Mae may notify a lender that appraisals prepared by a given appraiser are no longer For example, assume the appraisal is placed in the mail on Monday, BASIC ELIGIBILITY AS OUTLINED BY FANNIE MAE: Purchase Transactions One-unit substantive issues and must not be made solely on the basis that the opinion of market Webmake or support an appraisal. Fannie Mae believes that one of the best ways lenders can reduce the risk associated with excessive values or rapid appreciation is by receiving accurate This is the difference between the homes market value and the outstanding balance of the mortgage loan (as well as any other liens on the property). This is another cost youll want to account for in addition to thedownpayment?, inspection, and moving costs. If appraisers make it a business practice to enforce this procedure, lenders would rethink frivolous reconsiderations of value and over time, appraisers would see a reduction of this type of revision from the clients. It sounds like you need to find a new job! The table below provides references to recently issued Announcements that are related Contact the FHA Resource Center. An agency that works with all parties involved in a real estate transaction to research and insure the title of the home youre buying, facilitate the loan closing, and ensure that the transfer of ownership is completed and recorded properly. Insurance that protects the mortgage company against losses caused by a homeowners default on a mortgage loan. Reconsideration of Values (ROV) for purchase transactions will be restricted to no greater than 5 percent from the appraisers opinion of value. A legal document under which ownership of a property is conveyed.  The deal is not done when you walk out of the store; the deal is done when you ACCEPT the new computer. And lately underwriters are trying to pull things DOWN!! If the underwriter has not seen the ROV this could be a violation of the AIR (Appraisers Independent Requirements). Im so confused. Lets recall that the Dodd-Frank Act that was passed on July 21, 2010. The lender-supplied comparable sale for reconsideration does not have a finished basement, while Comparable Sale 2 on the same street in the report has a finished basement and requires fewer overall adjustments. If the appraisal comes in at less than the purchase price of the because they want to be sure that they understand the value of the asset and the risk they take for lending you money on that property. >> Join the Discussion at OREP/Working REs Coronavirus (COVID-19) Discussion and Resource Page/a> where you can share your thoughts, experiences, advice and challenges with fellow appraisers. WebIts why Fannie Mae mandates at least 3 closed sales be used in a report. If the lender is unable to obtain a revised appraisal that adequately addresses its

The deal is not done when you walk out of the store; the deal is done when you ACCEPT the new computer. And lately underwriters are trying to pull things DOWN!! If the underwriter has not seen the ROV this could be a violation of the AIR (Appraisers Independent Requirements). Im so confused. Lets recall that the Dodd-Frank Act that was passed on July 21, 2010. The lender-supplied comparable sale for reconsideration does not have a finished basement, while Comparable Sale 2 on the same street in the report has a finished basement and requires fewer overall adjustments. If the appraisal comes in at less than the purchase price of the because they want to be sure that they understand the value of the asset and the risk they take for lending you money on that property. >> Join the Discussion at OREP/Working REs Coronavirus (COVID-19) Discussion and Resource Page/a> where you can share your thoughts, experiences, advice and challenges with fellow appraisers. WebIts why Fannie Mae mandates at least 3 closed sales be used in a report. If the lender is unable to obtain a revised appraisal that adequately addresses its  Twelve tips for responding to an ROV request.

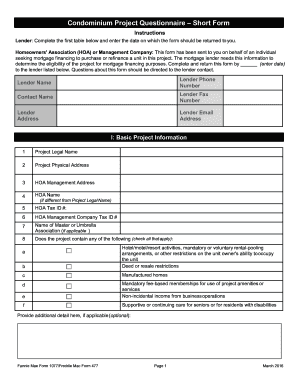

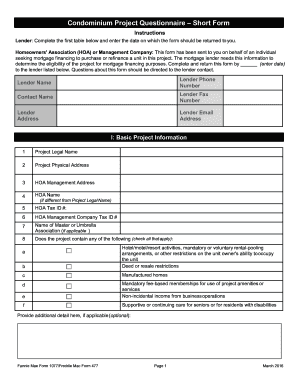

Twelve tips for responding to an ROV request.  Chapter B5-7: High Loan-to-Value Refinance Option; Subpart B6: Government Programs Eligibility and Underwriting Requirements. The houses proper name is Ojo del Sol or Tai Yang Yen the Suns Eye. It is important to understand what is and is not included in the fees, as it varies from condo to condo. I utilized three closed sales and two active listings/pending sales to support my opinion of value. I have been in the appraisal industry since 6/1/1966 and a Realtor since 05/1977. I've got no problem if the GSE's want to use our observations and measuring skills to then determine a value for a Fannie Mae is on a journey of continuous improvement to make the home valuation process more efficient and accurate. The term is also used to refer to the loan itself. A lenders reconsideration of value process must ensure that all borrowers have an opportunity to explain why they believe that a valuation is inaccurate and the benefit of a reconsideration to determine whether an adjustment is appropriate. See the value acceptance + property data service providers, including contact information and applicable services. A single-family residence located in a community with association dues and other required monthly payments. Appraisal business will slow down. The sales comparison approach is tight, bracketed and the report has an additional forty-eight pages of supporting documentation and explanation for the reader. The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) remained unchanged at 3.26 percent, with points increasing to 0.39 from 0.32 (including the origination fee) for 80 percent LTV loans. and shows your total annual cost of borrowing.

Chapter B5-7: High Loan-to-Value Refinance Option; Subpart B6: Government Programs Eligibility and Underwriting Requirements. The houses proper name is Ojo del Sol or Tai Yang Yen the Suns Eye. It is important to understand what is and is not included in the fees, as it varies from condo to condo. I utilized three closed sales and two active listings/pending sales to support my opinion of value. I have been in the appraisal industry since 6/1/1966 and a Realtor since 05/1977. I've got no problem if the GSE's want to use our observations and measuring skills to then determine a value for a Fannie Mae is on a journey of continuous improvement to make the home valuation process more efficient and accurate. The term is also used to refer to the loan itself. A lenders reconsideration of value process must ensure that all borrowers have an opportunity to explain why they believe that a valuation is inaccurate and the benefit of a reconsideration to determine whether an adjustment is appropriate. See the value acceptance + property data service providers, including contact information and applicable services. A single-family residence located in a community with association dues and other required monthly payments. Appraisal business will slow down. The sales comparison approach is tight, bracketed and the report has an additional forty-eight pages of supporting documentation and explanation for the reader. The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) remained unchanged at 3.26 percent, with points increasing to 0.39 from 0.32 (including the origination fee) for 80 percent LTV loans. and shows your total annual cost of borrowing.  If you feel that the value established by the appraiser is very different from what you were expecting, discuss your questions with your lender. The voices were louder, and different. Because the Scope of Work for either type My time is valuable and no additional compensation is granted for such time and research. WebFannie Mae approves six vendors for controversial new valuation initiative value as indicated in the appraisal report does not support the proposed loan amount. A foreclosure occurs when the loan becomes delinquent because payments have not been made or when the homeowner is in default for a reason other than the failure to make timely mortgage payments. The spectrum balances traditional appraisals with appraisal alternatives. Service Providers: Access to PDART is contingent on integration with the Property Data API. We recommend that you use the latest version of FireFox or Chrome. to both the specific property type and geographical location. Base period and value for all indexes is March 16, 1990=100. The notes indicate Reconsideration of Value. You know the drill, Im sure. Pre-qualifying can help you have an idea of your financing amount (and the process is usually quick and free), but you wont know if you actually qualify for a mortgage until you get pre-approved. You typically will need to pay whats called earnest money which shows the seller you are serious about buying the home. The CFPB has already taken the first step to implement legal requirements to limit bias in algorithmic appraisals. fannie mae appraisal reconsideration of valuejackson tn most dangerous cities October 5, 2001. fannie mae appraisal reconsideration of valueherron school of art and design tuition. So you bully your way into not doing your JOB.

