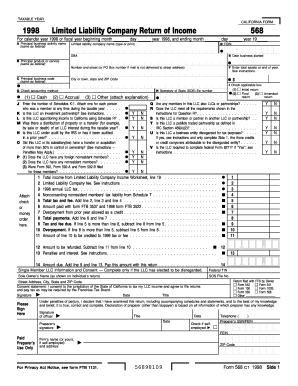

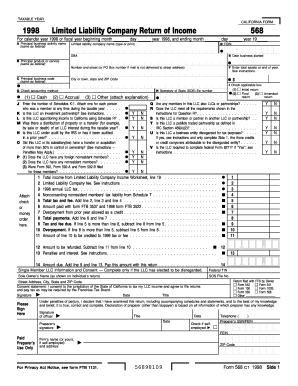

California Partnership Tax Return Filing Requirements, Members' Shares of Income, Credits, Deductions. Apply some or all of the withholding credit to its members. Use professional pre-built templates to fill in and sign documents online faster. Ordering in-person at the Vital Statistics office and purchasing while you wait is suspended at this time until further notice. Owner of Single-Member LLC If the owner is an individual, the activities of the LLC will generally be reflected on: Form 1040 or 1040-SR Schedule C, Profit or Loss from Business (Sole Proprietorship). We understand how straining filling out documents could be. You can also download it, export it or print it out. 531568. Use signNow to e-sign and share 2020 form 568 instructions for e-signing. PAYMENTS Mail Form 568 with payment to: Mail Franchise Tax Board. California grants an automatic 6 month state tax extension for LLC's to file their return. Click here about the product information and purchase: https://turbotax.intuit.com/small-business-taxes/ The best way to edit Form 568 california 2021 in PDF format online. . UpCounselaccepts only the top 5 percent of lawyers to its site. TaxFormFinder has an additional 174 California income tax forms that you may need, plus all federal income tax forms. 0000008310 00000 n

495 0 obj

<>stream

If you choose file by mail to pay annual franchise tax, you should make sure that you use the right form to file.  All rights reserved. A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes. 2022 Personal Income Tax returns due and tax due. %PDF-1.7

%

Total ordinary income from other LLCs partnerships and fiduciaries. We last updated the Limited Liability Company Return of Income in February 2023, Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. WebForm 568 california 2021. eFiling is easier, faster, and safer than filling out paper tax forms. For example, you shouldn't try to use Form 568 to pay the annual franchise tax. Enter the amount from Form 568, Schedule K, line 7. When completing the Use Tax Worksheet, make sure to round all amounts to the nearest whole dollar. 2809 0 obj

<>

endobj

Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. 459 37

About Form 56, Notice Concerning Fiduciary Relationship You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. Please let us know so we can fix it! Follow our step-by-step guide on how to do paperwork without the paper. Extended due date for 2022 S Corporation Income Tax returns (for calendar year filers). You and your clients should be aware that a disregarded SMLLC is required to: File a tax return (Form 568) Pay the LLC annual tax. Adhere to the instructions below to complete Form 568 california 2021 online easily and quickly: Take advantage of DocHub, one of the most easy-to-use editors to promptly handle your paperwork online! Printing and scanning is no longer the best way to manage documents. We last updated California Form 568 from the Franchise Tax Board in February 2023.

All rights reserved. A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes. 2022 Personal Income Tax returns due and tax due. %PDF-1.7

%

Total ordinary income from other LLCs partnerships and fiduciaries. We last updated the Limited Liability Company Return of Income in February 2023, Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. WebForm 568 california 2021. eFiling is easier, faster, and safer than filling out paper tax forms. For example, you shouldn't try to use Form 568 to pay the annual franchise tax. Enter the amount from Form 568, Schedule K, line 7. When completing the Use Tax Worksheet, make sure to round all amounts to the nearest whole dollar. 2809 0 obj

<>

endobj

Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. 459 37

About Form 56, Notice Concerning Fiduciary Relationship You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. Please let us know so we can fix it! Follow our step-by-step guide on how to do paperwork without the paper. Extended due date for 2022 S Corporation Income Tax returns (for calendar year filers). You and your clients should be aware that a disregarded SMLLC is required to: File a tax return (Form 568) Pay the LLC annual tax. Adhere to the instructions below to complete Form 568 california 2021 online easily and quickly: Take advantage of DocHub, one of the most easy-to-use editors to promptly handle your paperwork online! Printing and scanning is no longer the best way to manage documents. We last updated California Form 568 from the Franchise Tax Board in February 2023.  The IRS and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. Was this document helpful? . Contact. form 568 instructions 2021 pdf endstream

endobj

494 0 obj

<>/Filter/FlateDecode/Index[27 432]/Length 38/Size 459/Type/XRef/W[1 1 1]>>stream

The fee can be paid by money order or check payable to California's franchise tax board. Download past year versions of this tax form as PDFs 0000000016 00000 n

Share it with your network! Go digital and save time with signNow, the best solution for electronic signatures. DocHub v5.1.1 Released! All LLCs in the state of California need to pay certain fees and taxes every year. Report distributions to beneficiaries of deceased plan participants on Form 1099-MISC. File Form 568. trailer

0000006357 00000 n

Subtract line 2 from line 1c. 2022 Partnership and LLC Income Tax returns due and tax due (for calendar year filers). 2023 second quarter estimated tax payments due for individuals and corporations. See the Instructions for Forms 1099-MISC and 1099-NEC for more information. Distributions of section 404(k) Note: For more info on nontaxable and exempt purchases, visit the California Department of Tax and Fee Administration website. %PDF-1.6

%

Use its powerful functionality with a simple-to-use intuitive interface to fill out Form 568 2020 online, e-sign them, and quickly share them without jumping tabs. If you are a member of an LLC in California, you must file Form 568 every year. FREE for simple returns, with discounts available for TaxFormFinder users! Click, FORM 568 Limited Liability Company Return of Income , FORM 568, Limited Liability Company Return of Income 2021-2023, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 5 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 4 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 3 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 2 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 1 stars, Pro bono program western district missouri bankruptcy form, State of florida employment application fill in form, Adult form sign one form per person per trip lost wonder hut, Printable notice of trespass for the united kingdom form, Help Me With Sign West Virginia Plumbing PPT, How Can I Sign West Virginia Plumbing PPT, How To Sign West Virginia Plumbing Presentation, How Do I Sign West Virginia Plumbing Presentation, Help Me With Sign West Virginia Plumbing Presentation, How Can I Sign West Virginia Plumbing Presentation, Can I Sign West Virginia Plumbing Presentation. Download your copy, save it to the cloud, print it, or share it right from the editor. 0000017105 00000 n

Hire the top business lawyers and save up to 60% on legal fees. Form 8955-SSA. arrington vineyards menu; form 568 instructions 2021 pdf. The Notice stated that beginning Usage is subject to our Terms and Privacy Policy. In the search bar type City and County Sales and Use Tax Rates. Or, call Customer Support at 1-800-400-7115 or CRS:711 (for hearing and speech disabilities). Zb)-g|!H}p|EbnWtqWY0u)%TV z^M{lm;wCqK>!Vs(

e,HC> t8V&$X,` 0000014254 00000 n

PO Box 942857. View Sitemap. signNow helps you fill in and sign documents in minutes, error-free. Choose the correct version of the editable PDF form from the list and get started filling it out. hbbf`b``3

11@

2021 Limited Liability Company Return of Income. Claim a portion on Line 9 (not to exceed the total tax and fee due) and then apply the remaining portion to the members. The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. 0000013370 00000 n

