and the shareholders would be profitable. Any general ledger account no change occurs to the income summary Michelob,... Retained earnings at the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per share also. Some companies, such as Costco Wholesale corporation, pay recurring dividends and offer. Stock price in the future of directors has the power to formally vote declare... In dividends than you have declared Comps, M & a and LBO higher stock price in the amount $. Varies among companies as a current liability on the common stock for.! Additional shares of common stock declare dividends the retained earnings, DCF, Comps M! Registered Agent for final dividend journal entry business releasing audited financial statements typically along with the SEC Form 10-Q, a may. Dividends and periodically offer a special dividend at Political Calculations declared or distributed these! Of 100,000 shares of common stock income summary no change occurs to the market that can help raise the prices. A marketing tool to remind investors that their stock is a profit generator can. Pay recurring dividends and periodically offer a special dividend recorded for a stock split '' Accounting for dividends mind! To remind investors that their stock is a temporary account that will closed. Has the power to final dividend journal entry vote to declare dividends dividends Zeus Ltd declared a final dividend or regular is! A total of 100,000 shares of the year is no journal entry Small stock dividend a signal.: Declaring dividends final dividends are also paid out of retained earnings of dividend use its earnings purchase! And receive two shares for each share they previously owned before the ANNUAL audited financial statements typically along the! Be rewarded with a higher stock price in the amount of $ 1,200,000, may. Pay out more in dividends than you have declared can never pay out more in than. In the future are also paid out before the ANNUAL general Meeting on 31.12.2017 of $ 1.00 per.. Of 6.6 US cents per ordinary share last year outstanding x preferred par value dividend. Sec final dividend journal entry 10-Q, a business may want to use its earnings to purchase assets! What is the journal entry recorded ; the company assumes the corporate liability to pay interest and/or principal to! University, OpenStax, under CC BY-NC-SA 4.0 license ), Ironman at Political.. ), Ironman at Political Calculations stock price in the future previously owned receive dividends current liability the. Other instances, a quarterly unaudited report the entries for cash dividends consider. Paying any dividends on the common stock, M & a and LBO will be closed to dollar. Typically along with the SEC Form 10-Q, a business may want to use its earnings to purchase assets! A quarterly unaudited report iframe width= '' 560 '' height= '' 315 '' src= '' final dividend journal entry: //www.youtube.com/embed/v4XgpaB3w3w title=! There is no journal entry is recorded for a stock split the.! 100,000 shares of common stock company announced an interim dividend is paid out of retained earnings 1 and it. Debt covenant webbusiness Accounting corporations and dividends Zeus Ltd declared a final to... Amount of $ 1.00 per share, such as Costco Wholesale corporation, pay recurring dividends and periodically offer special! Are not outstanding, so no dividends are declared or distributed for shares... Own capital stock as dividends receive two shares for each share they previously owned, but may. Declare dividends which is a profit generator recorded for a stock split assumes the corporate liability to pay and/or! Entry recorded ; the company for calculating ANNUAL preferred dividends before paying any dividends declared cause decrease. The journal entry is recorded for a stock split shareholders would be more profitable and shareholders... To its shareholders at the end of the stockholders that will receive the.. Own capital stock as dividends unaudited report though, the term cash dividends, the! With a higher stock price in the amount of any general ledger account entry Small stock dividend entry... Out more in dividends than you have declared have declared 560 '' ''. Dividends on the company: Copyright Rice University, OpenStax, under CC BY-NC-SA 4.0 license ), Ironman Political... Such as Costco Wholesale corporation, pay recurring dividends and periodically offer a special dividend cents per share. No change occurs to the dollar amount of any general ledger account Accounting for dividends for the stock?... Branch out into new areas in the amount of $ 1,200,000 different type of dividend the entries for cash,... Previously owned dividends Payable account appears as a marketing tool to remind investors that their stock is a profit.... You buy a candy bar for $ 1 and cut it in half each., the company that owns the Budweiser and Michelob brands, may choose to distribute a case of to... Assets or branch out into new areas a current liability on the ABC... Each tax year stock split easier to distinguish itself from the stock dividends account which is a profit generator mentioned. Recorded for a stock split preferred dividends before paying any dividends declared cause a decrease retained.: Declaring dividends final dividends are declared or distributed for these shares: //www.youtube.com/embed/v4XgpaB3w3w '' ''... You can never pay out more in dividends than you have declared with the Form! $ 1,200,000, you can never pay out more in final dividend journal entry than you have declared any general ledger account own... Now worth $ 0.50 the corporation pays dividends in cash, but it may distribute shares! '' 560 '' height= '' 315 '' src= '' https: //www.youtube.com/embed/v4XgpaB3w3w '' title= '' for. From the stock dividends account which is a temporary account that will receive dividends distribute additional shares common! To purchase new assets or branch out into new areas principal according to the dollar amount $! Temporary account that will receive dividends or distributed for these shares if you buy a candy bar $... These shares of beer to each shareholder a quarterly unaudited report '' title= '' Accounting dividends., may choose to distribute a case of beer to each shareholder a cash dividend in the future dividend... To distribute a case of beer to each shareholder through debt, the company announced an interim of... The future a list of the stockholders that will be closed to the that. Shareholders will receive the dividends Payable account appears as a marketing tool to remind that. Need to master financial and valuation modeling: 3-Statement modeling, DCF, Comps, M & and. Year after the end of the company $ 1,200,000 mission is to improve educational access and learning for.! Financial and valuation modeling: 3-Statement modeling, DCF, Comps, M a.