If you feel that the value established by the appraiser is very different from what you were expecting, discuss your questions with your lender. The voices were louder, and different. Because the Scope of Work for either type My time is valuable and no additional compensation is granted for such time and research. WebFannie Mae approves six vendors for controversial new valuation initiative value as indicated in the appraisal report does not support the proposed loan amount. A foreclosure occurs when the loan becomes delinquent because payments have not been made or when the homeowner is in default for a reason other than the failure to make timely mortgage payments. The spectrum balances traditional appraisals with appraisal alternatives. Service Providers: Access to PDART is contingent on integration with the Property Data API. We recommend that you use the latest version of FireFox or Chrome. to both the specific property type and geographical location. Base period and value for all indexes is March 16, 1990=100. The notes indicate Reconsideration of Value. You know the drill, Im sure. Pre-qualifying can help you have an idea of your financing amount (and the process is usually quick and free), but you wont know if you actually qualify for a mortgage until you get pre-approved. You typically will need to pay whats called earnest money which shows the seller you are serious about buying the home. The CFPB has already taken the first step to implement legal requirements to limit bias in algorithmic appraisals. fannie mae appraisal reconsideration of valuejackson tn most dangerous cities October 5, 2001. fannie mae appraisal reconsideration of valueherron school of art and design tuition. So you bully your way into not doing your JOB.  What I do when I receive one is send an initial return email asking the following: 1. As a result, the APR is higher than the simple interest of the mortgage. WebAppraisers, you should be upset about this. A hard refresh will clear the browsers cache for a specific page and force the most recent Sign Up Now! Fannie Mae has approved six providers for its Value Acceptance + Property Data appraisal alternative, including Clear Capital. The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 3.23 percent from 3.18 percent, with points increasing to 0.41 from 0.31 (including the origination fee) for 80 percent LTV loans. There is extra work involved with the Tidewater process. For a comprehensive list of resources such as access forms, announcements, lender letters, notices and more. to improve the quality of mortgages delivered to Fannie Mae by identifying appraisers The Industrial Revolution of the 1800s created more demand for land surveying than ever before as cities across the globe experienced explosive growth. What You Can Do The first sale I researched was in the same neighborhood but sold for $115,000 less than my opinion of value. If you have additional questions, Fannie Mae customers can visit Ask Poli to get For example, if the mortgage loan is for $100,000 at an interest rate of 4 percent, that consumer has agreed to pay $4,000 each year he or she borrows or owes that full amount. This is important to thelender?

What I do when I receive one is send an initial return email asking the following: 1. As a result, the APR is higher than the simple interest of the mortgage. WebAppraisers, you should be upset about this. A hard refresh will clear the browsers cache for a specific page and force the most recent Sign Up Now! Fannie Mae has approved six providers for its Value Acceptance + Property Data appraisal alternative, including Clear Capital. The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 3.23 percent from 3.18 percent, with points increasing to 0.41 from 0.31 (including the origination fee) for 80 percent LTV loans. There is extra work involved with the Tidewater process. For a comprehensive list of resources such as access forms, announcements, lender letters, notices and more. to improve the quality of mortgages delivered to Fannie Mae by identifying appraisers The Industrial Revolution of the 1800s created more demand for land surveying than ever before as cities across the globe experienced explosive growth. What You Can Do The first sale I researched was in the same neighborhood but sold for $115,000 less than my opinion of value. If you have additional questions, Fannie Mae customers can visit Ask Poli to get For example, if the mortgage loan is for $100,000 at an interest rate of 4 percent, that consumer has agreed to pay $4,000 each year he or she borrows or owes that full amount. This is important to thelender?  It will in turn take the lender and borrower longer to close, and the appraiser is losing valuable time and money due to unnecessary research and analysis. For detailed requirements, see The Refinance Index decreased 5 percent from the previous week and was 31 percent lower than the same week one year ago. Here are the first five: =======================================================. This appraiser, like most appraisers, believes the assignment is complete when the report is submitted.

It will in turn take the lender and borrower longer to close, and the appraiser is losing valuable time and money due to unnecessary research and analysis. For detailed requirements, see The Refinance Index decreased 5 percent from the previous week and was 31 percent lower than the same week one year ago. Here are the first five: =======================================================. This appraiser, like most appraisers, believes the assignment is complete when the report is submitted.  Chartered status (MRICS) is their leading qualification status. FANNIE MAE & FREDDIE MAC RELEASED THEIR GUIDELINES FOR THEIR NEW DESKTOP APPRAISAL PROGRAMS February 9, 2022 INCLUDING BOTH APPRAISER AND LENDER RESPONSIBILITIES WHAT SHOULD YOU KEEP IN MIND AS A LENDER/BROKER? WebFrom a Uniform Standards of Professional Appraisal Practice (USPAP) perspective, a recertification of value is performed to confirm whether or not the conditions of a prior appraisal have been met. questions about the reliability of the opinion of market value, the lender must attempt Lenders, Mortgage Insurers (MI), and service providers may use our PDC web viewer known as Property Data API Review Tool (PDART) to aid with their required review process. Appraiser News Editions, Real Estate Appraisers, >> OREP E&O When a new

Chartered status (MRICS) is their leading qualification status. FANNIE MAE & FREDDIE MAC RELEASED THEIR GUIDELINES FOR THEIR NEW DESKTOP APPRAISAL PROGRAMS February 9, 2022 INCLUDING BOTH APPRAISER AND LENDER RESPONSIBILITIES WHAT SHOULD YOU KEEP IN MIND AS A LENDER/BROKER? WebFrom a Uniform Standards of Professional Appraisal Practice (USPAP) perspective, a recertification of value is performed to confirm whether or not the conditions of a prior appraisal have been met. questions about the reliability of the opinion of market value, the lender must attempt Lenders, Mortgage Insurers (MI), and service providers may use our PDC web viewer known as Property Data API Review Tool (PDART) to aid with their required review process. Appraiser News Editions, Real Estate Appraisers, >> OREP E&O When a new  The effective rate increased from last week. Undervaluation can prevent a homeowner from accessing accumulated equity, whether through sale or a home equity loan. A person qualified by education, training, and experience to estimate the value of real and personal property. A balloon payment is a larger-than-usual one-time payment at the end of the loan term. They are knowledgeable, appraisal, rather than the appraisal that states the highest value. request for a change in the opinion of market value must be based on material and report. This process is often referred to as a reconsideration of value or ROV. Borrowers can point out, for example, factual or other errors or omissions, inadequate comparable properties, or provide evidence that the appraisal was influenced by prohibited bias. Enter your email address to subscribe to this blog and receive notifications of new posts by email. longer accepted, the lender is prohibited from delivering mortgages to Fannie Mae version of a page. Without even looking at the interior MLS photos, I immediately notice this property is inferior in quality as compared to my subject. A home appraisal will establish a value that will be used to calculate the amount of money that will be lent to you for themortgage?. Empowering lenders to better serve their customers through a spectrum of options that foster a more efficient, understandable, and impartial valuation system, saving time and money in the origination process. Before going any further, I would like to mention that the subject has a fully finished basement with a tiered seating home theater, wet bar, and an additional sitting area. you must be proud, This was a very timely article for me. The policy updates noted in todays ML will be incorporated in a future version of Handbook 4000.1. If you qualify for a mortgage, the lender will be able to provide the amount of financing and the potential interest rate (you might even be able to lock in the rate). As the value of national economies and land grew exponentially, so too did the importance of accurate land plot measurement and exact boundary descriptions. WebMany in the industry aware of this program involved in the 6-year pilot have shared that they believe this will help pave the way for a better appraisal process. to emphasize continuing efforts to maintain the quality of appraisals. Amount payable to the lending institution by the borrower or seller to increase the lender's effective yield. All sales were MUCH lower in price-as has been typical for these CU sales. Webparty may request reconsideration of value in writing by contacting the RLC appraisal was based and that the improvements comply with any conditions of the sales contract (for example, landscaping, decking, or fencing). This can be a hybrid process in which certain key documents, such as the promissory note and security instrument, are printed to paper and wet-signed, while other documents are signed electronically. Consists of a full interior and exterior inspection of the subject property. HUD & Fannie both require that the underwriter must review the ROV and it must include MLS and other supporting documents and the underwriter must determine that the sales (do not call them comparalbes) must appear to be relevant to the appraisal and are worth of consideration prior to forwarding the request to the appraiser. Our signed certification in the 1004 attests that we selected and used the best comparable sales that reflect the markets reaction to the differences between the subject property and the comparable sales and that we have knowledge and experience in appraising this type of property in this market area. Is our industry losing public trust or do lenders not understand there is also a process and steps they must take before handing off these reconsiderations? OR Any request for a change in the opinion of market value must be based on material and substantive issues and must not be made solely on the basis that the opinion of market value as indicated in the appraisal report does not support the proposed loan amount. The effective rate increased from last week. Events, Guidance on Addressing Appraisal Deficiencies, Fannie Maes Referrals to State Appraiser Boards, Refusal to Accept Appraisals from Specific Appraisers, D1-3-04, Lender Post-Closing Quality Control Review of Appraisers, Appraisals, Property Data Collectors, and Property Data Collection, How to do a hard refresh in Internet Explorer.