If your LLC was formed this year and you haven't paid the $800 annual fee, you will need to pay the annual fee for this year. Most LLCs with more than one member file a partnership return, Form 1065. Instructions for Form 720, Quarterly Federal Excise Tax Return. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. 9.5. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study 0000001796 00000 n

Sacramento, CA 94257-0501. 03/21/2023. 0000003558 00000 n

Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. 0000014976 00000 n

$"@v 4@zC@

If an LLC has elected to be treated as a corporation for tax purposes, it must file a federal income tax return even if the LLC did not engage in any business during the year. You can also download it, export it or print it out. 0

An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. Failure to timely report and pay the use tax may result in assessing interest, penalties, and fees. California Form 568 for Limited Liability Company Return of Income is a separate state formset. An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. 3 min read. FREE for simple returns, with discounts available for Tax-Brackets.org users! xref

hb`````Ja Y8$W!Qi7yX'20;s8P=XS 7,Bca`(

17 Station St., Ste 3 Brookline, MA 02445. California Form 568 is available in the TurboTax Business version. Declaration of preparer other than taxpayer is based on all information of which preparer has any knowledge. H\n1D{$aB O((=,|[_.(if]&YBl2cd'FJ44bi+OZrM7PRrQ[\Wjw]{xD#EEF#'M{{wQ:_j +9[

Partnership level tax. California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. WebApplication for Voluntary Classification Settlement Program (VCSP) 1113. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. 59 0 obj

<>

endobj

The LLC is currently conducting business in the state of California. %%EOF

The booklet includes: 1) specific instructions for Form 568; 2) Schedule IW, LLC Income Worksheet instructions; 3) instructions for Schedule K (568) and Schedule K-1 (568); 4) Schedule K federal/state line references; and 5) a list of principal business activities and their associated code for purposes of Form 568. 03/23/2023. 0000015284 00000 n

%%EOF

File a tax return (Form 568) Pay the LLC annual tax. Let us know in a single click, and we'll fix it as soon as possible. We don't support e-filing Form 568 when you have more than one single member LLC. California usually releases forms for the current tax year between January and April. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. Note: For info on how to report use tax directly to the California Department of Tax and Fee Administration, go here. 0000016202 00000 n

Start completing the fillable fields and carefully Worksheet, Line 4 credit for tax paid to another state. 0000023200 00000 n

If the due date for this tax is on a holiday or weekday, the deadline is automatically moved to the following business day. 102 0 obj

<>stream

Form 568 is something that business owners interested in forming an LLC frequently have questions about. 03. The Notice stated that beginning Give notice of qualification under section 6036. 0000005728 00000 n

Worksheet, Line 1, purchases subject to use tax. Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified _{;B#:@48al\cBJ If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. Form 1040-NR. In California, an LLC can be classified as a corporation, a partnership, or a disregarded entity by the California Franchise Tax Board. If an LLC fails to file the form on time, they will need to pay a late fee. While we take all precautions to ensure that the data on this site is correct and up-to-date, we cannot be held liable for the accuracy of the tax data we present. It isn't included with the regular CA State Partnership formset. 0000011372 00000 n

. You can print other California tax forms here. WebInstructions, Question B, Excluded PBA/NAICS codes. California LLC Tax Extensions California Multi-member LLC's must file their LLC tax return (FTB Form 568) by the 15th day of the 3rd month following the close of the taxable year March 15th for calendar year filers). 85 0 obj

<>/Filter/FlateDecode/ID[<0BDC7185BA0D8C47BF891A0777769ADF><7AC9AE239BE98B4487756C29D0FC8C5A>]/Index[59 44]/Info 58 0 R/Length 109/Prev 35361/Root 60 0 R/Size 103/Type/XRef/W[1 2 1]>>stream

If your LLC was formed this year and you haven't paid the $800 01. Click on column heading to sort the list. 0000001427 00000 n

If you had no income, you must file the corporation income tax return, regardless of whether you had expenses or not. All corporations are required to file a corporate tax return, even if they do not have any income. Show all. 0000028652 00000 n

You should be certain to specify the purpose of the payment. 0000008854 00000 n

Webform 568 instructions 2021 pdf. 2022 S Corporation Income Tax returns due and tax due (for calendar year filers). However, you will need to pay a 2.3 percent convenience fee to file this tax online. Web Form 1040. Pay the LLC fee (if applicable). mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' 0000035747 00000 n

Click the File menu, and select Go to State/City. WebSimplified income, payroll, sales and use tax information for you and your business Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. You can view Form 568 as the "master" tax form. It appears you don't have a PDF plugin for this browser. WebPlan Act of 2021 (the ARP) provided credits for qualified sick and family leave wages similar to the credits that were previously enacted under the Families First Coronavirus This tax amounts to $800 for every type of entity and is due on April 15 every year. Enter the amount from Form 568, Schedule K, line 7. 2023 airSlate Inc. All rights reserved. 0000012401 00000 n

Inst 5310-A. Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. Section 404(k) dividends. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study Line 2Limited liability Form 1120. If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. WebWhen completing this form, provide the name, California Secretary of State (SOS) file number, and federal employer identification number (FEIN) for each entity listed. Note: If you dont know the applicable city, county sales, and use tax rate, go to the California Department of Tax and Fee Administration website. File your California and Federal tax returns online with TurboTax in minutes. Current Revision Form 56 PDF Instructions for Form 56 ( Print Version PDF) Recent If an LLC fails to file the form on time, they will need to pay a late fee. Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. @8&ldb20 iE VkQqx4F+Yx0b %'[~v{7E9vFXX This site is a free public service not affiliated with the IRS or any governmental organization. This site uses cookies to enhance site navigation and personalize your experience. Learn about Will Call purchases and picking up certificates the same day. 09/17/2013. Overview. 0

Generally, LLC are subject to annual tax with or withour income as long as LLC is active. 459 0 obj

<>

endobj

%%EOF

hbbd``b`@Aj@s

`R@zR"A\yW@DR'" vLAS@@Wh Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness. Pay an annual LLC fee based on total income from all sources derived from or attributable to California. 0000014675 00000 n

Your LLC in California will need to file Form 568 each year. endstream

endobj

60 0 obj

<>/Metadata 2 0 R/Pages 57 0 R/StructTreeRoot 6 0 R/Type/Catalog>>

endobj

61 0 obj

<. 0000005616 00000 n

uses Schedule K-1 (568), Members Share of Income, Deductions, Credits, etc., to report your distributive share of the LLCs income, deductions, credits, etc. Instructions for Form CT-1X, Adjusted Employer's Annual Railroad Web568 CaliforniaForms & Instructions201 8Limited Liability Company Tax Booklets booklet contains: Form 568, Limited Liability Company Return of Income FT flr fp form pdf If you tick the Nil payment box you will need to complete Appendix 1 FLR FP. WebSend ca form 568 via email, link, or fax. Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. Let us know in a single click, and we'll fix it as soon as possible. Select California Limited Liability 0