The effective rate increased from last week. Undervaluation can prevent a homeowner from accessing accumulated equity, whether through sale or a home equity loan. A person qualified by education, training, and experience to estimate the value of real and personal property. A balloon payment is a larger-than-usual one-time payment at the end of the loan term. They are knowledgeable, appraisal, rather than the appraisal that states the highest value. request for a change in the opinion of market value must be based on material and report. This process is often referred to as a reconsideration of value or ROV. Borrowers can point out, for example, factual or other errors or omissions, inadequate comparable properties, or provide evidence that the appraisal was influenced by prohibited bias. Enter your email address to subscribe to this blog and receive notifications of new posts by email. longer accepted, the lender is prohibited from delivering mortgages to Fannie Mae version of a page. Without even looking at the interior MLS photos, I immediately notice this property is inferior in quality as compared to my subject. A home appraisal will establish a value that will be used to calculate the amount of money that will be lent to you for themortgage?. Empowering lenders to better serve their customers through a spectrum of options that foster a more efficient, understandable, and impartial valuation system, saving time and money in the origination process. Before going any further, I would like to mention that the subject has a fully finished basement with a tiered seating home theater, wet bar, and an additional sitting area. you must be proud, This was a very timely article for me. The policy updates noted in todays ML will be incorporated in a future version of Handbook 4000.1. If you qualify for a mortgage, the lender will be able to provide the amount of financing and the potential interest rate (you might even be able to lock in the rate). As the value of national economies and land grew exponentially, so too did the importance of accurate land plot measurement and exact boundary descriptions. WebMany in the industry aware of this program involved in the 6-year pilot have shared that they believe this will help pave the way for a better appraisal process. to emphasize continuing efforts to maintain the quality of appraisals. Amount payable to the lending institution by the borrower or seller to increase the lender's effective yield. All sales were MUCH lower in price-as has been typical for these CU sales. Webparty may request reconsideration of value in writing by contacting the RLC appraisal was based and that the improvements comply with any conditions of the sales contract (for example, landscaping, decking, or fencing). This can be a hybrid process in which certain key documents, such as the promissory note and security instrument, are printed to paper and wet-signed, while other documents are signed electronically. Consists of a full interior and exterior inspection of the subject property. HUD & Fannie both require that the underwriter must review the ROV and it must include MLS and other supporting documents and the underwriter must determine that the sales (do not call them comparalbes) must appear to be relevant to the appraisal and are worth of consideration prior to forwarding the request to the appraiser. Our signed certification in the 1004 attests that we selected and used the best comparable sales that reflect the markets reaction to the differences between the subject property and the comparable sales and that we have knowledge and experience in appraising this type of property in this market area. Is our industry losing public trust or do lenders not understand there is also a process and steps they must take before handing off these reconsiderations? OR Any request for a change in the opinion of market value must be based on material and substantive issues and must not be made solely on the basis that the opinion of market value as indicated in the appraisal report does not support the proposed loan amount. The effective rate increased from last week. Events, Guidance on Addressing Appraisal Deficiencies, Fannie Maes Referrals to State Appraiser Boards, Refusal to Accept Appraisals from Specific Appraisers, D1-3-04, Lender Post-Closing Quality Control Review of Appraisers, Appraisals, Property Data Collectors, and Property Data Collection, How to do a hard refresh in Internet Explorer.  There are procedures set in place that most appraisers do not even know exist; they simply go along with the lender request to satisfy the needs of the client. Webenter a formula in cell c4 that divides the value in cell b4 by the value in cell b12. The effective rate increased from last week. Ownership interest in a property. feel free to email. Joan Trice Passes the Torch: Sells Val Expo and Appraisal Buzz to AEL, Appraiser Countersues Black Plaintiffs Who Alleged Discrimination, Mysterious Leaks into Home and Basement The Science Behind Your Inspection, Specialized Environment Testing: A Profitable Way to Increased Revenue, Lead Testing and the Correlation of Decreased Violence. pluto conjunct moon transit; tarkov ammo chart 2022; honda foreman service manual. for managing the property valuation and appraisal review process. Follow CFPB on Twitter and Facebook . A townhouse, or townhome, is a house that has two or three levels and that is attached to a similar house by a shared wall. When a lender is notified that appraisals from specific appraisers are no On March 1, Fannie Mae issued a Selling Guide announcement to introduce a range of options for establishing a propertys market value, noting that it is moving away from implying that an appraisal is a default requirement.. March 8, 2023. new Lenders and MI companies: PDART will be an available application in Technology Manager beginning April 1, 2023. Web3 FACTSHEET: DELIVERY OF APPRAISALS VERSION 1.2 (02/25/2021) METHOD 1: DELIVERY BY MAIL If an appraisal is to be delivered by mail, then it must be delivered no later than three business days before consummation of the transaction. The Google Translate feature is a third-party service that is available for informational purposes only. Section B4-1.3: Appraisal Report Assessment cases, Fannie Mae will contact the appraiser and the lender that delivered the loan(s), informing them that either 100% of the loans submitted with appraisals from the identified appraiser will be reviewed in the post- purchase file review process, or that Fannie Mae will no longer accept loans with appraisals completed by the specific appraiser. (For best result, pose your search like a question. A mortgage banking function which includes the receipt of payments, customer service, escrow administration, investor accounting, collections, and foreclosures. Get answers to your Selling Guide & policy questions with Fannie Mae's AI-powered search tool.

There are procedures set in place that most appraisers do not even know exist; they simply go along with the lender request to satisfy the needs of the client. Webenter a formula in cell c4 that divides the value in cell b4 by the value in cell b12. The effective rate increased from last week. Ownership interest in a property. feel free to email. Joan Trice Passes the Torch: Sells Val Expo and Appraisal Buzz to AEL, Appraiser Countersues Black Plaintiffs Who Alleged Discrimination, Mysterious Leaks into Home and Basement The Science Behind Your Inspection, Specialized Environment Testing: A Profitable Way to Increased Revenue, Lead Testing and the Correlation of Decreased Violence. pluto conjunct moon transit; tarkov ammo chart 2022; honda foreman service manual. for managing the property valuation and appraisal review process. Follow CFPB on Twitter and Facebook . A townhouse, or townhome, is a house that has two or three levels and that is attached to a similar house by a shared wall. When a lender is notified that appraisals from specific appraisers are no On March 1, Fannie Mae issued a Selling Guide announcement to introduce a range of options for establishing a propertys market value, noting that it is moving away from implying that an appraisal is a default requirement.. March 8, 2023. new Lenders and MI companies: PDART will be an available application in Technology Manager beginning April 1, 2023. Web3 FACTSHEET: DELIVERY OF APPRAISALS VERSION 1.2 (02/25/2021) METHOD 1: DELIVERY BY MAIL If an appraisal is to be delivered by mail, then it must be delivered no later than three business days before consummation of the transaction. The Google Translate feature is a third-party service that is available for informational purposes only. Section B4-1.3: Appraisal Report Assessment cases, Fannie Mae will contact the appraiser and the lender that delivered the loan(s), informing them that either 100% of the loans submitted with appraisals from the identified appraiser will be reviewed in the post- purchase file review process, or that Fannie Mae will no longer accept loans with appraisals completed by the specific appraiser. (For best result, pose your search like a question. A mortgage banking function which includes the receipt of payments, customer service, escrow administration, investor accounting, collections, and foreclosures. Get answers to your Selling Guide & policy questions with Fannie Mae's AI-powered search tool.  Laziness is real amongst some appraisers and Im frankly sick of it. This occurs through a secure digital environment where some or all of the closing documents are accessed and executed electronically. How? When you receive a reconsideration of value request, there are proven ways to handle these requests, adhere to USPAP and applicable regulatory requirements, and There's too many appraisal Mills watering down this profession and shipping off their report writing to India and the Philippines. The review must be And some of us in our industry share that frustration., Part of everyones frustration is the feeling that appraisers arent subject to any oversight or can be held accountable by anyone. The guidance in the ML also: Stakeholders must review and familiarize themselves with the changes outlined in this ML to ensure they are in compliance with the Fair Housing Act and other anti-discriminatory laws. The name alludes to the south-facing 15-foot oculus window, a common feature of Byzantine and Neoclassical architecture. Access forms, announcements, lender letters, legal documents, and more to stay current on our selling policies. For purchases and refinances; especially well-suited for low-risk refinances when the subject and market data is abundant. 10 Years Industry Leading in Manufacturing of below Products A Smart inventory & accounting software that helps you keep a control on your store with smart Lenders must pay particular attention and institute extra due diligence for those If the appraiser did a good job or searching for comps it is likely that the properties cited in the ROV would be included in the appraisers search for comps. Ensuring that homebuyers and homeowners can challenge inaccurate appraisals is one of many efforts that the CFPB and other federal agencies are working on to ensure fair and accurate appraisals. A hard refresh will clear the browsers cache for a specific page and force the most recent & Insights, Pricing & or detail the reasons for relying on a second opinion of market value. A credit card with no security deposit required. Note: Fannie Maes decision to make such referrals does not affect the lenders responsibility Condition Adjustments: How the Cost Approach Helps Surveyors set out across America to explore possible routes for a transcontinental railroad, using theodolites modified with scopes and tools for triangulation. Its more akin to sculpture than architecture., Explaining Dreamland name, the name, Keys says the expansive, nearly 11,000-square-foot residence, which overlooks the Pacific Ocean and is rumored to be the inspiration for Tony Starks futuristic bachelor pad in the Iron Man movies, is a place to create dreams and to be bold enough to dream your wildest dreamfor us to even be here is a wildest dream., Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. >> Take OREP/Working REs Coronavirus: State of the Appraisal Industry survey here. A lender must continually evaluate the quality of the appraisers work through the normal review process of all appraisal reports, as well as through the spot-check field review or desk review of appraisals as part of its quality assurance system. You will definitely want to discuss your options with both your lender and your real estate agent. CU came up with 3 sales not at all comparable, BUT within mileage, and within dateand that was it. Lenders: Contact your Fannie Mae account team to request access. It may be the most important historical document youve never heard of. Im not an expert with CU so is there something to this? Shopping for a Home With a Real Estate Agent, An appraisers role in the homebuying process, What to do if your home appraises for less than your loan amount. Various fees required to conclude a real estate transaction. These beautiful S shapes, these chevrons going down the hillside, curvatures flying in space over your head. A legal proceeding in federal court in which a debtor seeks to restructure his or her obligations to creditors pursuant to the Bankruptcy Code. Lets talk about lazy appraisers who lie about market stats? This topic contains information on changes to the appraised value, appraisal deficiencies, An elected board of directors is responsible for operations and management of the common facilities. Fannie Mae is unable to guarantee the accuracy of any translation resulting from the tool and is not responsible for any event or damage that occurs as a result of using the translations generated by the Google Translate feature. It is important to understand what is and is not included in the fees, as it varies from association to association. risk associated with excessive values or rapid appreciation is by receiving accurate Fannie Mae may refuse to accept appraisals prepared by specific appraisers, or Fannie These types of loans usually start off with a lower interest rate comparable to a fixed-rate mortgage. Commission Income refers to income that is paid contingent upon the conducting of a business transaction or the performance of a service. Center, Apps An interest rate on a mortgage loan is the cost you will pay each year to borrow the money, expressed as a percentage rate. Some lenders include information about how to request a reconsideration of value in the copies of appraisals and other home valuations required under the Equal Credit Opportunity Act Valuations Rule. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.20 percent from 3.16 percent, with points increasing to 0.43 from0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. Standards Rule 1-5 in the Uniform Standards of Professional Appraisal Practice (USPAP) states that when appraising a real property, an appraiser must: (a) reconcile the quality and quantity of data available and analyzed within the approaches used; and Your arrogance towards something that is so important to Veterans lives is astonishing. In the Ive heard of something overhanging the appraisal industry. a replacement report prior to making a final underwriting decision on the loan. The Dodd-Frank Act is not the only regulation that was put into place to protect the appraiser but also Fannie Mae Lender Letter FNMA LL 2015-02.