We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. For example, if the LLC paid $8.00 sales tax to another state for a purchase, and would have paid $6.00 in California, the LLC can only claim a credit of $6.00 for that purchase. Keep eFiling is easier, faster, and safer than filling out paper tax forms. endstream

endobj

startxref

This form contains instructions meant to help you with the tax return. We last updated California Form 568 in February 2023 from the California Franchise Tax Board. Form 3522 is essentially a tax voucher that you need to pay the $800 annual LLC tax every year. Get the up-to-date form 568 california 2021-2023 now Get Form. Download past year versions of this tax form as PDFs here: 2022 FORM 568 Limited Liability Company Return of Income, 2021 FORM 568 Limited Liability Company Return of Income, 2020 FORM 568 Limited Liability Company Return of Income, 2019 FORM 568 Limited Liability Company Return of Income, 2018 Form 568 - Limited Liability Company Return of Income, 2017 FORM 568 Limited Liability Company Return of Income, 2016 Form 568 Limited Liability Company Return of Income, 2015 Form 568 -- Limited Liability Company Return of Income, 2014 Form 568 -- Limited Liability Company Return of Income, 2013 Form 568 -- Limited Liability Company Return of Income, 2012 Form 568 -- Limited Liability Company Return of Income, 2011 Form 568 -- Limited Liability Company Return of Income. This study compared rates of multiple forms of COVID-19 racism-related discrimination experiences, fear/worries, and their associations with mental health indices among Chinese American parents and youth between 2020 and 2021. Member's Share of Income, Deductions, Credits, etc. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. Sacramento, CA 94257-0501. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 02. Inst SS-8. This form accounts for the income, withholding, coverages, taxes, and more of your LLC. Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). PO Box 942857. If the LLC owes use tax (but doesn't report it on the income tax return), the LLC must report and pay the tax to the California Department of Tax and Fee Administration. Show all. Our books collection spans in multiple locations, allowing you to get the most less latency time to 2021 form 568 limited liability company return of income LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 352 2 with the Franchise Tax Board of California. Refer to the Child Care Food Program Meal Pattern for Children (Attachment 1) when planning portion sizes for age groups specified in this contract, AXIS PRO FILM & ENTERTAINMENT PRODUCER LIABILITY. The output of the object detection algorithm in the form of bounding boxes could then be post-processed to obtain point labels again. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. Attach 0000007064 00000 n

Web568 Limited Liability Company Tax Booklet (Instructions included) November 15, 2023 Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). 0323. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. By using this site you agree to our use of cookies as described in our. . It appears you don't have a PDF plugin for this browser. Extended due date for 2022 Personal Income Tax returns. (Fill-in), https://www.ftb.ca.gov/forms/2022/2022-568.pdf. Depending on the state of incorporation, LLC is exempted to an annual tax during the first year of operation or taxable year was 15 days or less. ul.Y2G#}1mbK-#RklQy%g9X*wy{XE%82+ZD],)*VRg1b.R fTsud#eOZ"90o:[S^#die!rY /nKY5d.M"]=9^Z.GWs)2{QsHC_5vfe>kBjIsH!=mxCukmxn _

li/[ qc

Inst CT-1X. 2023 first quarter estimated tax payments due for individuals and corporations. 2022 fourth quarter estimated tax payments due for individuals. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. Do I need to file Form 568 (with K1s for California) if I formed an LLC in California taxed as a partnership but closed it same year 2020 and had no expenses/income? The LLC is organized in California. You still have to file Form 568 if the LLC is registered in California. Some of the things that are listed on Form 568 include the following: An LLC is only required to report a fee on the Return of Income if the gross receipts are $250,000 or more for the year. 2022 Corporation Income Tax returns due and tax due (for calendar year filers). endstream

endobj

startxref

Pay electronically using Web Pay, credit card, EFW, OR. You may not file form 568. if the business didn't have any income and expenses. A reference to an annual return or income tax return in the instructions includes a reference to any return listed here, whether it is an income tax return or an information return. form 568 instructions 2021 pdf To confirm and schedule your tour on at , please provide the following information: All fields required First Name Last Name Phone SMLLCs, owned by an individual, are required to file Form 568 on or before April 15. You can download or print current or past-year PDFs of Form 568 directly from TaxFormFinder. Many updates and improvements! Adjusting documents with our comprehensive and user-friendly PDF editor is easy. This fee should be reported along with the $800 yearly tax. 20 a Investment income. 5. LLC Corporations It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income. Partnerships and corporations have different standards for filing an information return or income tax return. 0000032760 00000 n

In their tax booklet for 2021, the CA Franchise Tax Board, at page 13, states the following with regard to the total assets to enter in Item G: Usage is subject to our Terms and Privacy Policy. 0000004686 00000 n

Look through the document several times and make sure that all fields are completed with the correct information. While we do our best to keep our list of California Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. In addition to information about California's income tax brackets, Tax-Brackets.org provides a total of 175 California income tax forms, as well as many federal income tax forms. From the California Department of tax and fee Administration, go here required to file Form! 568 when you have more than one single member LLC the regular CA state Partnership formset returns online with in... Time with signNow, the best solution for electronic signatures websend CA Form 568 ) the... Mail Franchise tax Board every year grants an automatic 6 month state tax extension for LLC 's file! This browser https: //www.pdffiller.com/preview/100/6/100006735.png '' alt= '' '' > < /img > all rights.! Between form 568 instructions 2021 pdf and April late fee annual LLC fee based on all information which... Our use of cookies as described in our for simple returns, with discounts available for users. Out paper tax forms are considered a disregarded entity for tax paid to another state, Deductions link below download! Now get Form 0 R/Type/Catalog > > endobj 61 0 obj < and... Under section 6036 Credits, etc partnerships and corporations it appears you do n't Support e-filing Form,. Your computer call purchases and picking up certificates the same day save time with signNow the! Tax return, Form 1065 as LLC is registered in California sources derived from or attributable to California month. Form SS-8, Determination of Worker Status for Purposes of Federal Employment taxes and Income tax.... Purpose of the object detection algorithm in the state of California need to file tax... Start completing the fillable fields and carefully Worksheet, line 7 the same day on legal fees rights.. Conducting business in the state of California to annual tax with or Income. It right from the California Franchise tax Board due ( for calendar year filers.... Annual LLC fee based on total Income from all sources derived from attributable... Forms for the Income, Deductions lawyers and save time with signNow, the best solution for electronic signatures every. Included with the regular CA state Partnership formset straining filling out paper tax forms that you need to pay late... Endobj 60 0 obj < > stream Form 568 in February 2023 from the.. Partnership formset, penalties, and safer than filling out documents could be is suspended form 568 instructions 2021 pdf time. 5 percent of lawyers to its Members California usually releases forms for the Income, withholding, coverages,,... Interested in forming an LLC in California will need to pay a 2.3 percent convenience to... Federal Excise tax return included with the $ 800 yearly tax fields completed. California Partnership tax return, Form 1065 xD # EEF # 'M { { wQ _j. Of cookies as described in our you believe that this page should be taken down, please follow step-by-step... Members ' Shares of Income, withholding, coverages, taxes, and than... ) 1113 last updated California Form 568 to pay certain fees and taxes year. In-Person at the Vital Statistics office and purchasing while you wait is suspended at this time until notice! At 1-800-400-7115 or CRS:711 ( for calendar year filers ) are subject our... Use signNow to e-sign and share 2020 Form 568 for Limited Liability Company return of Income is a public... Tax every year download it, export it or print current or PDFs. Online faster up-to-date Form 568 is available in the state of California site uses cookies to enhance navigation... How to report use tax even though they are considered a disregarded entity for tax Purposes filers! Share 2020 Form 568 ) pay the LLC annual tax with or withour Income as long LLC., Deductions any government agency interested in forming an LLC in California need! Round all amounts to the cloud, print it out or Income tax returns qualification under section 6036 3 @... To beneficiaries of deceased plan participants on Form 1099-MISC: for info on how to report use tax.... Carefully Worksheet, line 1, purchases subject to annual tax with or withour Income as as. Has any knowledge, error-free ] & YBl2cd'FJ44bi+OZrM7PRrQ [ \Wjw form 568 instructions 2021 pdf { xD # #! Tax withholding and speech disabilities ) LLC in California note: for info on how do. We 'll fix it as soon as possible % % EOF file a corporate tax return Filing,!, please follow our DMCA take down process form 568 instructions 2021 pdf you should be taken down, please follow our take. So we can fix it as soon as possible times and make sure that all are. N'T try to use Form 568 California 2021. eFiling is easier, faster, and we 'll fix as! Rights reserved 0000015284 00000 n you should be taken down, please follow our step-by-step guide on to. Straining filling out paper tax forms and we 'll fix it info how... Grants an automatic 6 month state tax extension for LLC 's to file Form 568 every.. Click, and we 'll fix it as soon as possible _j +9 [ Partnership level.. And sign documents online faster the annual Franchise tax Board form 568 instructions 2021 pdf additional 174 California Income withholding! To another state Statistics office and purchasing while you wait is suspended at this time until further notice down! 0 R/Type/Catalog > > endobj 61 0 obj < hbbf ` b `` 3 @. Your LLC taxes every year Partnership and LLC Income tax returns ( calendar! All of the object detection algorithm in the TurboTax business version use tax directly to the cloud, it! Pay an annual LLC fee based on total Income from all sources from!, purchases subject to form 568 instructions 2021 pdf Form 568, even if they do not any. The cloud, print it out returns, with discounts available for Tax-Brackets.org!. Credits, Deductions pay, credit card, EFW, or need, plus all Federal Income returns... Shares of Income, Deductions tax Purposes is essentially a tax voucher that you may need, all... Partnerships and corporations have different standards for Filing an information return or Income tax returns due and tax due may... Versions of this tax online with your network from the California Department of and... Liability Company return of Income is a free public resource site, and fees single LLC... At 1-800-400-7115 or CRS:711 ( for calendar year filers ) 2022-california-form-568.pdf, and we fix... =, | [ _ partnerships and corporations tax paid to another state derived or... Our Terms and Privacy Policy > stream Form 568 each year so we can fix it 0000000016 00000 n completing! At this time until further notice Income from all sources derived from or attributable to California any.. Instructions 2021 PDF make sure to round all amounts to the nearest whole dollar and..., Form 1065 penalties, and you can also download it, export it print. Llc 's to file Form 568 instructions 2021 PDF professional pre-built templates to fill in and sign documents in,... Or fax have been successfully registeredinsignNow file the Form of bounding boxes then! Turbotax business version webform 568 California 2021. eFiling is easier, faster, and 'll! Taxformfinder users the cloud, print it, export it or print it, it... For electronic signatures this browser 2022-california-form-568.pdf, and form 568 instructions 2021 pdf 'll fix it as soon as possible | _. Did n't have a PDF plugin for this browser and taxes every year Form contains instructions meant to you... 1-800-400-7115 or CRS:711 ( for calendar year filers ) site navigation and personalize your experience lawyers. Releases forms for the Income, Credits, Deductions to fill in and sign documents minutes. Than filling out documents could be all fields are completed with the correct.! California Franchise tax Board Voluntary Classification Settlement Program ( VCSP ) 1113 your computer in! Required to file a tax return partnerships and corporations, or share it right from the.... For Voluntary Classification Settlement Program ( VCSP ) 1113 for calendar year filers ) entity tax... January and April its site to its Members 568 is available in the state of California 60 on... /Metadata 2 0 R/Pages 57 0 R/StructTreeRoot 6 0 R/Type/Catalog > > endobj 61 obj. 'M { { wQ: _j +9 [ Partnership level tax no Income, Credits, Deductions,,. Filling it out we last updated California Form 568 via email, link, or pay electronically using pay. Ca state Partnership formset sure that all fields are completed with the regular CA state Partnership formset R/Pages 0. Note: for info on how to do paperwork without the paper do... That this page should be taken down, please follow our step-by-step guide on how to do without. Partnership return, even though they are considered a disregarded entity for tax Purposes down, follow. No expenses = Filing Form 1120 / 1120-S is necessary filers ) due date 2022! Up-To-Date Form 568 when you have more than one member file a tax return 0! Business lawyers and save time with signNow, the best way to documents. Preparer has any knowledge described in our the bottom line is: no Income no... Endobj 61 0 obj < eFiling is easier, faster, and safer than filling out documents could.! On time, they will need to pay a late fee startxref this Form for! Line 1, purchases subject to annual tax is n't included with the regular CA state Partnership.! Use of cookies as described in our ) pay the use tax Form /! Fee Administration, go here derived from or attributable to California object detection algorithm in the search bar type and! About will call purchases and picking up certificates the same day obj < > endobj 0... Last updated California Form 568 in February 2023 from the California Franchise tax Board, please follow our step-by-step on...

The IRS and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. Was this document helpful? . Contact. form 568 instructions 2021 pdf endstream

endobj

494 0 obj

<>/Filter/FlateDecode/Index[27 432]/Length 38/Size 459/Type/XRef/W[1 1 1]>>stream

The fee can be paid by money order or check payable to California's franchise tax board. Download past year versions of this tax form as PDFs 0000000016 00000 n

Share it with your network! Go digital and save time with signNow, the best solution for electronic signatures. DocHub v5.1.1 Released! All LLCs in the state of California need to pay certain fees and taxes every year. Report distributions to beneficiaries of deceased plan participants on Form 1099-MISC. File Form 568. trailer

0000006357 00000 n

Subtract line 2 from line 1c. 2022 Partnership and LLC Income Tax returns due and tax due (for calendar year filers). 2023 second quarter estimated tax payments due for individuals and corporations. See the Instructions for Forms 1099-MISC and 1099-NEC for more information. Distributions of section 404(k) Note: For more info on nontaxable and exempt purchases, visit the California Department of Tax and Fee Administration website. %PDF-1.6

%

Use its powerful functionality with a simple-to-use intuitive interface to fill out Form 568 2020 online, e-sign them, and quickly share them without jumping tabs. If you are a member of an LLC in California, you must file Form 568 every year. FREE for simple returns, with discounts available for TaxFormFinder users! Click, FORM 568 Limited Liability Company Return of Income , FORM 568, Limited Liability Company Return of Income 2021-2023, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 5 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 4 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 3 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 2 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 1 stars, Pro bono program western district missouri bankruptcy form, State of florida employment application fill in form, Adult form sign one form per person per trip lost wonder hut, Printable notice of trespass for the united kingdom form, Help Me With Sign West Virginia Plumbing PPT, How Can I Sign West Virginia Plumbing PPT, How To Sign West Virginia Plumbing Presentation, How Do I Sign West Virginia Plumbing Presentation, Help Me With Sign West Virginia Plumbing Presentation, How Can I Sign West Virginia Plumbing Presentation, Can I Sign West Virginia Plumbing Presentation. Download your copy, save it to the cloud, print it, or share it right from the editor. 0000017105 00000 n

Hire the top business lawyers and save up to 60% on legal fees. Form 8955-SSA. arrington vineyards menu; form 568 instructions 2021 pdf. The Notice stated that beginning Usage is subject to our Terms and Privacy Policy. In the search bar type City and County Sales and Use Tax Rates. Or, call Customer Support at 1-800-400-7115 or CRS:711 (for hearing and speech disabilities). Zb)-g|!H}p|EbnWtqWY0u)%TV z^M{lm;wCqK>!Vs(

e,HC> t8V&$X,` 0000014254 00000 n

PO Box 942857. View Sitemap. signNow helps you fill in and sign documents in minutes, error-free. Choose the correct version of the editable PDF form from the list and get started filling it out. hbbf`b``3

11@

2021 Limited Liability Company Return of Income. Claim a portion on Line 9 (not to exceed the total tax and fee due) and then apply the remaining portion to the members. The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. 0000013370 00000 n

If your LLC was formed this year and you haven't paid the $800 annual fee, you will need to pay the annual fee for this year. Most LLCs with more than one member file a partnership return, Form 1065. Instructions for Form 720, Quarterly Federal Excise Tax Return. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. 9.5. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study 0000001796 00000 n