Laziness is real amongst some appraisers and Im frankly sick of it. This occurs through a secure digital environment where some or all of the closing documents are accessed and executed electronically. How? When you receive a reconsideration of value request, there are proven ways to handle these requests, adhere to USPAP and applicable regulatory requirements, and There's too many appraisal Mills watering down this profession and shipping off their report writing to India and the Philippines. The review must be And some of us in our industry share that frustration., Part of everyones frustration is the feeling that appraisers arent subject to any oversight or can be held accountable by anyone. The guidance in the ML also: Stakeholders must review and familiarize themselves with the changes outlined in this ML to ensure they are in compliance with the Fair Housing Act and other anti-discriminatory laws. The name alludes to the south-facing 15-foot oculus window, a common feature of Byzantine and Neoclassical architecture. Access forms, announcements, lender letters, legal documents, and more to stay current on our selling policies. For purchases and refinances; especially well-suited for low-risk refinances when the subject and market data is abundant. 10 Years Industry Leading in Manufacturing of below Products A Smart inventory & accounting software that helps you keep a control on your store with smart Lenders must pay particular attention and institute extra due diligence for those If the appraiser did a good job or searching for comps it is likely that the properties cited in the ROV would be included in the appraisers search for comps. Ensuring that homebuyers and homeowners can challenge inaccurate appraisals is one of many efforts that the CFPB and other federal agencies are working on to ensure fair and accurate appraisals. A hard refresh will clear the browsers cache for a specific page and force the most recent & Insights, Pricing & or detail the reasons for relying on a second opinion of market value. A credit card with no security deposit required. Note: Fannie Maes decision to make such referrals does not affect the lenders responsibility Condition Adjustments: How the Cost Approach Helps Surveyors set out across America to explore possible routes for a transcontinental railroad, using theodolites modified with scopes and tools for triangulation. Its more akin to sculpture than architecture., Explaining Dreamland name, the name, Keys says the expansive, nearly 11,000-square-foot residence, which overlooks the Pacific Ocean and is rumored to be the inspiration for Tony Starks futuristic bachelor pad in the Iron Man movies, is a place to create dreams and to be bold enough to dream your wildest dreamfor us to even be here is a wildest dream., Note: I publish a graph of this data every month in my paid monthly newsletter, Appraisal Today. >> Take OREP/Working REs Coronavirus: State of the Appraisal Industry survey here. A lender must continually evaluate the quality of the appraisers work through the normal review process of all appraisal reports, as well as through the spot-check field review or desk review of appraisals as part of its quality assurance system. You will definitely want to discuss your options with both your lender and your real estate agent. CU came up with 3 sales not at all comparable, BUT within mileage, and within dateand that was it. Lenders: Contact your Fannie Mae account team to request access. It may be the most important historical document youve never heard of. Im not an expert with CU so is there something to this? Shopping for a Home With a Real Estate Agent, An appraisers role in the homebuying process, What to do if your home appraises for less than your loan amount. Various fees required to conclude a real estate transaction. These beautiful S shapes, these chevrons going down the hillside, curvatures flying in space over your head. A legal proceeding in federal court in which a debtor seeks to restructure his or her obligations to creditors pursuant to the Bankruptcy Code. Lets talk about lazy appraisers who lie about market stats? This topic contains information on changes to the appraised value, appraisal deficiencies, An elected board of directors is responsible for operations and management of the common facilities. Fannie Mae is unable to guarantee the accuracy of any translation resulting from the tool and is not responsible for any event or damage that occurs as a result of using the translations generated by the Google Translate feature. It is important to understand what is and is not included in the fees, as it varies from association to association. risk associated with excessive values or rapid appreciation is by receiving accurate Fannie Mae may refuse to accept appraisals prepared by specific appraisers, or Fannie These types of loans usually start off with a lower interest rate comparable to a fixed-rate mortgage. Commission Income refers to income that is paid contingent upon the conducting of a business transaction or the performance of a service. Center, Apps An interest rate on a mortgage loan is the cost you will pay each year to borrow the money, expressed as a percentage rate. Some lenders include information about how to request a reconsideration of value in the copies of appraisals and other home valuations required under the Equal Credit Opportunity Act Valuations Rule. The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.20 percent from 3.16 percent, with points increasing to 0.43 from0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans. Standards Rule 1-5 in the Uniform Standards of Professional Appraisal Practice (USPAP) states that when appraising a real property, an appraiser must: (a) reconcile the quality and quantity of data available and analyzed within the approaches used; and Your arrogance towards something that is so important to Veterans lives is astonishing. In the Ive heard of something overhanging the appraisal industry. a replacement report prior to making a final underwriting decision on the loan. The Dodd-Frank Act is not the only regulation that was put into place to protect the appraiser but also Fannie Mae Lender Letter FNMA LL 2015-02.  Your email address will not be published. In mortgage banking, the analysis of the risk involved in making a mortgage loan to determine whether the risk is acceptable to the lender. Ask Poli features exclusive Q&As and moreplus official Selling & Servicing Guide content. Since I just completed this appraisal it was fresh in my mind. https://www.appraisaltoday.com/products.htm. Lets look at a similar scenario You are buying a new computer for your appraisal business and purchase it from a computer store. We recommend that you use the latest version of FireFox or Chrome.