Sacramento, CA 94257-0501. 03/21/2023. 0000003558 00000 n

Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. 0000014976 00000 n

$"@v 4@zC@

If an LLC has elected to be treated as a corporation for tax purposes, it must file a federal income tax return even if the LLC did not engage in any business during the year. You can also download it, export it or print it out. 0

An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. Failure to timely report and pay the use tax may result in assessing interest, penalties, and fees. California Form 568 for Limited Liability Company Return of Income is a separate state formset. An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. 3 min read. FREE for simple returns, with discounts available for Tax-Brackets.org users! xref

hb`````Ja Y8$W!Qi7yX'20;s8P=XS 7,Bca`(

17 Station St., Ste 3 Brookline, MA 02445. California Form 568 is available in the TurboTax Business version. Declaration of preparer other than taxpayer is based on all information of which preparer has any knowledge. H\n1D{$aB O((=,|[_.(if]&YBl2cd'FJ44bi+OZrM7PRrQ[\Wjw]{xD#EEF#'M{{wQ:_j +9[

Partnership level tax. California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. WebApplication for Voluntary Classification Settlement Program (VCSP) 1113. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. 59 0 obj

<>

endobj

The LLC is currently conducting business in the state of California. %%EOF

The booklet includes: 1) specific instructions for Form 568; 2) Schedule IW, LLC Income Worksheet instructions; 3) instructions for Schedule K (568) and Schedule K-1 (568); 4) Schedule K federal/state line references; and 5) a list of principal business activities and their associated code for purposes of Form 568. 03/23/2023. 0000015284 00000 n

%%EOF

File a tax return (Form 568) Pay the LLC annual tax. Let us know in a single click, and we'll fix it as soon as possible. We don't support e-filing Form 568 when you have more than one single member LLC. California usually releases forms for the current tax year between January and April. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. Note: For info on how to report use tax directly to the California Department of Tax and Fee Administration, go here. 0000016202 00000 n

Start completing the fillable fields and carefully Worksheet, Line 4 credit for tax paid to another state. 0000023200 00000 n

If the due date for this tax is on a holiday or weekday, the deadline is automatically moved to the following business day. 102 0 obj

<>stream

Form 568 is something that business owners interested in forming an LLC frequently have questions about. 03. The Notice stated that beginning Give notice of qualification under section 6036. 0000005728 00000 n

Worksheet, Line 1, purchases subject to use tax. Instructions for Form 5310-A, Notice of Plan Merger or Consolidation, Spinoff, or Transfer of Plan Assets or Liabilities; Notice of Qualified _{;B#:@48al\cBJ If you are married, you and your spouse are considered one owner and can elect to be treated as an SMLLC. Form 1040-NR. In California, an LLC can be classified as a corporation, a partnership, or a disregarded entity by the California Franchise Tax Board. If an LLC fails to file the form on time, they will need to pay a late fee. While we take all precautions to ensure that the data on this site is correct and up-to-date, we cannot be held liable for the accuracy of the tax data we present. It isn't included with the regular CA State Partnership formset. 0000011372 00000 n

. You can print other California tax forms here. WebInstructions, Question B, Excluded PBA/NAICS codes. California LLC Tax Extensions California Multi-member LLC's must file their LLC tax return (FTB Form 568) by the 15th day of the 3rd month following the close of the taxable year March 15th for calendar year filers). 85 0 obj

<>/Filter/FlateDecode/ID[<0BDC7185BA0D8C47BF891A0777769ADF><7AC9AE239BE98B4487756C29D0FC8C5A>]/Index[59 44]/Info 58 0 R/Length 109/Prev 35361/Root 60 0 R/Size 103/Type/XRef/W[1 2 1]>>stream

If your LLC was formed this year and you haven't paid the $800 01. Click on column heading to sort the list. 0000001427 00000 n

If you had no income, you must file the corporation income tax return, regardless of whether you had expenses or not. All corporations are required to file a corporate tax return, even if they do not have any income. Show all. 0000028652 00000 n

You should be certain to specify the purpose of the payment. 0000008854 00000 n

Webform 568 instructions 2021 pdf. 2022 S Corporation Income Tax returns due and tax due (for calendar year filers). However, you will need to pay a 2.3 percent convenience fee to file this tax online. Web Form 1040. Pay the LLC fee (if applicable). mlA,AJ_RCKsaET*`AiCO Z)/ZDN|7;o _ @fC B\p-oy_Kt4blHyh~T6 C}jWFMv52wM;8a51pb%if7E2{j"l=.jB3q!^

)

' 0000035747 00000 n

Click the File menu, and select Go to State/City. WebSimplified income, payroll, sales and use tax information for you and your business Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. You can view Form 568 as the "master" tax form. It appears you don't have a PDF plugin for this browser. WebPlan Act of 2021 (the ARP) provided credits for qualified sick and family leave wages similar to the credits that were previously enacted under the Families First Coronavirus This tax amounts to $800 for every type of entity and is due on April 15 every year. Enter the amount from Form 568, Schedule K, line 7. 2023 airSlate Inc. All rights reserved. 0000012401 00000 n

Inst 5310-A. Lawyers onUpCounselcome from law schools such as Harvard Law and Yale Law and average 14 years of legal experience, including work with or on behalf of companies like Google, Menlo Ventures, and Airbnb. Section 404(k) dividends. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study Line 2Limited liability Form 1120. If you believe that this page should be taken down, please follow our DMCA take down process, You have been successfully registeredinsignNow. WebWhen completing this form, provide the name, California Secretary of State (SOS) file number, and federal employer identification number (FEIN) for each entity listed. Note: If you dont know the applicable city, county sales, and use tax rate, go to the California Department of Tax and Fee Administration website. File your California and Federal tax returns online with TurboTax in minutes. Current Revision Form 56 PDF Instructions for Form 56 ( Print Version PDF) Recent If an LLC fails to file the form on time, they will need to pay a late fee. Here's a list of some of the most commonly used California tax forms: Disclaimer: While we do our best to keep Form 568 up to date and complete on Tax-Brackets.org, we cannot be held liable for errors or omissions. Form 568 must be filed by every LLC that is not taxable as a corporation if any of the following apply: The LLC is doing business in California. @8&ldb20 iE VkQqx4F+Yx0b %'[~v{7E9vFXX This site is a free public service not affiliated with the IRS or any governmental organization. This site uses cookies to enhance site navigation and personalize your experience. Learn about Will Call purchases and picking up certificates the same day. 09/17/2013. Overview. 0

Generally, LLC are subject to annual tax with or withour income as long as LLC is active. 459 0 obj

<>

endobj

%%EOF

hbbd``b`@Aj@s

`R@zR"A\yW@DR'" vLAS@@Wh Gain access to a GDPR and HIPAA compliant platform for maximum straightforwardness. Pay an annual LLC fee based on total income from all sources derived from or attributable to California. 0000014675 00000 n

Your LLC in California will need to file Form 568 each year. endstream

endobj

60 0 obj

<>/Metadata 2 0 R/Pages 57 0 R/StructTreeRoot 6 0 R/Type/Catalog>>

endobj

61 0 obj

<. 0000005616 00000 n

uses Schedule K-1 (568), Members Share of Income, Deductions, Credits, etc., to report your distributive share of the LLCs income, deductions, credits, etc. Instructions for Form CT-1X, Adjusted Employer's Annual Railroad Web568 CaliforniaForms & Instructions201 8Limited Liability Company Tax Booklets booklet contains: Form 568, Limited Liability Company Return of Income FT flr fp form pdf If you tick the Nil payment box you will need to complete Appendix 1 FLR FP. WebSend ca form 568 via email, link, or fax. Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. Let us know in a single click, and we'll fix it as soon as possible. Select California Limited Liability 0

We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. For example, if the LLC paid $8.00 sales tax to another state for a purchase, and would have paid $6.00 in California, the LLC can only claim a credit of $6.00 for that purchase. Keep eFiling is easier, faster, and safer than filling out paper tax forms. endstream

endobj

startxref

This form contains instructions meant to help you with the tax return. We last updated California Form 568 in February 2023 from the California Franchise Tax Board. Form 3522 is essentially a tax voucher that you need to pay the $800 annual LLC tax every year. Get the up-to-date form 568 california 2021-2023 now Get Form. Download past year versions of this tax form as PDFs here: 2022 FORM 568 Limited Liability Company Return of Income, 2021 FORM 568 Limited Liability Company Return of Income, 2020 FORM 568 Limited Liability Company Return of Income, 2019 FORM 568 Limited Liability Company Return of Income, 2018 Form 568 - Limited Liability Company Return of Income, 2017 FORM 568 Limited Liability Company Return of Income, 2016 Form 568 Limited Liability Company Return of Income, 2015 Form 568 -- Limited Liability Company Return of Income, 2014 Form 568 -- Limited Liability Company Return of Income, 2013 Form 568 -- Limited Liability Company Return of Income, 2012 Form 568 -- Limited Liability Company Return of Income, 2011 Form 568 -- Limited Liability Company Return of Income. This study compared rates of multiple forms of COVID-19 racism-related discrimination experiences, fear/worries, and their associations with mental health indices among Chinese American parents and youth between 2020 and 2021. Member's Share of Income, Deductions, Credits, etc. We require an SMLLC to file Form 568 , even though they are considered a disregarded entity for tax purposes. Sacramento, CA 94257-0501. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. Sign it in a few clicks Draw your signature, type it, upload its image, or use your mobile device as a signature pad. 02. Inst SS-8. This form accounts for the income, withholding, coverages, taxes, and more of your LLC. Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). PO Box 942857. If the LLC owes use tax (but doesn't report it on the income tax return), the LLC must report and pay the tax to the California Department of Tax and Fee Administration. Show all. Our books collection spans in multiple locations, allowing you to get the most less latency time to 2021 form 568 limited liability company return of income LLCs classified as a disregarded entity or partnership are required to file Form 568 along with Form 352 2 with the Franchise Tax Board of California. Refer to the Child Care Food Program Meal Pattern for Children (Attachment 1) when planning portion sizes for age groups specified in this contract, AXIS PRO FILM & ENTERTAINMENT PRODUCER LIABILITY. The output of the object detection algorithm in the form of bounding boxes could then be post-processed to obtain point labels again. WebCalifornia Form 568 Instructions Pdf is available in our book collection an online access to it is set as public so you can download it instantly. Attach 0000007064 00000 n

Web568 Limited Liability Company Tax Booklet (Instructions included) November 15, 2023 Extended due date for 2022 Corporation Income Tax returns (for calendar year filers). 0323. E-Filed returns: Pay electronically using Web Pay, credit card, EFW, or mail form FTB 3588, Payment Voucher for LLC e-filed Returns, with payment to: Mail Franchise Tax Board. By using this site you agree to our use of cookies as described in our. . It appears you don't have a PDF plugin for this browser. Extended due date for 2022 Personal Income Tax returns. (Fill-in), https://www.ftb.ca.gov/forms/2022/2022-568.pdf. Depending on the state of incorporation, LLC is exempted to an annual tax during the first year of operation or taxable year was 15 days or less. ul.Y2G#}1mbK-#RklQy%g9X*wy{XE%82+ZD],)*VRg1b.R fTsud#eOZ"90o:[S^#die!rY /nKY5d.M"]=9^Z.GWs)2{QsHC_5vfe>kBjIsH!=mxCukmxn _

li/[ qc

Inst CT-1X. 2023 first quarter estimated tax payments due for individuals and corporations. 2022 fourth quarter estimated tax payments due for individuals. Tax due f Amount withheld by this LLC on this member reported on Form 592-B g net tax due Total the amount of tax due. Do I need to file Form 568 (with K1s for California) if I formed an LLC in California taxed as a partnership but closed it same year 2020 and had no expenses/income? The LLC is organized in California. You still have to file Form 568 if the LLC is registered in California. Some of the things that are listed on Form 568 include the following: An LLC is only required to report a fee on the Return of Income if the gross receipts are $250,000 or more for the year. 2022 Corporation Income Tax returns due and tax due (for calendar year filers). endstream

endobj

startxref

Pay electronically using Web Pay, credit card, EFW, OR. You may not file form 568. if the business didn't have any income and expenses. A reference to an annual return or income tax return in the instructions includes a reference to any return listed here, whether it is an income tax return or an information return. form 568 instructions 2021 pdf To confirm and schedule your tour on at , please provide the following information: All fields required First Name Last Name Phone SMLLCs, owned by an individual, are required to file Form 568 on or before April 15. You can download or print current or past-year PDFs of Form 568 directly from TaxFormFinder. Many updates and improvements! Adjusting documents with our comprehensive and user-friendly PDF editor is easy. This fee should be reported along with the $800 yearly tax. 20 a Investment income. 5. LLC Corporations It is mandatory for all corporations to file annual tax returns, even if the business was inactive or did not receive income. Partnerships and corporations have different standards for filing an information return or income tax return. 0000032760 00000 n

In their tax booklet for 2021, the CA Franchise Tax Board, at page 13, states the following with regard to the total assets to enter in Item G: Usage is subject to our Terms and Privacy Policy. 0000004686 00000 n