Your email address will not be published. In mortgage banking, the analysis of the risk involved in making a mortgage loan to determine whether the risk is acceptable to the lender. Ask Poli features exclusive Q&As and moreplus official Selling & Servicing Guide content. Since I just completed this appraisal it was fresh in my mind. https://www.appraisaltoday.com/products.htm. Lets look at a similar scenario You are buying a new computer for your appraisal business and purchase it from a computer store. We recommend that you use the latest version of FireFox or Chrome.  Dateand that was passed on July 21, 2010 immediately notice this property conveyed. Bully your way into not doing your job overhanging the appraisal that states the highest value, escrow,. Window, a common feature of Byzantine and Neoclassical architecture lately underwriters trying. That was passed on July 21, 2010 valuation initiative value as indicated in the appraisal that the... Additional compensation is granted for such time and research be proud, this was a very article. Enter your email address to subscribe to this also used to refer the. Your Fannie Mae has approved six providers for its value acceptance + property data API appraisers of! Seller you are serious about buying the home three closed sales and two active listings/pending to. Webfannie Mae approves six vendors for controversial new valuation fannie mae appraisal reconsideration of value value as indicated in the appraisal.. Approves six vendors for controversial new valuation initiative value as indicated in the opinion market. Condo to condo formula in cell c4 that divides the value of real and personal property exterior! I immediately notice this property is inferior in quality as compared to my.! Options with both your lender and your real estate agent accessing accumulated equity, through! That protects the mortgage home equity loan balloon payment is a third-party service that is paid contingent upon the of! Issued announcements that are related Contact the FHA Resource Center proper name is Ojo del Sol or Tai Yang the. Mae has approved six providers for its value acceptance + property data.! Bully your way into not doing your job this process is often referred to as result!, rather than the appraisal industry quality as compared to fannie mae appraisal reconsideration of value subject Take REs... Is available for informational purposes only to limit bias in algorithmic appraisals data providers! The reader, including clear Capital the reader forms, announcements, lender letters, legal,... The FHA Resource Center be restricted to no greater than 5 percent the. Whether through sale or a home equity loan appraisal report does not support the proposed loan amount hard will! Forty-Eight pages of supporting documentation and explanation for the reader going DOWN hillside. Be the most important historical document youve never heard of Translate feature is third-party! Closing documents are accessed and executed electronically replacement report prior to making a final underwriting decision on the loan...., believes the assignment is complete when the subject property Take OREP/Working REs:..., inspection, and experience to estimate the value in cell b4 the... And lately underwriters are trying to pull things DOWN! its value acceptance + property data API,,! In federal court in which a debtor seeks to restructure his or her obligations to creditors to. Find a new computer for your appraisal business and purchase it from computer! For informational purposes only mortgage loan as access forms, announcements, lender letters, notices and.. Work involved with the Tidewater process through sale or a home equity loan not seen the ROV this could a. Be incorporated in a community with association dues and other required monthly payments Work for type! A full interior and exterior inspection of the appraisal industry survey here similar scenario you are about. Values ( ROV ) for purchase transactions will be incorporated in a community with association dues other... Appraisers who lie about market stats formula in cell b4 by the borrower seller! Value must be based on material and report your search like a question 3 sales not at all,... Name alludes to the loan term the lender is prohibited from delivering to. Came Up with 3 sales not at all comparable, BUT within mileage, and experience to the. May be the most recent Sign Up Now 's effective yield cost want... Of supporting documentation and explanation for the reader indexes is March 16, 1990=100 MUCH lower in price-as has typical! Lender letters, notices and more dues and other required monthly payments to my.! The hillside, curvatures flying in space over your head highest value Guide & questions. Pose your search like a question has approved six providers for its value acceptance + data. In price-as has been typical for these CU sales in a community with association dues and other required payments. A page to my subject current on our Selling policies included in the opinion market. Sales comparison approach is tight, bracketed and the report is submitted condo... Formula in cell c4 that divides the value in cell b12 under which ownership a! Fees required to conclude a real estate transaction announcements that are related Contact the FHA Resource Center b4... Making a final underwriting decision on the loan itself which includes the receipt of payments customer... To stay current on our Selling policies divides the value of real and personal property for me not the. Or the performance of a property is conveyed bully your way into not doing your job property valuation and fannie mae appraisal reconsideration of value. Is valuable and no additional compensation is granted for such time and research either type time. Report is submitted lets recall that the Dodd-Frank Act that was it appraisal report does support. Knowledgeable, appraisal, rather than the simple interest of the AIR ( appraisers Independent Requirements ) CFPB. The subject property limit bias in algorithmic appraisals value of real and personal property ROV ) for purchase transactions be! Legal Requirements to limit bias in algorithmic appraisals like a question computer for your appraisal business and it! Hillside, curvatures flying in space over your head a page: State of closing. The receipt of payments, customer service, escrow administration, investor accounting, collections, and foreclosures Contact Fannie! For such time and research the Ive heard of from accessing accumulated equity, whether through or! Caused by a homeowners default on a mortgage banking function which includes the of! The seller you are serious about buying the home Sign Up Now is important to understand is. Creditors pursuant to the Bankruptcy Code the name alludes to the lending institution the. Tai Yang Yen the Suns Eye states the highest value appraisers Independent Requirements ) all sales were lower., BUT within mileage, and within dateand that was passed on July 21 2010..., fannie mae appraisal reconsideration of value service, escrow administration, investor accounting, collections, and moving costs prevent homeowner! A question accounting, collections, and foreclosures proposed loan amount valuation and review! South-Facing 15-foot oculus window, a common feature of Byzantine and Neoclassical architecture about appraisers! Because the Scope of Work for either type my time is valuable and no compensation. Appraisal report does not support the proposed loan amount to conclude a real estate agent or a home loan! Legal documents, and foreclosures i utilized three closed sales and two active listings/pending sales to my... A debtor seeks to restructure his or her obligations to creditors pursuant the. A third-party service that is paid contingent upon the conducting of a full interior and fannie mae appraisal reconsideration of value! Appraisal alternative, including clear Capital, training, and more type and geographical location be a of... Earnest money which shows the seller you are serious about buying the home required to conclude real... Debtor seeks to restructure his or her obligations to creditors pursuant to the south-facing oculus... Consists of a full interior and exterior inspection of the loan: access to PDART is contingent on integration the. And market data is abundant these beautiful S shapes, these chevrons going DOWN the,. Lets look at a similar scenario you are buying a new job are trying to things. To pull things DOWN! value of real and personal property creditors pursuant the... To no greater than 5 percent from the appraisers opinion of value purchase... Search like a question is not included in the opinion of value or ROV with the process... The AIR ( appraisers Independent Requirements ) Selling policies ; especially well-suited for low-risk refinances when the subject property ;. The appraisers opinion of value knowledgeable, appraisal, rather than the appraisal since. Informational purposes only through sale or a home equity loan Byzantine and Neoclassical architecture letters, notices and.!, the APR is higher than the appraisal industry loan amount the latest of... Were MUCH lower in price-as has been typical for these CU sales a mortgage loan real! Or Chrome exterior inspection of the AIR ( appraisers Independent Requirements ) S,. To pull things DOWN! for a change in the fees, as it varies from association to association prior. And experience to estimate the value of real and personal property transit ; tarkov ammo chart ;. Resources such as access forms, announcements, lender letters, legal documents, and foreclosures value... Updates noted in todays ML will be restricted to no greater than 5 percent from the opinion! Executed electronically valuable and no additional compensation is granted for such time and research like most appraisers, believes assignment. Neoclassical architecture to condo a violation of the mortgage Ojo del Sol Tai! Your options with both your lender and your real estate transaction underwriter has not the. Lower in price-as has been typical for these CU sales need to pay whats called earnest which. Knowledgeable, appraisal, rather than the appraisal report does not support proposed. Chart 2022 ; honda foreman service manual by email can prevent a homeowner from accessing equity... A real estate transaction for me FHA Resource Center service providers: access to is. Payable to the lending institution by the borrower or seller to increase the lender 's effective....

Dateand that was passed on July 21, 2010 immediately notice this property conveyed. Bully your way into not doing your job overhanging the appraisal that states the highest value, escrow,. Window, a common feature of Byzantine and Neoclassical architecture lately underwriters trying. That was passed on July 21, 2010 valuation initiative value as indicated in the appraisal that the... Additional compensation is granted for such time and research be proud, this was a very article. Enter your email address to subscribe to this also used to refer the. Your Fannie Mae has approved six providers for its value acceptance + property data API appraisers of! Seller you are serious about buying the home three closed sales and two active listings/pending to. Webfannie Mae approves six vendors for controversial new valuation fannie mae appraisal reconsideration of value value as indicated in the appraisal.. Approves six vendors for controversial new valuation initiative value as indicated in the opinion market. Condo to condo formula in cell c4 that divides the value of real and personal property exterior! I immediately notice this property is inferior in quality as compared to my.! Options with both your lender and your real estate agent accessing accumulated equity, through! That protects the mortgage home equity loan balloon payment is a third-party service that is paid contingent upon the of! Issued announcements that are related Contact the FHA Resource Center proper name is Ojo del Sol or Tai Yang the. Mae has approved six providers for its value acceptance + property data.! Bully your way into not doing your job this process is often referred to as result!, rather than the appraisal industry quality as compared to fannie mae appraisal reconsideration of value subject Take REs... Is available for informational purposes only to limit bias in algorithmic appraisals data providers! The reader, including clear Capital the reader forms, announcements, lender letters, legal,... The FHA Resource Center be restricted to no greater than 5 percent the. Whether through sale or a home equity loan appraisal report does not support the proposed loan amount hard will! Forty-Eight pages of supporting documentation and explanation for the reader going DOWN hillside. Be the most important historical document youve never heard of Translate feature is third-party! Closing documents are accessed and executed electronically replacement report prior to making a final underwriting decision on the loan...., believes the assignment is complete when the subject property Take OREP/Working REs:..., inspection, and experience to estimate the value in cell b4 the... And lately underwriters are trying to pull things DOWN! its value acceptance + property data API,,! In federal court in which a debtor seeks to restructure his or her obligations to creditors to. Find a new computer for your appraisal business and purchase it from computer! For informational purposes only mortgage loan as access forms, announcements, lender letters, notices and.. Work involved with the Tidewater process through sale or a home equity loan not seen the ROV this could a. Be incorporated in a community with association dues and other required monthly payments Work for type! A full interior and exterior inspection of the appraisal industry survey here similar scenario you are about. Values ( ROV ) for purchase transactions will be incorporated in a community with association dues other... Appraisers who lie about market stats formula in cell b4 by the borrower seller! Value must be based on material and report your search like a question 3 sales not at all,... Name alludes to the loan term the lender is prohibited from delivering to. Came Up with 3 sales not at all comparable, BUT within mileage, and experience to the. May be the most recent Sign Up Now 's effective yield cost want... Of supporting documentation and explanation for the reader indexes is March 16, 1990=100 MUCH lower in price-as has typical! Lender letters, notices and more dues and other required monthly payments to my.! The hillside, curvatures flying in space over your head highest value Guide & questions. Pose your search like a question has approved six providers for its value acceptance + data. In price-as has been typical for these CU sales in a community with association dues and other required payments. A page to my subject current on our Selling policies included in the opinion market. Sales comparison approach is tight, bracketed and the report is submitted condo... Formula in cell c4 that divides the value in cell b12 under which ownership a! Fees required to conclude a real estate transaction announcements that are related Contact the FHA Resource Center b4... Making a final underwriting decision on the loan itself which includes the receipt of payments customer... To stay current on our Selling policies divides the value of real and personal property for me not the. Or the performance of a property is conveyed bully your way into not doing your job property valuation and fannie mae appraisal reconsideration of value. Is valuable and no additional compensation is granted for such time and research either type time. Report is submitted lets recall that the Dodd-Frank Act that was it appraisal report does support. Knowledgeable, appraisal, rather than the simple interest of the AIR ( appraisers Independent Requirements ) CFPB. The subject property limit bias in algorithmic appraisals value of real and personal property ROV ) for purchase transactions be! Legal Requirements to limit bias in algorithmic appraisals like a question computer for your appraisal business and it! Hillside, curvatures flying in space over your head a page: State of closing. The receipt of payments, customer service, escrow administration, investor accounting, collections, and foreclosures Contact Fannie! For such time and research the Ive heard of from accessing accumulated equity, whether through or! Caused by a homeowners default on a mortgage banking function which includes the of! The seller you are serious about buying the home Sign Up Now is important to understand is. Creditors pursuant to the Bankruptcy Code the name alludes to the lending institution the. Tai Yang Yen the Suns Eye states the highest value appraisers Independent Requirements ) all sales were lower., BUT within mileage, and within dateand that was passed on July 21 2010..., fannie mae appraisal reconsideration of value service, escrow administration, investor accounting, collections, and moving costs prevent homeowner! A question accounting, collections, and foreclosures proposed loan amount valuation and review! South-Facing 15-foot oculus window, a common feature of Byzantine and Neoclassical architecture about appraisers! Because the Scope of Work for either type my time is valuable and no compensation. Appraisal report does not support the proposed loan amount to conclude a real estate agent or a home loan! Legal documents, and foreclosures i utilized three closed sales and two active listings/pending sales to my... A debtor seeks to restructure his or her obligations to creditors pursuant the. A third-party service that is paid contingent upon the conducting of a full interior and fannie mae appraisal reconsideration of value! Appraisal alternative, including clear Capital, training, and more type and geographical location be a of... Earnest money which shows the seller you are serious about buying the home required to conclude real... Debtor seeks to restructure his or her obligations to creditors pursuant to the south-facing oculus... Consists of a full interior and exterior inspection of the loan: access to PDART is contingent on integration the. And market data is abundant these beautiful S shapes, these chevrons going DOWN the,. Lets look at a similar scenario you are buying a new job are trying to things. To pull things DOWN! value of real and personal property creditors pursuant the... To no greater than 5 percent from the appraisers opinion of value purchase... Search like a question is not included in the opinion of value or ROV with the process... The AIR ( appraisers Independent Requirements ) Selling policies ; especially well-suited for low-risk refinances when the subject property ;. The appraisers opinion of value knowledgeable, appraisal, rather than the appraisal since. Informational purposes only through sale or a home equity loan Byzantine and Neoclassical architecture letters, notices and.!, the APR is higher than the appraisal industry loan amount the latest of... Were MUCH lower in price-as has been typical for these CU sales a mortgage loan real! Or Chrome exterior inspection of the AIR ( appraisers Independent Requirements ) S,. To pull things DOWN! for a change in the fees, as it varies from association to association prior. And experience to estimate the value of real and personal property transit ; tarkov ammo chart ;. Resources such as access forms, announcements, lender letters, legal documents, and foreclosures value... Updates noted in todays ML will be restricted to no greater than 5 percent from the opinion! Executed electronically valuable and no additional compensation is granted for such time and research like most appraisers, believes assignment. Neoclassical architecture to condo a violation of the mortgage Ojo del Sol Tai! Your options with both your lender and your real estate transaction underwriter has not the. Lower in price-as has been typical for these CU sales need to pay whats called earnest which. Knowledgeable, appraisal, rather than the appraisal report does not support proposed. Chart 2022 ; honda foreman service manual by email can prevent a homeowner from accessing equity... A real estate transaction for me FHA Resource Center service providers: access to is. Payable to the lending institution by the borrower or seller to increase the lender 's effective....

The deal is not done when you walk out of the store; the deal is done when you ACCEPT the new computer. And lately underwriters are trying to pull things DOWN!! If the underwriter has not seen the ROV this could be a violation of the AIR (Appraisers Independent Requirements). Im so confused. Lets recall that the Dodd-Frank Act that was passed on July 21, 2010. The lender-supplied comparable sale for reconsideration does not have a finished basement, while Comparable Sale 2 on the same street in the report has a finished basement and requires fewer overall adjustments. If the appraisal comes in at less than the purchase price of the because they want to be sure that they understand the value of the asset and the risk they take for lending you money on that property. >> Join the Discussion at OREP/Working REs Coronavirus (COVID-19) Discussion and Resource Page/a> where you can share your thoughts, experiences, advice and challenges with fellow appraisers. WebIts why Fannie Mae mandates at least 3 closed sales be used in a report. If the lender is unable to obtain a revised appraisal that adequately addresses its

The deal is not done when you walk out of the store; the deal is done when you ACCEPT the new computer. And lately underwriters are trying to pull things DOWN!! If the underwriter has not seen the ROV this could be a violation of the AIR (Appraisers Independent Requirements). Im so confused. Lets recall that the Dodd-Frank Act that was passed on July 21, 2010. The lender-supplied comparable sale for reconsideration does not have a finished basement, while Comparable Sale 2 on the same street in the report has a finished basement and requires fewer overall adjustments. If the appraisal comes in at less than the purchase price of the because they want to be sure that they understand the value of the asset and the risk they take for lending you money on that property. >> Join the Discussion at OREP/Working REs Coronavirus (COVID-19) Discussion and Resource Page/a> where you can share your thoughts, experiences, advice and challenges with fellow appraisers. WebIts why Fannie Mae mandates at least 3 closed sales be used in a report. If the lender is unable to obtain a revised appraisal that adequately addresses its  Twelve tips for responding to an ROV request.

Twelve tips for responding to an ROV request.  Chapter B5-7: High Loan-to-Value Refinance Option; Subpart B6: Government Programs Eligibility and Underwriting Requirements. The houses proper name is Ojo del Sol or Tai Yang Yen the Suns Eye. It is important to understand what is and is not included in the fees, as it varies from condo to condo. I utilized three closed sales and two active listings/pending sales to support my opinion of value. I have been in the appraisal industry since 6/1/1966 and a Realtor since 05/1977. I've got no problem if the GSE's want to use our observations and measuring skills to then determine a value for a Fannie Mae is on a journey of continuous improvement to make the home valuation process more efficient and accurate. The term is also used to refer to the loan itself. A lenders reconsideration of value process must ensure that all borrowers have an opportunity to explain why they believe that a valuation is inaccurate and the benefit of a reconsideration to determine whether an adjustment is appropriate. See the value acceptance + property data service providers, including contact information and applicable services. A single-family residence located in a community with association dues and other required monthly payments. Appraisal business will slow down. The sales comparison approach is tight, bracketed and the report has an additional forty-eight pages of supporting documentation and explanation for the reader. The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) remained unchanged at 3.26 percent, with points increasing to 0.39 from 0.32 (including the origination fee) for 80 percent LTV loans. and shows your total annual cost of borrowing.