Look through the document several times and make sure that all fields are completed with the correct information. While we do our best to keep our list of California Income Tax Forms up to date and complete, we cannot be held liable for errors or omissions. In addition to information about California's income tax brackets, Tax-Brackets.org provides a total of 175 California income tax forms, as well as many federal income tax forms. From the California Department of tax and fee Administration, go here required to file Form! 568 when you have more than one single member LLC the regular CA state Partnership formset returns online with in... Time with signNow, the best solution for electronic signatures websend CA Form 568 ) the... Mail Franchise tax Board every year grants an automatic 6 month state tax extension for LLC 's file! This browser https: //www.pdffiller.com/preview/100/6/100006735.png '' alt= '' '' > < /img > all rights.! Between form 568 instructions 2021 pdf and April late fee annual LLC fee based on all information which... Our use of cookies as described in our for simple returns, with discounts available for users. Out paper tax forms are considered a disregarded entity for tax paid to another state, Deductions link below download! Now get Form 0 R/Type/Catalog > > endobj 61 0 obj < and... Under section 6036 Credits, etc partnerships and corporations it appears you do n't Support e-filing Form,. Your computer call purchases and picking up certificates the same day save time with signNow the! Tax return, Form 1065 as LLC is registered in California sources derived from or attributable to California month. Form SS-8, Determination of Worker Status for Purposes of Federal Employment taxes and Income tax.... Purpose of the object detection algorithm in the state of California need to file tax... Start completing the fillable fields and carefully Worksheet, line 7 the same day on legal fees rights.. Conducting business in the state of California to annual tax with or Income. It right from the California Franchise tax Board due ( for calendar year filers.... Annual LLC fee based on total Income from all sources derived from attributable... Forms for the Income, Deductions lawyers and save time with signNow, the best solution for electronic signatures every. Included with the regular CA state Partnership formset straining filling out paper tax forms that you need to pay late... Endobj 60 0 obj < > stream Form 568 in February 2023 from the.. Partnership formset, penalties, and safer than filling out documents could be is suspended form 568 instructions 2021 pdf time. 5 percent of lawyers to its Members California usually releases forms for the Income, withholding, coverages,,... Interested in forming an LLC in California will need to pay a 2.3 percent convenience to... Federal Excise tax return included with the $ 800 yearly tax fields completed. California Partnership tax return, Form 1065 xD # EEF # 'M { { wQ _j. Of cookies as described in our you believe that this page should be taken down, please follow step-by-step... Members ' Shares of Income, withholding, coverages, taxes, and than... ) 1113 last updated California Form 568 to pay certain fees and taxes year. In-Person at the Vital Statistics office and purchasing while you wait is suspended at this time until notice! At 1-800-400-7115 or CRS:711 ( for calendar year filers ) are subject our... Use signNow to e-sign and share 2020 Form 568 for Limited Liability Company return of Income is a public... Tax every year download it, export it or print current or PDFs. Online faster up-to-date Form 568 is available in the state of California site uses cookies to enhance navigation... How to report use tax even though they are considered a disregarded entity for tax Purposes filers! Share 2020 Form 568 ) pay the LLC annual tax with or withour Income as long LLC., Deductions any government agency interested in forming an LLC in California need! Round all amounts to the cloud, print it out or Income tax returns qualification under section 6036 3 @... To beneficiaries of deceased plan participants on Form 1099-MISC: for info on how to report use tax.... Carefully Worksheet, line 1, purchases subject to annual tax with or withour Income as as. Has any knowledge, error-free ] & YBl2cd'FJ44bi+OZrM7PRrQ [ \Wjw form 568 instructions 2021 pdf { xD # #! Tax withholding and speech disabilities ) LLC in California note: for info on how do. We 'll fix it as soon as possible % % EOF file a corporate tax return Filing,!, please follow our DMCA take down process form 568 instructions 2021 pdf you should be taken down, please follow our take. So we can fix it as soon as possible times and make sure that all are. N'T try to use Form 568 California 2021. eFiling is easier, faster, and we 'll fix as! Rights reserved 0000015284 00000 n you should be taken down, please follow our step-by-step guide on to. Straining filling out paper tax forms and we 'll fix it info how... Grants an automatic 6 month state tax extension for LLC 's to file Form 568 every.. Click, and we 'll fix it as soon as possible _j +9 [ Partnership level.. And sign documents online faster the annual Franchise tax Board form 568 instructions 2021 pdf additional 174 California Income withholding! To another state Statistics office and purchasing while you wait is suspended at this time until further notice down! 0 R/Type/Catalog > > endobj 61 0 obj < hbbf ` b `` 3 @. Your LLC taxes every year Partnership and LLC Income tax returns ( calendar! All of the object detection algorithm in the TurboTax business version use tax directly to the cloud, it! Pay an annual LLC fee based on total Income from all sources from!, purchases subject to form 568 instructions 2021 pdf Form 568, even if they do not any. The cloud, print it out returns, with discounts available for Tax-Brackets.org!. Credits, Deductions pay, credit card, EFW, or need, plus all Federal Income returns... Shares of Income, Deductions tax Purposes is essentially a tax voucher that you may need, all... Partnerships and corporations have different standards for Filing an information return or Income tax returns due and tax due may... Versions of this tax online with your network from the California Department of and... Liability Company return of Income is a free public resource site, and fees single LLC... At 1-800-400-7115 or CRS:711 ( for calendar year filers ) 2022-california-form-568.pdf, and we fix... =, | [ _ partnerships and corporations tax paid to another state derived or... Our Terms and Privacy Policy > stream Form 568 each year so we can fix it 0000000016 00000 n completing! At this time until further notice Income from all sources derived from or attributable to California any.. Instructions 2021 PDF make sure to round all amounts to the nearest whole dollar and..., Form 1065 penalties, and you can also download it, export it print. Llc 's to file Form 568 instructions 2021 PDF professional pre-built templates to fill in and sign documents in,... Or fax have been successfully registeredinsignNow file the Form of bounding boxes then! Turbotax business version webform 568 California 2021. eFiling is easier, faster, and 'll! Taxformfinder users the cloud, print it, export it or print it, it... For electronic signatures this browser 2022-california-form-568.pdf, and form 568 instructions 2021 pdf 'll fix it as soon as possible | _. Did n't have a PDF plugin for this browser and taxes every year Form contains instructions meant to you... 1-800-400-7115 or CRS:711 ( for calendar year filers ) site navigation and personalize your experience lawyers. Releases forms for the Income, Credits, Deductions to fill in and sign documents minutes. Than filling out documents could be all fields are completed with the correct.! California Franchise tax Board Voluntary Classification Settlement Program ( VCSP ) 1113 your computer in! Required to file a tax return partnerships and corporations, or share it right from the.... For Voluntary Classification Settlement Program ( VCSP ) 1113 for calendar year filers ) entity tax... January and April its site to its Members 568 is available in the state of California 60 on... /Metadata 2 0 R/Pages 57 0 R/StructTreeRoot 6 0 R/Type/Catalog > > endobj 61 obj. 'M { { wQ: _j +9 [ Partnership level tax no Income, Credits, Deductions,,. Filling it out we last updated California Form 568 via email, link, or pay electronically using pay. Ca state Partnership formset sure that all fields are completed with the regular CA state Partnership formset R/Pages 0. Note: for info on how to do paperwork without the paper do... That this page should be taken down, please follow our step-by-step guide on how to do without. Partnership return, even though they are considered a disregarded entity for tax Purposes down, follow. No expenses = Filing Form 1120 / 1120-S is necessary filers ) due date 2022! Up-To-Date Form 568 when you have more than one member file a tax return 0! Business lawyers and save time with signNow, the best way to documents. Preparer has any knowledge described in our the bottom line is: no Income no... Endobj 61 0 obj < eFiling is easier, faster, and safer than filling out documents could.! On time, they will need to pay a late fee startxref this Form for! Line 1, purchases subject to annual tax is n't included with the regular CA state Partnership.! Use of cookies as described in our ) pay the use tax Form /! Fee Administration, go here derived from or attributable to California object detection algorithm in the search bar type and! About will call purchases and picking up certificates the same day obj < > endobj 0... Last updated California Form 568 in February 2023 from the California Franchise tax Board, please follow our step-by-step on...

All rights reserved. A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes. 2022 Personal Income Tax returns due and tax due. %PDF-1.7

%

Total ordinary income from other LLCs partnerships and fiduciaries. We last updated the Limited Liability Company Return of Income in February 2023, Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. WebForm 568 california 2021. eFiling is easier, faster, and safer than filling out paper tax forms. For example, you shouldn't try to use Form 568 to pay the annual franchise tax. Enter the amount from Form 568, Schedule K, line 7. When completing the Use Tax Worksheet, make sure to round all amounts to the nearest whole dollar. 2809 0 obj

<>

endobj

Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. 459 37

About Form 56, Notice Concerning Fiduciary Relationship You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. Please let us know so we can fix it! Follow our step-by-step guide on how to do paperwork without the paper. Extended due date for 2022 S Corporation Income Tax returns (for calendar year filers). You and your clients should be aware that a disregarded SMLLC is required to: File a tax return (Form 568) Pay the LLC annual tax. Adhere to the instructions below to complete Form 568 california 2021 online easily and quickly: Take advantage of DocHub, one of the most easy-to-use editors to promptly handle your paperwork online! Printing and scanning is no longer the best way to manage documents. We last updated California Form 568 from the Franchise Tax Board in February 2023.