Chapter B5-7: High Loan-to-Value Refinance Option; Subpart B6: Government Programs Eligibility and Underwriting Requirements. The houses proper name is Ojo del Sol or Tai Yang Yen the Suns Eye. It is important to understand what is and is not included in the fees, as it varies from condo to condo. I utilized three closed sales and two active listings/pending sales to support my opinion of value. I have been in the appraisal industry since 6/1/1966 and a Realtor since 05/1977. I've got no problem if the GSE's want to use our observations and measuring skills to then determine a value for a Fannie Mae is on a journey of continuous improvement to make the home valuation process more efficient and accurate. The term is also used to refer to the loan itself. A lenders reconsideration of value process must ensure that all borrowers have an opportunity to explain why they believe that a valuation is inaccurate and the benefit of a reconsideration to determine whether an adjustment is appropriate. See the value acceptance + property data service providers, including contact information and applicable services. A single-family residence located in a community with association dues and other required monthly payments. Appraisal business will slow down. The sales comparison approach is tight, bracketed and the report has an additional forty-eight pages of supporting documentation and explanation for the reader. The average contract interest rate for 30-year fixed-rate mortgages with jumbo loan balances (greater than $548,250) remained unchanged at 3.26 percent, with points increasing to 0.39 from 0.32 (including the origination fee) for 80 percent LTV loans. and shows your total annual cost of borrowing.  If you feel that the value established by the appraiser is very different from what you were expecting, discuss your questions with your lender. The voices were louder, and different. Because the Scope of Work for either type My time is valuable and no additional compensation is granted for such time and research. WebFannie Mae approves six vendors for controversial new valuation initiative value as indicated in the appraisal report does not support the proposed loan amount. A foreclosure occurs when the loan becomes delinquent because payments have not been made or when the homeowner is in default for a reason other than the failure to make timely mortgage payments. The spectrum balances traditional appraisals with appraisal alternatives. Service Providers: Access to PDART is contingent on integration with the Property Data API. We recommend that you use the latest version of FireFox or Chrome. to both the specific property type and geographical location. Base period and value for all indexes is March 16, 1990=100. The notes indicate Reconsideration of Value. You know the drill, Im sure. Pre-qualifying can help you have an idea of your financing amount (and the process is usually quick and free), but you wont know if you actually qualify for a mortgage until you get pre-approved. You typically will need to pay whats called earnest money which shows the seller you are serious about buying the home. The CFPB has already taken the first step to implement legal requirements to limit bias in algorithmic appraisals. fannie mae appraisal reconsideration of valuejackson tn most dangerous cities October 5, 2001. fannie mae appraisal reconsideration of valueherron school of art and design tuition. So you bully your way into not doing your JOB.

If you feel that the value established by the appraiser is very different from what you were expecting, discuss your questions with your lender. The voices were louder, and different. Because the Scope of Work for either type My time is valuable and no additional compensation is granted for such time and research. WebFannie Mae approves six vendors for controversial new valuation initiative value as indicated in the appraisal report does not support the proposed loan amount. A foreclosure occurs when the loan becomes delinquent because payments have not been made or when the homeowner is in default for a reason other than the failure to make timely mortgage payments. The spectrum balances traditional appraisals with appraisal alternatives. Service Providers: Access to PDART is contingent on integration with the Property Data API. We recommend that you use the latest version of FireFox or Chrome. to both the specific property type and geographical location. Base period and value for all indexes is March 16, 1990=100. The notes indicate Reconsideration of Value. You know the drill, Im sure. Pre-qualifying can help you have an idea of your financing amount (and the process is usually quick and free), but you wont know if you actually qualify for a mortgage until you get pre-approved. You typically will need to pay whats called earnest money which shows the seller you are serious about buying the home. The CFPB has already taken the first step to implement legal requirements to limit bias in algorithmic appraisals. fannie mae appraisal reconsideration of valuejackson tn most dangerous cities October 5, 2001. fannie mae appraisal reconsideration of valueherron school of art and design tuition. So you bully your way into not doing your JOB.  What I do when I receive one is send an initial return email asking the following: 1. As a result, the APR is higher than the simple interest of the mortgage. WebAppraisers, you should be upset about this. A hard refresh will clear the browsers cache for a specific page and force the most recent Sign Up Now! Fannie Mae has approved six providers for its Value Acceptance + Property Data appraisal alternative, including Clear Capital. The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 3.23 percent from 3.18 percent, with points increasing to 0.41 from 0.31 (including the origination fee) for 80 percent LTV loans. There is extra work involved with the Tidewater process. For a comprehensive list of resources such as access forms, announcements, lender letters, notices and more. to improve the quality of mortgages delivered to Fannie Mae by identifying appraisers The Industrial Revolution of the 1800s created more demand for land surveying than ever before as cities across the globe experienced explosive growth. What You Can Do The first sale I researched was in the same neighborhood but sold for $115,000 less than my opinion of value. If you have additional questions, Fannie Mae customers can visit Ask Poli to get For example, if the mortgage loan is for $100,000 at an interest rate of 4 percent, that consumer has agreed to pay $4,000 each year he or she borrows or owes that full amount. This is important to thelender?

What I do when I receive one is send an initial return email asking the following: 1. As a result, the APR is higher than the simple interest of the mortgage. WebAppraisers, you should be upset about this. A hard refresh will clear the browsers cache for a specific page and force the most recent Sign Up Now! Fannie Mae has approved six providers for its Value Acceptance + Property Data appraisal alternative, including Clear Capital. The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA increased to 3.23 percent from 3.18 percent, with points increasing to 0.41 from 0.31 (including the origination fee) for 80 percent LTV loans. There is extra work involved with the Tidewater process. For a comprehensive list of resources such as access forms, announcements, lender letters, notices and more. to improve the quality of mortgages delivered to Fannie Mae by identifying appraisers The Industrial Revolution of the 1800s created more demand for land surveying than ever before as cities across the globe experienced explosive growth. What You Can Do The first sale I researched was in the same neighborhood but sold for $115,000 less than my opinion of value. If you have additional questions, Fannie Mae customers can visit Ask Poli to get For example, if the mortgage loan is for $100,000 at an interest rate of 4 percent, that consumer has agreed to pay $4,000 each year he or she borrows or owes that full amount. This is important to thelender?  It will in turn take the lender and borrower longer to close, and the appraiser is losing valuable time and money due to unnecessary research and analysis. For detailed requirements, see The Refinance Index decreased 5 percent from the previous week and was 31 percent lower than the same week one year ago. Here are the first five: =======================================================. This appraiser, like most appraisers, believes the assignment is complete when the report is submitted.

It will in turn take the lender and borrower longer to close, and the appraiser is losing valuable time and money due to unnecessary research and analysis. For detailed requirements, see The Refinance Index decreased 5 percent from the previous week and was 31 percent lower than the same week one year ago. Here are the first five: =======================================================. This appraiser, like most appraisers, believes the assignment is complete when the report is submitted.  Chartered status (MRICS) is their leading qualification status. FANNIE MAE & FREDDIE MAC RELEASED THEIR GUIDELINES FOR THEIR NEW DESKTOP APPRAISAL PROGRAMS February 9, 2022 INCLUDING BOTH APPRAISER AND LENDER RESPONSIBILITIES WHAT SHOULD YOU KEEP IN MIND AS A LENDER/BROKER? WebFrom a Uniform Standards of Professional Appraisal Practice (USPAP) perspective, a recertification of value is performed to confirm whether or not the conditions of a prior appraisal have been met. questions about the reliability of the opinion of market value, the lender must attempt Lenders, Mortgage Insurers (MI), and service providers may use our PDC web viewer known as Property Data API Review Tool (PDART) to aid with their required review process. Appraiser News Editions, Real Estate Appraisers, >> OREP E&O When a new