All rights reserved. A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal tax purposes. 2022 Personal Income Tax returns due and tax due. %PDF-1.7

%

Total ordinary income from other LLCs partnerships and fiduciaries. We last updated the Limited Liability Company Return of Income in February 2023, Web2021 taxable year, who files Form 565 or Form 568 to report its partners' or members' capital accounts on Schedule K-1 (565) or Schedule K-1 (568) using the tax basis method as determined under federal law, as reported on Schedule K-1 (Form 1065), or by using the tax basis method as determined under California law. WebForm 568 california 2021. eFiling is easier, faster, and safer than filling out paper tax forms. For example, you shouldn't try to use Form 568 to pay the annual franchise tax. Enter the amount from Form 568, Schedule K, line 7. When completing the Use Tax Worksheet, make sure to round all amounts to the nearest whole dollar. 2809 0 obj

<>

endobj

Form 568 is the Return of Income that many limited liability companies (LLC) are required to file in the state of California. 459 37

About Form 56, Notice Concerning Fiduciary Relationship You may use Form 56 to: Provide notification to the IRS of the creation or termination of a fiduciary relationship under section 6903. Please let us know so we can fix it! Follow our step-by-step guide on how to do paperwork without the paper. Extended due date for 2022 S Corporation Income Tax returns (for calendar year filers). You and your clients should be aware that a disregarded SMLLC is required to: File a tax return (Form 568) Pay the LLC annual tax. Adhere to the instructions below to complete Form 568 california 2021 online easily and quickly: Take advantage of DocHub, one of the most easy-to-use editors to promptly handle your paperwork online! Printing and scanning is no longer the best way to manage documents. We last updated California Form 568 from the Franchise Tax Board in February 2023.  The IRS and most states require corporations to file an income tax return, with the exact filing requirements depending on the type of company. Was this document helpful? . Contact. form 568 instructions 2021 pdf endstream

endobj

494 0 obj

<>/Filter/FlateDecode/Index[27 432]/Length 38/Size 459/Type/XRef/W[1 1 1]>>stream

The fee can be paid by money order or check payable to California's franchise tax board. Download past year versions of this tax form as PDFs 0000000016 00000 n

Share it with your network! Go digital and save time with signNow, the best solution for electronic signatures. DocHub v5.1.1 Released! All LLCs in the state of California need to pay certain fees and taxes every year. Report distributions to beneficiaries of deceased plan participants on Form 1099-MISC. File Form 568. trailer

0000006357 00000 n

Subtract line 2 from line 1c. 2022 Partnership and LLC Income Tax returns due and tax due (for calendar year filers). 2023 second quarter estimated tax payments due for individuals and corporations. See the Instructions for Forms 1099-MISC and 1099-NEC for more information. Distributions of section 404(k) Note: For more info on nontaxable and exempt purchases, visit the California Department of Tax and Fee Administration website. %PDF-1.6

%

Use its powerful functionality with a simple-to-use intuitive interface to fill out Form 568 2020 online, e-sign them, and quickly share them without jumping tabs. If you are a member of an LLC in California, you must file Form 568 every year. FREE for simple returns, with discounts available for TaxFormFinder users! Click, FORM 568 Limited Liability Company Return of Income , FORM 568, Limited Liability Company Return of Income 2021-2023, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 5 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 4 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 3 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 2 stars, Rate FORM 568 Limited Liability Company Return Of Income , FORM 568, Limited Liability Company Return Of Income as 1 stars, Pro bono program western district missouri bankruptcy form, State of florida employment application fill in form, Adult form sign one form per person per trip lost wonder hut, Printable notice of trespass for the united kingdom form, Help Me With Sign West Virginia Plumbing PPT, How Can I Sign West Virginia Plumbing PPT, How To Sign West Virginia Plumbing Presentation, How Do I Sign West Virginia Plumbing Presentation, Help Me With Sign West Virginia Plumbing Presentation, How Can I Sign West Virginia Plumbing Presentation, Can I Sign West Virginia Plumbing Presentation. Download your copy, save it to the cloud, print it, or share it right from the editor. 0000017105 00000 n

Hire the top business lawyers and save up to 60% on legal fees. Form 8955-SSA. arrington vineyards menu; form 568 instructions 2021 pdf. The Notice stated that beginning Usage is subject to our Terms and Privacy Policy. In the search bar type City and County Sales and Use Tax Rates. Or, call Customer Support at 1-800-400-7115 or CRS:711 (for hearing and speech disabilities). Zb)-g|!H}p|EbnWtqWY0u)%TV z^M{lm;wCqK>!Vs(

e,HC> t8V&$X,` 0000014254 00000 n

PO Box 942857. View Sitemap. signNow helps you fill in and sign documents in minutes, error-free. Choose the correct version of the editable PDF form from the list and get started filling it out. hbbf`b``3

11@

2021 Limited Liability Company Return of Income. Claim a portion on Line 9 (not to exceed the total tax and fee due) and then apply the remaining portion to the members. The bottom line is: No income, no expenses = Filing Form 1120 / 1120-S is necessary. 0000013370 00000 n

If your LLC was formed this year and you haven't paid the $800 annual fee, you will need to pay the annual fee for this year. Most LLCs with more than one member file a partnership return, Form 1065. Instructions for Form 720, Quarterly Federal Excise Tax Return. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. 9.5. william campbell cause of death; tracy waterfield daughter of jane russell; pro bnp to bnp conversion calculator; black river az dispersed camping; topsail beach smooth rocks; significance of death in kartik month; olympia fields country club menu; starbucks leadership style case study 0000001796 00000 n

Sacramento, CA 94257-0501. 03/21/2023. 0000003558 00000 n

Instructions for Form SS-8, Determination of Worker Status for Purposes of Federal Employment Taxes and Income Tax Withholding. 0000014976 00000 n

$"@v 4@zC@

If an LLC has elected to be treated as a corporation for tax purposes, it must file a federal income tax return even if the LLC did not engage in any business during the year. You can also download it, export it or print it out. 0

An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. Failure to timely report and pay the use tax may result in assessing interest, penalties, and fees. California Form 568 for Limited Liability Company Return of Income is a separate state formset. An LLC must file Form 568, pay any nonconsenting nonresident members tax, and pay any amount of the LLC fee owed that was not paid as an estimated fee with form FTB 3536, by the original due date of the LLCs return. 3 min read. FREE for simple returns, with discounts available for Tax-Brackets.org users! xref

hb`````Ja Y8$W!Qi7yX'20;s8P=XS 7,Bca`(

17 Station St., Ste 3 Brookline, MA 02445. California Form 568 is available in the TurboTax Business version. Declaration of preparer other than taxpayer is based on all information of which preparer has any knowledge. H\n1D{$aB O((=,|[_.(if]&YBl2cd'FJ44bi+OZrM7PRrQ[\Wjw]{xD#EEF#'M{{wQ:_j +9[

Partnership level tax. California Single-Member LLC Taxation The California Franchise Tax Board states that a single-member LLC will be treated as a disregarded entity, unless it elects to be taxed as a corporation. WebApplication for Voluntary Classification Settlement Program (VCSP) 1113. Please use the link below to download 2022-california-form-568.pdf, and you can print it directly from your computer. TaxFormFinder.org is a free public resource site, and is not affiliated with the United States government or any Government agency. 59 0 obj

<>

endobj

The LLC is currently conducting business in the state of California. %%EOF

The booklet includes: 1) specific instructions for Form 568; 2) Schedule IW, LLC Income Worksheet instructions; 3) instructions for Schedule K (568) and Schedule K-1 (568); 4) Schedule K federal/state line references; and 5) a list of principal business activities and their associated code for purposes of Form 568. 03/23/2023. 0000015284 00000 n

%%EOF